Exceptional returns by Broadcom, Oracle (ORCL 0.57%), and Netflix have paved the way for a new class of market-leading growth stocks known as the "Ten Titans."

The group includes these three companies plus the "Magnificent Seven" -- Nvidia, Microsoft, Apple, Alphabet, Amazon, Meta Platforms, and Tesla.

The Ten Titans make up 38% of the S&P 500 (^GSPC +0.03%) and offer a more comprehensive way to measure the index's leadership.

Broadcom delivered blowout results and soared to a new all-time high on Sept. 5 after reporting its quarterly earnings. Here's why the pressure is on Oracle, which is slated to report results on Sept. 9, and what the company needs to do to justify its premium valuation.

Image source: Getty Images.

Oracle is becoming a major player in cloud computing

Oracle is up more than 300% since the start of 2020, largely thanks to the build-out of Oracle Cloud Infrastructure (OCI).

As a database services company, Oracle previously relied on third-party cloud providers. But OCI changed the game, allowing Oracle to tap into a new revenue stream from its enterprise clients.

The decision to scale OCI came at a high cost, but it has redefined Oracle's investment thesis. The key advantage is Oracle's competitive pricing model. OCI is a no-brainer add-on for customers who already use its database services. And because Oracle is a pure-play business-to-business company, it can build its cloud and integrated pricing model around enterprise needs. In comparison, the other major cloud players -- Amazon Web Services, Microsoft Azure, and Google Cloud -- have massive consumer-facing segments. So Oracle offers a unique way for investors to bet on cloud computing and enterprise software.

Oracle is building on its cloud momentum

The key metrics to watch for when Oracle reports earnings are its capital expenditures (capex) and cloud revenue, which encompasses both cloud infrastructure and cloud applications. In fourth-quarter fiscal 2025, which Oracle reported in June, cloud revenue made up 42.1% of total revenue -- illustrating how cloud is truly transforming Oracle's business.

NYSE: ORCL

Key Data Points

For the full fiscal year, Oracle grew total cloud by 24%. In its June earnings release, Oracle said that it expects its growth rates in fiscal 2026 to be "dramatically higher," accelerating cloud growth to 40%, led by a staggering 70% increase in cloud infrastructure (thanks to OCI).

The upcoming results are crucial to supporting Oracle's ambitious targets and laying the groundwork for the remainder of the fiscal year. If Oracle fails to maintain its cloud growth rates, investors may scrutinize its spending and become concerned about its leveraged balance sheet.

Growth comes at a cost

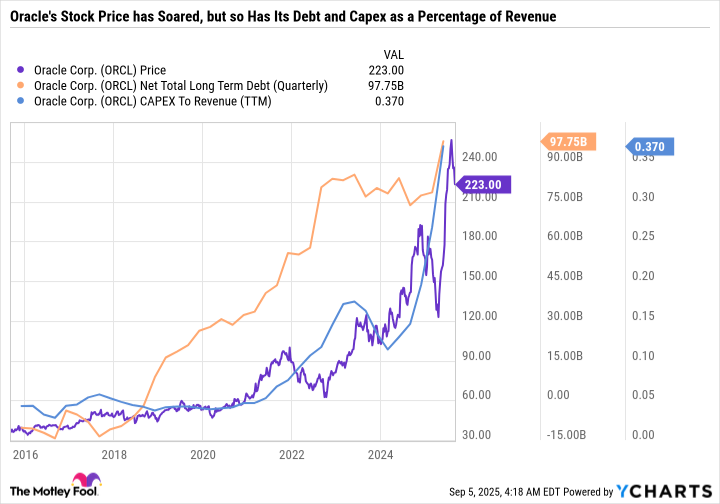

The following chart encapsulates the narrative around Oracle stock right now.

The stock is red-hot, but net long-term debt and capex to revenue are also on the rise. Put another way, investors are rewarding Oracle for taking on debt and spending a ton of money on long-term investments, even though its revenue isn't reflecting the payoff of those investments just yet. Investors are giving Oracle the green light to aggressively expand its cloud offerings. But there will come a time when the investments have to convert to bottom-line results.

Analyst consensus estimates reflect this optimistic outlook. They're calling for $6.78 in fiscal 2026 earnings per share (EPS), followed by 20% earnings growth in fiscal 2027 of $8.14 in EPS. For context, Oracle's fiscal 2025 diluted EPS was $4.34, which was close to an all-time high.

Approaching Oracle with a long-term mindset

Oracle is a high-risk, high-potential-reward AI and software play. With a stock price of $223 at the time of this writing, Oracle's valuation looks reasonable if it can deliver on earnings estimates for the next couple of years. If Oracle falls short, investors may question whether the spending and debt accumulation are worth it.

Oracle's investment thesis is now heavily centered around AI and cloud, and the stock price reflects that with a premium valuation. So investors should only approach the stock if they have a high risk tolerance and a long-term investment time horizon.