Buying the best high-yield dividend stocks at a discount can be an incredible opportunity for investors.

Not only do investors get a better bang for their buck with a lower share price, but they also receive a juiced dividend yield.

A perfect example of this in today's market is dining and snacking brands franchisor, MTY Food Group (MTYF.F +1.10%) (MTY 2.82%), which currently trades 50% below its all-time high.

While I typically would argue that a 50% drop in price for a high-yield dividend stock may make it more of a falling knife than an opportunity, MTY looks more like an exception to this rule for the following reasons.

OTC: MTYF.F

Key Data Points

Why MTY Food Group is a once-in-a-decade opportunity

Despite its 50% decline over the past few years, MTY Food Group has more than doubled the total returns of the S&P 500 since 2005.

Powered along by its strategy of a serial acquirer, MTY has assembled a well-diversified portfolio of over 90 brands that span the quick-service, fast casual, and restaurant dining categories in Canada and the United States.

Making 48 separate acquisitions since 1999, the company is now home to over 7,000 food service locations -- the vast majority of which are franchised.

Image source: Getty Images.

A well-diversified dining and snacking franchisor

With these acquisitions, MTY's brands serve an array of food and dining categories, such as:

- Frozen treats and smoothies: Cold Stone Creamery, sweetFrog, and TCBY.

- American: Mike's, Famous Dave's, and Papa Murphy's.

- Asian and Indian: Manchu Wok, Thai Express, and Yuzu Sushi.

- Snacks, breakfast, Mexican, sandwiches, and more: Wetzel's Pretzels, Village Inn, TacoTime, and Mr. Sub.

This well-rounded portfolio enables MTY to maintain balanced sales throughout the year, regardless of the season. Whereas its frozen treats category booms during the summer and Papa Murphy's thrives in football season, Wetzel's Pretzels excels during shopping season in the winter.

Best yet for investors, MTY's primarily franchise-focused model allows it to generate substantial free cash flow (FCF) while transferring operational risk to its franchisees.

Declining margins, but rising free cash flow

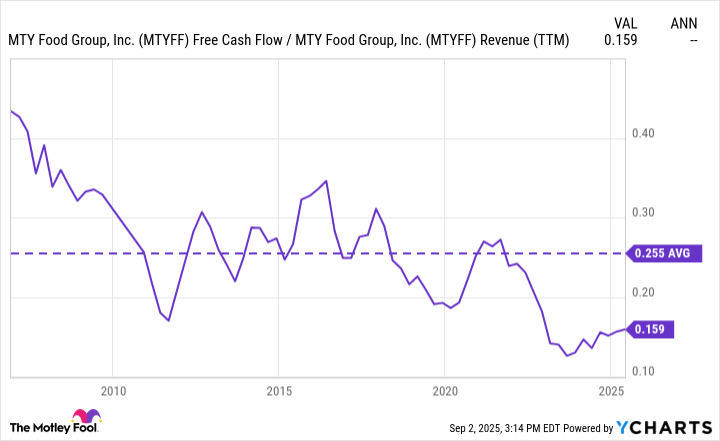

MTY's FCF margin is currently a healthy 16%. However, this is down from its average of 26% since 2006, which helps explain the stock's disappointing results over the last few years.

MTY Food Group FCF Margin data by YCharts

While MTY is primarily a franchisor, it does own a small portion of its stores outright. For instance, roughly 200 of its Famous Dave's, Papa Murphy's, and Wetzel's Pretzels locations are owned by the corporation, rather than franchised.

These brands were acquired in 2019 and 2022, which explains the dip in FCF margin over that period, as corporate-owned stores typically have lower margins.

Over the long term, MTY is likely to refranchise these stores once it is financially viable. For instance, the company recently bought back 50 high-potential, but underperforming Papa Murphy's locations to improve their operations, and is now starting to refranchise them.

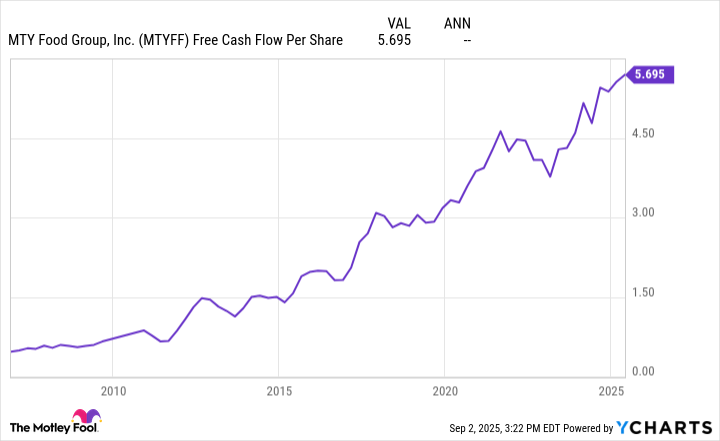

Furthermore, while this process weighs on margins temporarily, as the chart below shows, MTY's FCF-per-share has ballooned, nevertheless.

MTYFF Free Cash Flow Per Share data by YCharts

With FCF-per-share at all-time highs, MTY seems much more likely to be an opportunity than a falling knife.

MTY's high-yield dividend and accelerating stock buybacks

Powered along by this FCF creation, the company typically seeks out new mergers and acquisitions (M&A) to build out its portfolio. However, Chief Executive Officer Eric Lefebvre explained that the M&A market remains too expensive with many brands commanding "very, very high multiples."

Due to these exorbitant valuations, management decided to buy back its own stock instead -- especially since shares are available at a deep discount.

MTYFF Share Price and Stock Buyback data by YCharts

Thanks to these well-timed buybacks, MTY's shares outstanding have declined by 2% annually over the last five years.

In addition to generating shareholder value through these share repurchases, the company pays a 3.3% dividend yield that only uses 15% of MTY's FCF.

Despite the company offering a high-yield dividend to investors, this low 15% figure shows that there is ample FCF available for future dividend increases. MTY has grown its dividend payments by 29% annually over the last decade, and I believe it is well-positioned for more growth over the following 10 years.

A once-in-a-decade valuation

Though there is a lot to like about MTY's success as a serial acquirer, its franchise model, and its robust FCF creation, its once-in-a-decade valuation may steal the show.

MTY currently trades with an enterprise value-to-FCF (EV/FCF) ratio of just 11 -- its lowest mark in nearly 10 years.

MTYFF EV to Free Cash Flow data by YCharts

To illustrate the potential value of this valuation, the market is essentially saying MTY Food Group is priced to never grow its FCF again when I plug the company's figures into a discounted cash flow calculator.

Yet, its FCF-per-share has nearly tripled over the last decade.

Though it's anybody's guess as to when MTY's valuation will catch up to its steady (and improving) fundamentals, I'll happily collect my 3.3% dividend yield each year to wait and find out.