It's certainly not the most exciting of potential stock picks. Last quarter's revenue growth of 4.8% (or 5.6% when adjusting for currency fluctuation) is in line with the company's long-term norms, in fact.

Nevertheless, retailer Walmart (WMT 0.83%) is a solid prospect for almost any investor's portfolio. Here are the top five reasons it might belong in yours as well.

Image source: Getty Images.

1. It dominates the retail landscape

To say Walmart is a major brick-and-mortar retailer still understates what the company is. It's the United States' -- as well as the world's -- single-biggest biggest retailer, operating more than 5,200 domestic locales plus nearly 5,600 more stores outside of the United States that collectively did $681 billion worth of business last year, trouncing next-nearest Costco's figure of $254 billion. That's even more sales than e-commerce giant Amazon (AMZN 3.42%) reported for 2025.

In other words, Walmart dominates the retail landscape.

NASDAQ: WMT

Key Data Points

Being bigger doesn't mean it's inherently better, of course. Size does have its clear advantages though. For instance, its suppliers and vendors cater to the needs of their most important distributor, and the company itself can use its scale to negotiate good prices -- and pass those savings along to its customers.

It may not be fair to other retailers. Investors don't want a fair fight, though. They want to own the strongest name in any industry, since strength makes it easier to continue dominating.

2. It thrives in any and all environments

Many consumer-facing businesses are cyclical. For example, people purchase fewer new automobiles when they're feeling cash-strapped or fear losing a job. Or they're less likely to take an extravagant vacation in the middle of a recession.

This isn't a dynamic that applies to Walmart, though. Being the low-price leader for a wide range of basic consumer goods and consumables means it's a go-to option when times are tough. Over the course of the past few inflation-riddled years, in fact, the company frequently touted how most of its market share gains were being made with households earning in excess of $100,000 per year specifically because of the value it offers its shoppers.

Or look at it like this. With the exception of one soft patch in 2015 (when it was suffering some significant labor-related challenges) Walmart hasn't failed to report at least some degree of quarterly sales growth since at least 2010.

3. Walmart is (mostly) debt-free

When interest rates were as low as they were for the better part of the past 17 years, a company's debt load didn't matter much simply because interest charges didn't really eat into earnings. Now that rates are back near multi-decade highs, however, any debt racked-up during this time has become an expensive nuisance.

Walmart's an exception to this dynamic, though. See, it doesn't have a lot of debt on its books. As of the end of July, it's only got $35.6 billion worth of long-term obligations on its balance sheet that are costing it roughly $2.3 billion per year. For perspective, the company's recent annual net income has been in the ballpark of $11 billion, while its total assets are $254 million and its market cap is a massive $800 billion.

This minimal debt burden means Walmart enjoys the fiscal flexibility of investing more money in its own growth -- an edge that many of its smaller and more-debt-burdened competitors don't have.

4. Consistent stock repurchases bolster shareholder gains

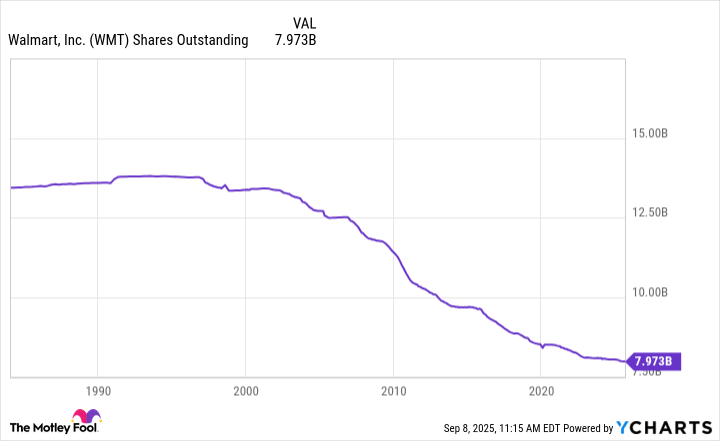

The world's biggest brick-and-mortar retailer may not produce much net growth in any given year. That doesn't mean shareholders' stakes are only making an average annual gain of 5%, though. Walmart's consistent profitability is being used to add shareholder value in a different way. That's through stock buybacks, which reduce the total number of outstanding shares, thus making the remaining ones more valuable. Since 1995, the total number of WMT shares has nearly been halved.

WMT Shares Outstanding data by YCharts

The total number of shares being taken out of circulation has slowed since 2020. Don't misinterpret the graphic above, though. The company's spending as much money on stock repurchases as it ever has. It's just not been able to buy back as many shares as it historically has due to the stock's sizable price increase since 2019.

5. It's willing and able to evolve -- and is doing so

Finally -- and perhaps most important -- buy Walmart stock because the company is willing and able to evolve its business. It's proactively doing so, in fact.

There was a time when simply opening its doors and offering consumers everything they might need was good enough. Not anymore, though. Competition is fierce. Not only is Amazon an obvious threat, but Dollar General and Dollar Tree stores appear to still be popping up everywhere. Walmart can't simply rest on its laurels.

And it isn't.

While not every experiment it's tried has panned out as hoped (the world's not quite ready for Walmart-branded healthcare clinics, for instance), many of them have.

For example, online shopping now accounts for nearly one-fifth of the company's total sales, and just last year Walmart collected $4.4 billion worth of high-margin advertising revenue from sellers looking to more promote their goods being sold via a Walmart-operated e-commerce platform. Its Walmart+ program continues to add paying subscribers, giving these members perks like free next-day shipping of online orders, or in some case, same-day deliveries.

Meanwhile, although it's more qualitative than quantitative, Walmart shoppers are now seeing in-store displays and brand-focused presentations that look like something you'd expect to find in more conventional department stores such as Macy's or JCPenney.

In short, Walmart understands that if it doesn't offer solutions that serve consumers' specific lifestyles, one of its rivals will.

Bottom line

So it's a must-have for all investors? Not necessarily. If you crave massive growth and can tolerate any reasonable degree of risk, you may ultimately be dissatisfied by holding a stake in the world's biggest retailer.

If you're looking for a lower-risk name with good value and proven long-term growth prospects, though, Walmart is a solid pick despite its frothy valuation of nearly 40 times this year's expected per-share earnings of $2.63. Sometimes the premium you pay for quality is well worth it.