I first began covering electric vertical takeoff and landing (eVTOL) stocks in the third quarter of 2023. At the time, Archer Aviation (ACHR +2.06%) and Joby Aviation (JOBY +1.61%) were trading under $6 a share, and the broader media rarely discussed either company.

Fast forward roughly 24 months, and both companies have delivered stellar returns for shareholders. Archer and Joby have also managed to grab headlines in the mainstream media, thanks to the "flying car" hype and Archer's involvement in the 2028 Olympics.

Image source: Getty Images.

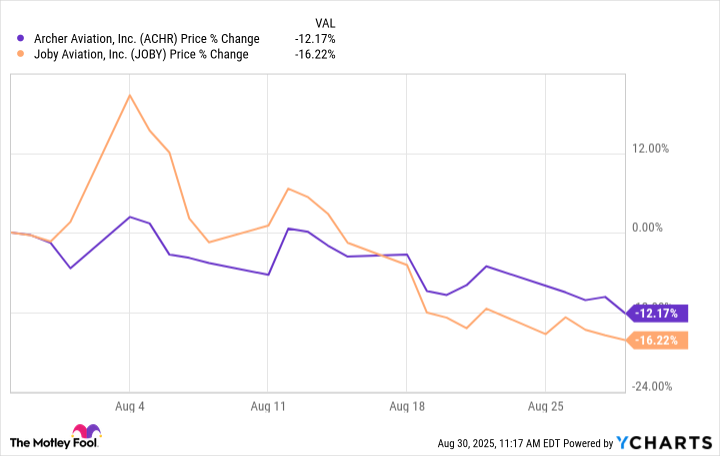

Recently, though, Archer and Joby have seen their shares slump. Over the past 30 days, Archer's stock has fallen by 12.2%, while Joby's shares have dropped by 16.2%. As an investor, not a day-trader, I welcome these double-digit declines and think now is the time to restart my planned buying program. Here's why.

Operational momentum meets market reality

Archer Aviation has transformed from a concept company to a manufacturing powerhouse. The company closed Q2 2025 with $1.7 billion in cash -- nearly twice as much as its nearest competitor. Six Midnight aircraft are now in production, positioning Archer for the 2028 Los Angeles Olympics, where it will serve as the official air taxi provider.

NYSE: ACHR

Key Data Points

This Olympics partnership isn't just publicity -- it's validation. Presidential executive orders and national priority status de-risk Archer's certification path compared to companies relying purely on commercial timelines. The government's explicit backing all but ensures a launch customer and accelerated regulatory approval. After all, it's abundantly clear that America doesn't intend to lose the eVTOL race to China.

The company's defense pivot strengthens this thesis. Two strategic acquisitions -- Overair's patent portfolio and a defense composite manufacturing facility -- position Archer to capture military contracts that will provide revenue during the commercial ramp. International expansion into the UAE, Ethiopia, and Indonesia, including a multiyear partnership with Abu Dhabi Aviation, creates multiple revenue streams beyond U.S. operations.

Joby builds for vertical integration

Joby Aviation has achieved equally impressive milestones. The company made history in August 2025 by completing the first piloted eVTOL flight between two public airports. With $991 million in cash and growing strategic advantages, Joby is building a vertically integrated leader in urban air mobility.

NYSE: JOBY

Key Data Points

The $125 million Blade Air Mobility acquisition deserves attention. By acquiring Blade's passenger business, Joby isn't just buying assets -- it's securing immediate demand pipelines and real routes, effectively purchasing its first customer base. This gives Joby actual passengers to serve the moment certification arrives.

Toyota Motor's strategic investment provides more than capital. The automaker brings supply chain discipline and manufacturing expertise that's often the downfall of aerospace start-ups. Toyota's involvement signals that mass production -- not just prototypes -- is achievable.

But Joby trades at a $12 billion valuation while planning to burn approximately $500 million in 2025 -- a venture-style multiple that underscores the risk. The recent pullback has shaved nearly $2 billion off Joby's peak valuation.

The multidecade opportunity ahead

The recent sell-offs reflect healthy recalibration, not fundamental weakness. At their peaks, Archer hit nearly $14 per share, while Joby touched $20.95 -- valuations that assumed flawless execution. Today's pullbacks bring prices closer to earth while leaving the long-term thesis intact. Neither company expects profitability before 2027 at the earliest.

The path won't be smooth; certification hurdles, cash burn, and infrastructure buildout guarantee turbulence. But if Archer or Joby succeeds, they'll redefine transportation in a way few companies ever do. I'm allocating no more than 3% of my portfolio across both names, viewing them as venture-style investments in transportation's electric future. Investors who think in decades, not quarters, should treat these dips as their boarding call to urban air mobility's future.