Docusign (DOCU 4.08%) stock was a pandemic darling. Its stock price peaked at around $310 in 2021, a tenfold gain from its 2018 IPO price of $29. Lockdowns and social restrictions triggered by COVID-19 drove explosive demand for the company's digital contract management tools, which helped businesses close deals even when participants could not meet face to face.

But Docusign's growth slowed dramatically when social conditions returned to normal in 2022, which led to a sharp decline in its stock. Despite climbing by 40% over the past year, it remains 74% below its 2021 peak.

Fortunately for shareholders, the company's recovery looks set to continue thanks to strong demand for its new Intelligent Agreement Management (IAM) platform, which uses artificial intelligence (AI) to make contract management even simpler. Here's why investors might want to buy the stock while it's still trading at a steep discount to its all-time high.

Image source: Getty Images.

Solving the "agreement trap" with AI

A study published earlier this year by global consulting firm Deloitte estimates that businesses combined are losing a whopping $2 trillion in economic value each year from poor contract management processes. Docusign's IAM platform aims to solve the "agreement trap" problem by using AI to help businesses draft, negotiate, and close deals more efficiently. But the platform doesn't stop there, because it also makes contract lifecycle management a breeze.

One of IAM's flagship features is a digital repository called Navigator, where businesses can store all of their agreements. It uses AI to automatically extract key details from each contract, and makes them discoverable via a search function, so employees no longer have to dig through individual documents for the information they need. Navigator also notifies managers of upcoming contract renewal dates, so deals don't expire unexpectedly.

In prepared remarks delivered last week in conjunction with the company's fiscal 2026 second-quarter report, CEO Allan Thygesen said the number of documents ingested by Navigator had soared by 150% compared to just six months ago. Businesses are now using it to process tens of millions of agreements every single month.

Docusign continues to roll out new IAM features, and the platform is likely to expand for the foreseeable future. For example, the company launched a new tool during fiscal Q2 called Agreement Preparation, which uses AI to detect the type of contract a business is trying to draft, and automatically create a template complete with the necessary fields (like areas for critical details and signatures). The larger an organization, the more potential time this tool could save it.

NASDAQ: DOCU

Key Data Points

Docusign's revenue growth just reaccelerated

Docusign generated $800.6 million in revenue during fiscal Q2, which was comfortably above management's guidance range of $777 million to $781 million. That was a 9% increase from the year-ago period, and an acceleration from the 8% growth the company delivered in its fiscal first quarter.

Docusign was growing far more quickly at the height of the pandemic in 2021, mainly because it was investing aggressively in areas like marketing to attract new customers. This strategy worked well in the short term, but it was unsustainable and led to significant losses at the bottom line.

The new-look Docusign might be growing at a more modest pace, but it's highly profitable. It delivered generally accepted accounting principles (GAAP) net income of $135.1 million during the first two quarters of fiscal 2026, and adjusted (non-GAAP) net income of $385.9 million.

The non-GAAP metric is management's preferred measure of profitability because it excludes one-off and non-cash expenses like stock-based compensation, so it's a better reflection of how much actual money the business is generating.

Consistent profits give Docusign the flexibility to start funneling more money into growth-oriented expenses like marketing once again, which could fuel a further acceleration in revenue growth.

Docusign stock is trading at an attractive valuation

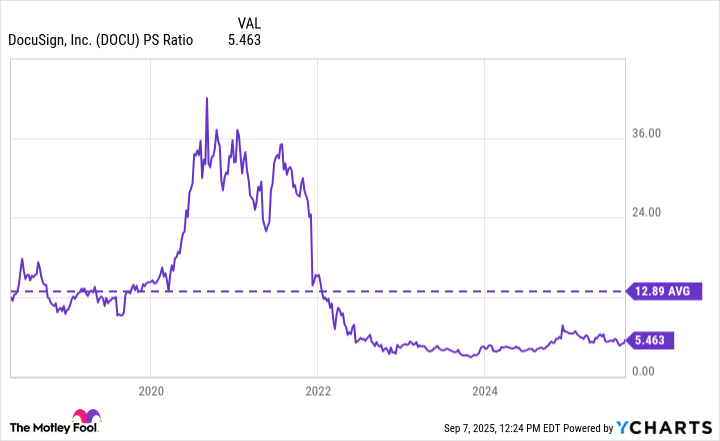

Docusign's price-to-sales (P/S) ratio peaked at above 40 during 2021 -- an unsustainable valuation. However, the 74% decline in the stock since then, combined with the company's consistent revenue growth, has pushed its P/S ratio down to a more reasonable 5.4. That is actually a steep discount to its average of 12.9, which dates back to its IPO in 2018.

Data by YCharts.

On that note, Docusign's strong fiscal Q2 revenue prompted management to increase its fiscal 2026 guidance for the second time this year. The company now expects to generate up to $3.201 billion in revenue, which is $60 million higher than the $3.141 billion top end of its original guidance range.

The momentum in Docusign's business is clear, which explains why its stock has climbed by more than 40% over the past year. The IAM platform could be the secret to unlocking further upside, so investors might want to take advantage of the stock's attractive valuation by buying it now.