Struggling semiconductor giant Intel (INTC +3.39%) announced a flurry of management changes on Monday as the company embarks on an urgent turnaround effort led by CEO Lip-Bu Tan. Michelle Johnston, an Intel veteran and head of the product division, will depart the company. Kevork Kechichian, previously at Arm, will now lead the data center group as the company looks to regain market share. For the client computing group, Intel is turning to Jim Johnson, a 40-year Intel employee.

The most meaningful announcement, though, was the formation of a new Central Engineering Group. This group will be led by Srini Iyengar, who joined Intel earlier this year from Cadence Design Systems. Iyengar will be focused on building a new custom silicon business to help external customers design their own chips.

While Intel has collaborated on custom silicon projects in the past, most notably a deal with Amazon last year to produce a custom AI fabric chip and custom Xeon 6 server central processing units (CPUs), the creation of a new group puts custom silicon front and center.

Image source: Getty Images.

Why custom silicon is a big deal

Not long ago, data centers were filled with Intel CPUs. Today, with demand for AI infrastructure booming, data centers have evolved dramatically. Graphics processing units (GPUs), largely from Nvidia, power AI workloads. Hyperscalers and other large tech companies have been increasingly designing their own chips, both AI accelerators and server CPUs.

It was recently reported that OpenAI is working with Broadcom to develop custom AI chips in a $10 billion deal. For a company like OpenAI, reducing its dependence on Nvidia is critical to bring down costs. Microsoft has designed its own server CPUs and AI chips. So have Amazon and Alphabet.

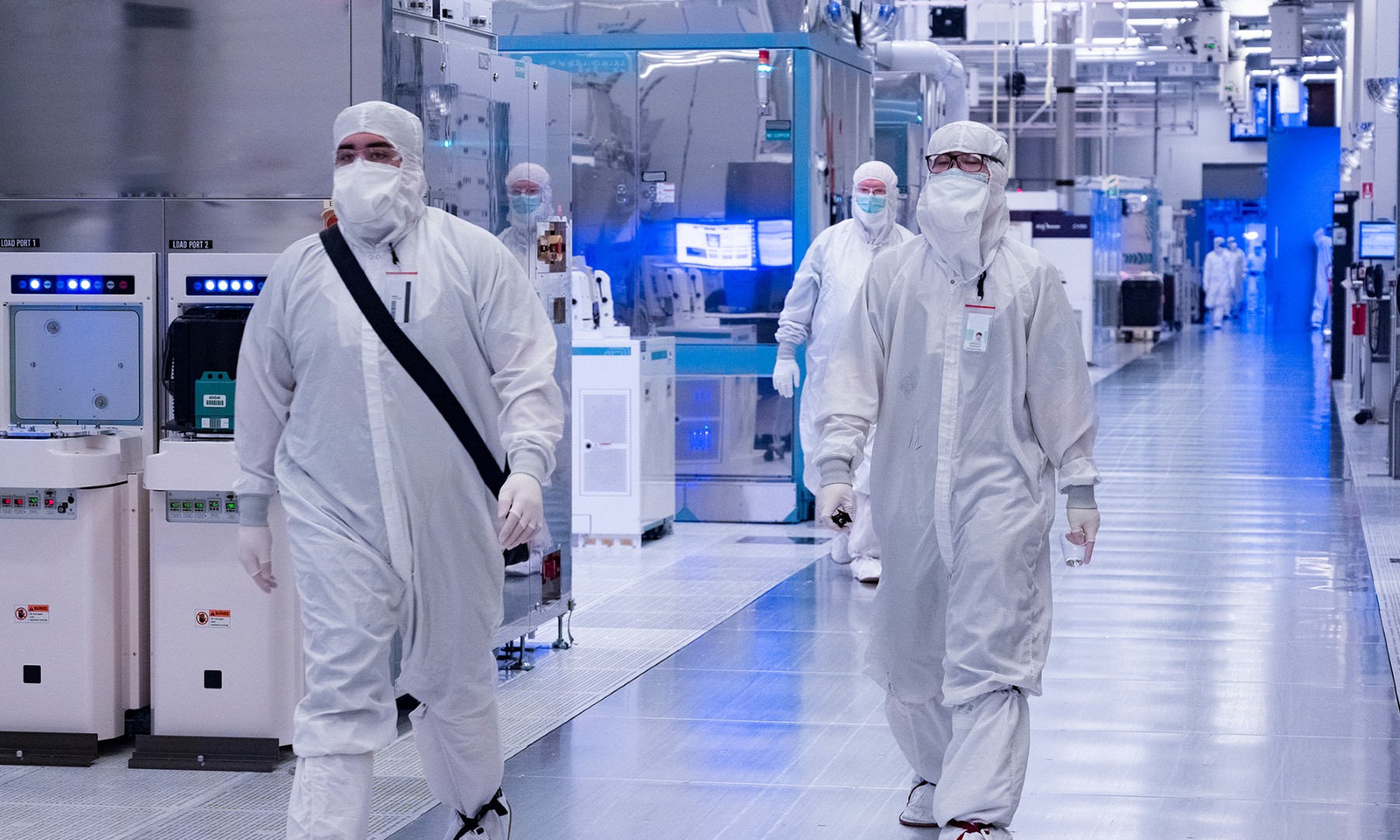

Intel's foundry business can tap into the growing custom chip business, but the company has so far struggled to win many external customers. A dedicated custom silicon business can help this situation by optimizing custom chips for Intel's manufacturing processes and funneling customers to the foundry.

Intel's opportunities extend beyond the data center. Custom smartphone chips based on the Arm architecture could be on the table, as could custom chips for future game consoles. One driver of AMD's comeback over the past decade was that company's semi-custom chip business getting its products into the major game consoles.

NASDAQ: INTC

Key Data Points

A major shift in strategy

In the past, before Intel kicked off its foundry strategy and kept its manufacturing operations to itself, it made little sense to go after custom chip orders. Intel could make more money from its own first-party products. Intel's server CPU business used to be so dominant that profit margins were incredibly high. In 2019, Intel's data center group reported an operating margin of 44%.

Those days are now long gone. AMD is far more competitive, and custom Arm-based server CPUs are making inroads. Intel needs external customers for its foundry to be sustainable, partly because its market share in server and PC CPUs has declined, and partly because building leading-edge foundries has become more expensive. Given these developments, a custom silicon business now makes a lot of sense.

Intel didn't disclose much about this new endeavor, but Tan will likely have more to say when Intel reports its third-quarter results next month.