Most investors understand that small-cap stocks often offer enormous upside potential. But they also bring considerably more risk to the table. That's the typical trade-off with any investment.

This relationship raises a key question, though: As a whole, how much overall performance are small-cap stocks as a group actually dishing out these days in exchange for the risk they impose?

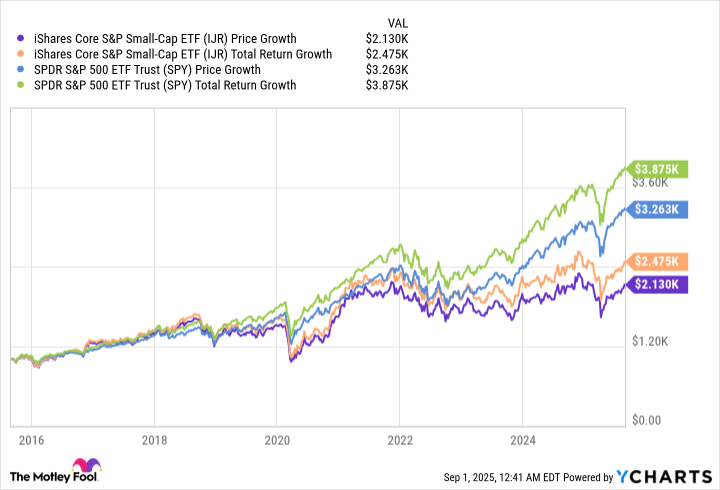

The graphic below tells the tale. A $1,000 invested in small-cap stocks via the broad-based iShares Core S&P Small-Cap ETF (IJR +1.04%) made back in early September of 2015 would be worth $2,130. That figure grows to $2,475 if you reinvested any dividends paid by the exchange-traded fund along the way. Not bad.

NYSEMKT: IJR

Key Data Points

Just don't plow into a basket of small caps because of this measurable gain just yet. You would have fared far better with something more familiar. Specifically, a $1,000 investment in the SPDR S&P 500 ETF Trust (SPY +0.53%) -- which, of course, mirrors the performance of the S&P 500 (^GSPC +0.54%) large-cap index -- made at the same time would be worth $3,263 today, or $3,875 when reinvesting its dividends.

In percentage terms, SPY's average annual gain of 14.5% over the course of the past decade outright trounces IJR's average yearly gain of only 9.5%.

Just bear in mind that the past 10 years have been particularly unusual, led by a small handful of enormous companies. The next 10 years could look very different. In this vein, it's also worth considering that there may just be too many unprofitable and unsustainable start-ups coming to the market only as a means of raising easy capital -- companies that wouldn't have been able to generate any investor interest 20 to 30 years ago, when there were fewer but better-performing small-caps.

The irony? Small-cap stocks' prolonged subpar performance may finally be forcing investors to be pickier about funding start-ups, ultimately limiting the publicly traded ones to only higher-quality prospects. As such, this might actually be the right time to take on a long-term stake in IJR.