Whenever I discuss ride-sharing platform Lyft (LYFT 3.01%), I'm quickly met by a horde of people telling me that its days are numbered. Yet here in 2025, the stock is crushing the performance of the S&P 500 (^GSPC 0.84%) with a greater-than-40% gain year to date. And in 2026, I predict that Lyft stock will crush the market again.

As I'll explain, reports of Lyft's demise have been greatly exaggerated, and the stock is consequently dirt cheap and in a position to deliver outstanding returns for shareholders from here.

Image source: Getty Images.

Defying the narrative

According to many pundits, the future of ride-sharing is fully autonomous fleets of cars. Currently, anyone over 18 with a vehicle can start driving for Lyft or Uber to start making some money. But some argue that, in the future, the cars will drive themselves, leading to large businesses deploying entire fleets on to ride-sharing platforms.

Others take this narrative a step further: Tesla has ambitions to have its own fleet of autonomous taxis -- Robotaxis -- on the road. And some believe the company will have a near-monopoly on ride-sharing. If that's true, then the need for a ride-sharing platform such as Lyft wouldn't even exist. Everyone would use Tesla's platform.

To rebut this narrative, I'll start by pointing out that this fear isn't new. For example, investment management company Ark Invest published research in 2020, suggesting that Tesla would already be generating hundreds of billions in revenue from Robotaxis by 2024. It doesn't. Disruption often takes longer than you think.

Moreover, if autonomous taxis are the future, it seems unlikely that Tesla would have a near-monopoly in the space. All the car manufacturers are working on autonomous vehicles. And as the technology improves and regulatory hurdles are cleared, it stands to reason that all companies will follow the same playbook as the leader, resulting in viable competition.

If there's competition from multiple players, then the need for demand aggregators such as Uber and Lyft would still exist.

While Ark Invest and others have been pounding the table on autonomous taxis for over five years, Lyft's key performance metrics continue climbing to all-time highs, defying the narratives.

NASDAQ: LYFT

Key Data Points

In the second quarter of 2025, Lyft provided nearly 235 million rides on its platform, which was a record and up 14% year over year. More than this, it was its ninth consecutive quarter of double-digit growth in rides. This is being carried higher by a record 26 million active riders.

For now at least, Lyft is defying the narrative of its demise with the best numbers it's ever reported.

The value proposition for investors

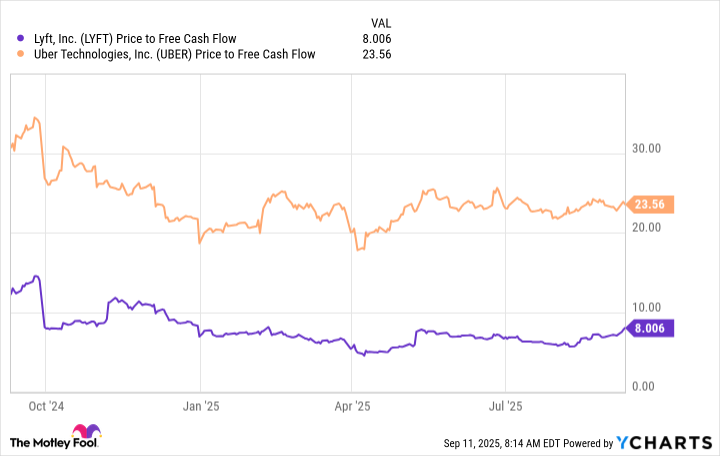

Mismatched expectations can lead to outstanding valuations, and that's certainly the case for Lyft stock. Granted, the valuation was even better just a few months ago. But even after its recent run-up, it still trades at just 8 times its trailing free cash flow.

Compare Lyft's valuation to Uber's valuation of 23 times free cash flow. Even if Uber is worth a premium, does Lyft really deserve to be valued at just one-third of Uber's valuation?

LYFT Price to Free Cash Flow data by YCharts

For investors, I don't think it matters what Lyft stock deserves, because it can win either way. Here's how.

Right now, it appears as though the investing community is finally waking up to how undervalued Lyft stock is. If that's true, this stock could easily double from here and still be valued at a far lower valuation than peers in the space. Ongoing growth in the business would provide additional upside for crushing the market in 2026 and beyond.

By contrast, if Lyft stock stays at a dirt cheap valuation, all is not lost. In Q2, the company repurchased $200 million of its stock at these cheap prices, which can be a good use of its free cash flow. In fact, it reduced its share count for the first time ever, which is a trend that can continue, considering it plans to repurchase around $500 million of its stock over the next year or so.

When Lyft's share count goes down, it boosts the value of the remaining shares. Therefore, whether the market gives Lyft stock a better valuation or whether management takes advantage of its cheap stock price, investors can win -- as long as Lyft continues to grow its revenue and generate copious amounts of free cash flow.

Based on the current business trends, I believe the company will succeed at doing both things, which is why I predict that Lyft stock will crush the market in 2026 and beyond.