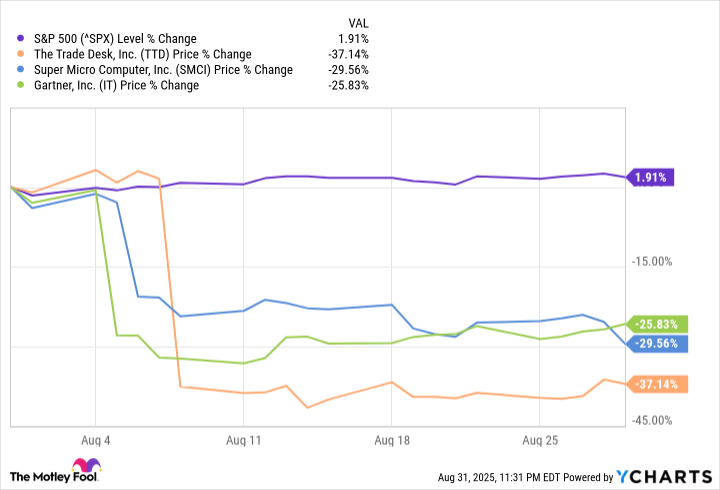

August was a good month for the S&P 500. The stock market's most-followed index finished the period up 1.91%, marking its fourth consecutive month of positive returns and fifth overall positive month of 2025. Unfortunately, it wasn't a good month for all stocks in the index.

Three stocks in particular had a really bad month: The Trade Desk (TTD 9.68%), Super Micro Computer (SMCI 1.77%), and Gartner (IT 22.33%). These stocks lost between 25% to 37% of their value in the month.

The reason for the disappointing month varies. The Trade Desk's revenue growth has slowed (up 19% year over year to $694 million), and its new chief financial officer took over on Aug. 21 after its previous one stepped down after almost 12 years with the company. There are also concerns that stricter privacy rules will hurt the company's ability to use targeted advertising, its main business proposition.

NASDAQ: SMCI

Key Data Points

Super Micro Computer's fiscal fourth-quarter results weren't very encouraging, with the company missing both revenue and adjusted earnings per share estimates. It also cut its fiscal 2026 guidance from $40 billion to $33 billion, which discouraged investors, as the company was already trading at a premium.

Gartner met analysts' estimates for the second quarter, but its total contract value (a key part of its business) increased by a light 4.9% year over year. This led the company to cut its 2025 revenue guidance and note that its business demand could slow down.