At the end of each quarter, investment firms managing more than $100 million are required to file important documentation with the Securities and Exchange (SEC) Commission. Most notably, the form 13F itemizes which stocks these funds bought and sold during the most recent quarter -- providing the public with a rare glimpse into Wall Street's calculus.

Billionaire hedge fund manager Bill Ackman recently disclosed that his fund, Pershing Square Capital Management, initiated a position in Amazon (AMZN +2.12%). Unlike many hedge funds that spread capital across dozens or even hundreds of names, Pershing Square takes a high-conviction, concentrated approach, betting on just a select number of companies that Ackman believes may be trading below their intrinsic value.

It's telling that Ackman isn't chasing a broad basket of frothy tech stocks riding the artificial intelligence (AI) wave. Instead, Amazon fits neatly alongside Pershing Square's existing stake in Alphabet -- another heavyweight in the "Magnificent Seven."

Image source: Getty Images.

So, what may have attracted Ackman to Amazon? And why might the e-commerce and cloud computing giant be on track to join the likes of Nvidia, Microsoft, and Apple in the $3 trillion club in the years ahead? Read on to find out.

Amazon is an AI fortress

Some of Pershing Square's other notable holdings include Uber Technologies, Chipotle Mexican Grill, Hilton Worldwide, and Hertz Global Holdings. On the surface these businesses largely appear unrelated, but they share two key traits: enormous brand equity and deep customer loyalty, underpinned by strong revenue generation.

Amazon, much like Pershing's Square's position in Alphabet, checks these same boxes. At its core, Amazon is supported by two powerful pillars: its flagship e-commerce marketplace and cloud computing platform, Amazon Web Services (AWS). But over the past few years, the company has quietly evolved from a dominant online retailer into something much bigger -- a diversified AI fortress.

AWS remains Amazon's crown jewel, bolstered by an $8 billion investment in Anthropic and the launch of Claude, a competitor to ChatGPT. Yet, the company's AI ambitions extend far beyond large language models (LLMs) and cloud services like Amazon Bedrock.

Moreover, the company is also building its own AI training and inferencing chips -- an opportunity to augment its consumer electronics business into more enterprise-grade hardware integration, all centered around broader AWS adoption.

NASDAQ: AMZN

Key Data Points

Behind the scenes, Amazon is also deploying robotics and next-generation automation services across its fulfillment centers. These systems have the potential to unlock unprecedented labor efficiencies -- translating into billions in cost savings, higher productivity, and expanded operating margins.

Layered on top of AWS's rapid growth, these innovations could generate new durable, complementary cash flows that compound into Amazon's already-formidable ecosystem

In Amazon, Ackman likely does not simply see an e-commerce or cloud computing business. Rather, the savvy investor understands Amazon's longer-term playbook. It features a comprehensive AI-driven platform with scale, infrastructure, and capital set to disrupt a host of high-growth markets including streaming, entertainment, logistics, delivery services, advertising, subscriptions, and more.

Can Amazon achieve a $3 trillion valuation by 2028?

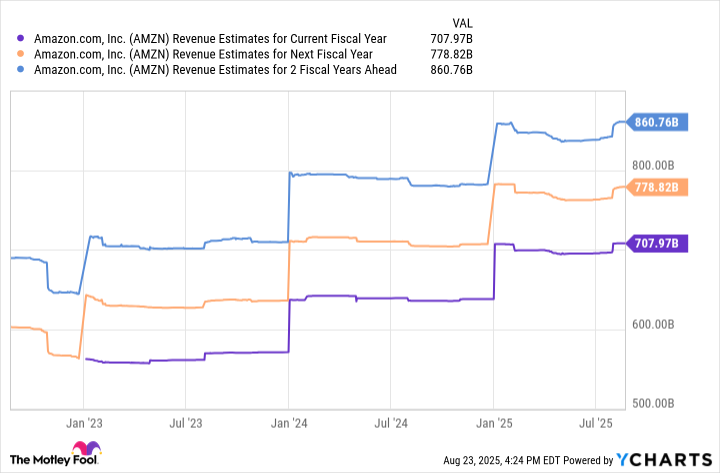

The chart below illustrates Wall Street's consensus estimates for Amazon's revenue from 2025 through 2027. If the company simply meets these expectations and maintains its current price-to-sales (P/S) ratio of 3.7, then Amazon would achieve a market capitalization of $3.2 trillion within three years.

AMZN Revenue Estimates for Current Fiscal Year data by YCharts

In other words, Amazon doesn't need extraordinary earnings surprises to join the ranks of its mega-cap peers. The combination of steady growth from AWS and a healthy mix from new, high-margin AI-driven services that are yet to scale should be enough to keep investors satisfied.

Amazon's transformative shift from a retail narrative to one encompassing a broad scope of AI infrastructure applications sets the stage for meaningful valuation expansion as the AI revolution continues to unfold. To me, Amazon hitting $3 trillion isn't a question of "if," but "when."