SentinelOne (S +1.48%) is a leading provider of enterprise cybersecurity software. Its Singularity platform protects cloud networks, employee identities, endpoints (computers and devices), and more. It's powered by artificial intelligence (AI), so it autonomously uncovers threats and thwarts attacks, reducing the workload on human cybersecurity managers.

The company released a positive set of financial results for its fiscal 2026 second quarter (ended July 31) on Aug. 28, which sent its stock soaring by as much as 9% in after-hours trading. However, it remains 75% below its 2021 record high, when a frenzy in the tech sector drove its valuation to an unsustainable level.

But here's the good news: Wall Street thinks SentinelOne's recovery will continue, because the majority of the analysts tracked by The Wall Street Journal have given it a buy rating, and none of them recommend selling. Here's why the bullish consensus might be justified.

Image source: Getty Images.

Singularity outperforms some of its most noteworthy peers

AI is at the heart of the Singularity platform because SentinelOne believes machines can respond to cyberthreats much faster than humans can. AI stands ready to act at any given moment -- it doesn't need sleep or days off.

However, in cases where human intervention is required, Singularity's Storyline feature generates detailed incident summaries to help managers find the root cause of the incident, saving hours of manual investigations. Then there is the one-click remediation feature, which allows managers to instantly roll networks back to their pre-breach state in the event of a successful attack, which reduces downtime.

SentinelOne also developed an AI-powered assistant called Purple AI Athena, which uses advanced reasoning to deliver humanlike capabilities in identifying, analyzing, and remediating threats. Over time, this means even fewer incidents will require human intervention.

Singularity outperformed most of its peers in MITRE's 2024 Evaluations, which measured the effectiveness of cybersecurity platforms. Singularity delivered perfect accuracy, the highest possible detection rate with zero delays, and 88% less noise than its peers, which means it handled more cyber incidents autonomously relative to competing products from CrowdStrike and Palo Alto Networks.

NYSE: S

Key Data Points

Strong revenue growth and increased guidance

SentinelOne generated $242.2 million in revenue during the fiscal 2026 second quarter, which was up 22% year over year, and slightly above management's guidance of $242 million. The company's annual recurring revenue (ARR) grew by 24% and topped the $1 billion milestone for the first time ever.

On the back of the strong quarterly result, management increased its full-year revenue guidance for fiscal 2026 slightly, taking it from $998.5 million to $1 billion at the midpoint of the forecast range.

SentinelOne is much smaller than its main competitors in the AI-powered cybersecurity space, but based on its second-quarter performance, it's growing more quickly than Palo Alto Networks and CrowdStrike, which delivered revenue increases of 16% and 21%, respectively, during their most recent quarters. This could suggest SentinelOne is gradually taking market share.

The company also made progress on the bottom line during the second quarter. Although it lost $72 million on the basis of generally accepted accounting principles (GAAP), which was slightly worse than its year-ago result, its adjusted (non-GAAP) profit surged by 277% to $13.2 million. The latter excludes one-off and noncash expenses, so it can be a more useful indicator of how much money SentinelOne's business is actually generating.

Wall Street's bullishness might be justified

The Wall Street Journal tracks 39 analysts who cover SentinelOne stock, and 21 have given it a buy rating. Three others are in the overweight (bullish) camp, and the remaining 15 recommend holding. None of the analysts recommend selling.

They have an average price target of $23.20, which implies a potential upside of 25% over the next 12 to 18 months. But the Street-high target is $30, which suggests the stock could soar by as much as 62%.

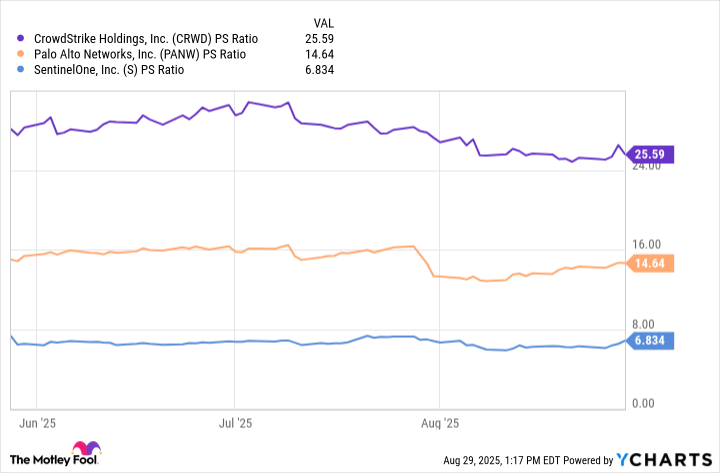

When the stock peaked in 2021, its price-to-sales ratio (P/S) was over 120, which was unsustainable. But the 75% decline in the stock since then, combined with the company's consistent revenue growth, has pushed its P/S down to a far more reasonable 6.8.

In fact, relative to CrowdStrike and Palo Alto Networks, SentinelOne actually looks cheap:

SentinelOne values its total addressable market at over $100 billion, and since the company only just crossed $1 billion in ARR, it has a very long runway for growth.

As a result, I think Wall Street's bullish consensus is justified, so this stock could be a great long-term addition to a diversified portfolio.