For the past 10 to 15 years, growth stocks have been the driving force in the stock market. For good reason, too. Such stocks have been some of the best-performing investments.

The downside is that with the growth opportunity usually comes higher risk. All stocks come with risk, but growth stocks often have more risk because their stock prices have their expectations priced into them, and investors are more likely to jump ship if these expectations aren't met.

To help hedge some of this risk and gain exposure to growth stocks, I would recommend investing in a growth-focused exchange-traded fund (ETF). There are plenty of options to choose from, but one I would recommend is the Vanguard Growth ETF (VUG +0.68%). Investing $2,000 today could set you up for market-beating long-term returns.

Image source: Getty Images.

Big tech is leading the way for this ETF

The Vanguard Growth ETF focuses on large-cap companies that are expected to grow their earnings faster than the overall market, show strong revenue increases, a high return on equity (a measure of profitability and financial efficiency), and a high level of capital investments.

These criteria, along with the ETF being weighted by market cap, mean that many of its top holdings are big tech companies (technology accounts for 61.8% of the ETF). Below are its top 10 holdings:

| Company | Percentage of the ETF |

|---|---|

| Nvidia | 12.64% |

| Microsoft | 12.18% |

| Apple | 9.48% |

| Amazon | 6.72% |

| Meta Platforms | 4.62% |

| Broadcom | 4.39% |

| Alphabet (Class A) | 3.34% |

| Tesla | 2.69% |

| Alphabet (Class C) | 2.67% |

| Eli Lilly & Co. | 2.01% |

Source: Vanguard. Percentages are as of July 31.

Having 10 companies account for nearly 61% of a 165-stock ETF isn't ideal from a diversification standpoint, but it has worked out strictly from a growth perspective. Tech has been by far the best-performing S&P 500 sector over the past decade, and it isn't particularly close. Here is how the ETF is allocated by sector:

- Technology: 61.8%

- Consumer discretionary: 18.3%

- Industrials: 8.6%

- Healthcare: 5%

- Financials: 2.9%

- Real estate: 1.3%

- Telecommunications: 0.9%

- Energy: 0.4%

- Basic materials: 0.4%

- Consumer staples: 0.2%

- Utilities: 0.2%

This ETF has consistently outperformed the broader market

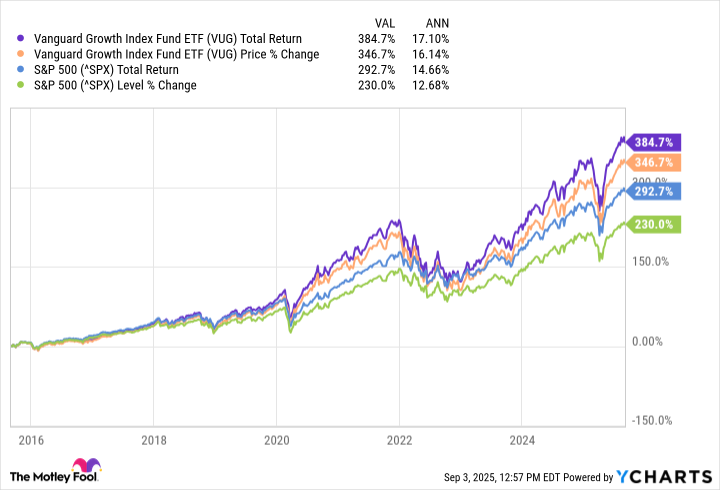

If you're investing in a growth ETF, the goal should always be to outperform the broader market, based on S&P 500 returns. If it's not doing that, you're likely better off just investing in an S&P 500 ETF. The Vanguard Growth ETF has shown it can consistently outperform the market.

Since the fund debuted in January 2004, it has averaged close to 12% annual total returns, while the S&P 500 has averaged around 10.4% in that span. In the past decade, the returns have been even more impressive.

VUG Total Return Level data by YCharts.

It seems unreasonable to expect this ETF to continue averaging these high returns from the past decade over the long term, but it's well equipped to continue being a market beater. If we assume the ETF averages 12% annual returns, here's how much an investment could grow in 20 years based on different monthly investment amounts:

| Monthly Investments | Investment Total After 20 Years |

|---|---|

| $500 | $430,315 |

| $750 | $645,473 |

| $1,000 | $860,631 |

Chart by author. Investment total accounts for the ETF's expense ratio and are rounded down to the nearest dollar.

Past performance doesn't guarantee future results, but this shows just how lucrative investing in the Vanguard Growth ETF (or many other ETFs) can be with enough time and consistency.

This is one of the cheapest growth ETFs you can find

The icing on the cake for this Vanguard ETF is its low expense ratio of 0.04%, which works out to only paying $0.80 per $2,000 invested. This is one of the cheapest expense ratios from any stock on the market, but especially a growth ETF.

Investing in low-cost ETFs like the Vanguard Growth ETF ensures you can keep more of your returns in your pocket instead of in Vanguard's.