Rocket Lab (RKLB +9.39%) is one of the best-performing growth stocks over the past year. The stock is up 676% in the past 12 months as of this writing on Aug. 28, which actually bests the performance of Palantir Technologies, another hot stock over that time span. Investors are falling in love with this space economy stock as it aims to become the next SpaceX and a key contractor to the U.S. government.

Today, Rocket Lab stock trades at a price of $47. Does it have room to more than double again and hit $100?

NASDAQ: RKLB

Key Data Points

Comprehensive space flight services

Like SpaceX, Rocket Lab has a highly ambitious business plan to build a vertically integrated space flight company. It began by launching the small Electron rocket and has now moved downstream to building space systems that will get launched on its rocket missions.

These space systems include sensors, satellites, solar arrays, and semiconductors, among other products for its contracted customers. The United States government believes these integrated systems are so important that it recently gave Rocket Lab a $24 million grant to increase its production of semiconductors to maintain a homegrown supply chain.

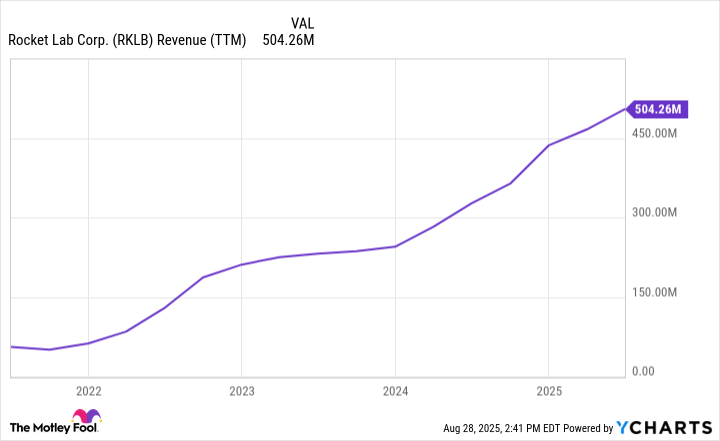

Financial growth for Rocket Lab has been phenomenal, a key reason the stock has soared in the past year. Revenue hit $500 million over the last 12 months, up 800% since its initial public offering (IPO) back in 2021. This is driven by demand for the Electron rocket and its space systems division. With a backlog of $1 billion, Rocket Lab is seeing growing demand from customers.

As one of the few companies that can reliably get objects into orbit, it is unsurprising to see large demand for Rocket Lab's services, both from commercial providers and the U.S. government. Its relationship with the government is growing. Given the importance of space defense and projects such as the Golden Dome with a $175 billion budget, Rocket Lab has the potential to win contracts with huge dollar values from the United States in the years to come.

Image source: Getty Images.

Step change in growth with the Neutron rocket

Although its existing business is doing just fine, Rocket Lab aims to pour fuel on the growth fire with its upcoming Neutron rocket. The larger rocket is in testing today, but plans to be commercially ready for customers in 2026. With a payload capacity much larger than the Electron and on par with SpaceX rockets, this device can greatly increase the potential contract value for Rocket Lab.

Larger payloads mean more revenue per launch, which could be in between $50 million and $100 million just to get objects into orbit. With a vertically integrated strategy, Rocket Lab could also see a boost in its satellite design and semiconductors business for space systems that go on to these Neutron rockets, leading to even more revenue potential.

With just $500 million in revenue today, a Rocket Lab a few years into the future that is launching the Neutron rocket regularly could see its revenue hit a step change in growth to $1 billion, $2 billion, and eventually even higher levels. For reference, SpaceX revenue is expected to hit $15 billion this year.

RKLB Revenue (TTM) data by YCharts

Is Rocket Lab stock headed to $100?

Rocket Lab's revenue growth may accelerate in the next five years if it can successfully deploy the Neutron rocket. Its stock price has started to reflect this acceleration and more.

Today, Rocket Lab's stock price gives it a market capitalization of $24 billion. Assuming no further share dilution -- which is unlikely and presents a headwind to stock price appreciation over the long term -- and a $100 share price means a $50 billion market cap for Rocket Lab.

It's important to note that $50 billion is an expensive valuation for a company of this size, even though its SpaceX competition is valued at a reported $400 billion in private markets. Rocket Lab's business is unprofitable today, burning cash, and has low gross margins of just over 30%. Its net income margin at scale may only reach 10% or, in an optimistic scenario, 15%.

Under an optimistic scenario, let's assume that Rocket Lab's revenue can reach $10 billion due to massive adoption of the Neutron rocket, which leads to operating leverage and a 15% bottom-line profit margin. That's $1.5 billion in annual net income, which is a price-to-earnings ratio (P/E) of 33 compared to a market cap of $50 billion.

Rocket Lab may trade at a $100 share price if this occurs, but it is not happening anytime soon and would only mean a double from the current share price. A double over 10 to 15 years is not a good return for buying an individual stock. Investors should stay away from the expensive-looking Rocket Lab for the time being.