We're quickly approaching the fourth quarter of 2025, and this year is showing no signs of letting up. War in Ukraine, conflict in the Middle East, weakening employment numbers, and increasing signs of a recession mean some volatile times may lie ahead. While nobody wants it to happen, investors should prepare for a period of market instability.

Currently, the CBOE Volatility Index, also called the fear index, is at 15.2 as of this writing -- indicating a relative lack of investor concern right now -- and that's down 15% year to date. But this can change quickly. In April, the VIX topped 45, which was the highest it's been since the COVID-19 pandemic.

Image source: Getty Images.

Investors would be wise to seek safety during a volatile market, but you also don't want to miss any upside should the markets continue to be resilient and move higher.

That makes the Invesco QQQ Trust (QQQ 1.54%) an interesting play right now. Should you be investing in the QQQ exchange-traded fund as markets face an unknown future, or are you better off looking for something else? Let's take a closer look.

NASDAQ: QQQ

Key Data Points

About the QQQ ETF

The Invesco QQQ Trust is an index fund passively managed by Invesco, which is one of the leading asset managers. The fund tracks the Nasdaq-100 Index, which consists of 100 of the biggest nonfinancial companies on the Nasdaq stock exchange. That's an interesting distinction for the nature of this discussion, as financial stocks tend to perform poorly in a market downturn. By using the QQQ, you can avoid those kinds of stocks.

Instead, the QQQ ETF is heavy on technology stocks, which represents 60.8% of the fund. Consumer discretionary stocks are next at 19.4%, followed by healthcare, industrials, and telecommunications, which have weightings between 4% and 5%; then basic materials, utilities, energy, and real estate, all of which have weightings below 2%.

The Invesco QQQ Trust is a weighted-capitalization ETF, which means that companies with larger market caps have a heavier weighting in the QQQ ETF. The top 10 stocks make up 52.77% of the fund. And as you can see, tech stocks dominate the biggest positions.

| Company | Allocation |

|---|---|

| Nvidia | 9.24% |

| Microsoft | 8.36% |

| Apple | 8.12% |

| Broadcom | 5.90% |

| Amazon | 5.59% |

| Meta Platforms | 3.70% |

| Alphabet Class A | 3.10% |

| Netflix | 2.95% |

| Alphabet Class C | 2.91% |

| Tesla | 2.90% |

Data source: Invesco; allocations as of Sept. 6, 2025.

The QQQ ETF has a greater expense ratio than many other index funds, coming in at 0.2%, or $20 annually per $10,000 invested. In contrast, the Vanguard High Dividend ETF has an expense ratio of 0.06%; and the Schwab US Dividend Equity ETF has an expense ratio of 0.06%; the Vanguard S&P 500 ETF has an expense ratio of just 0.03%.

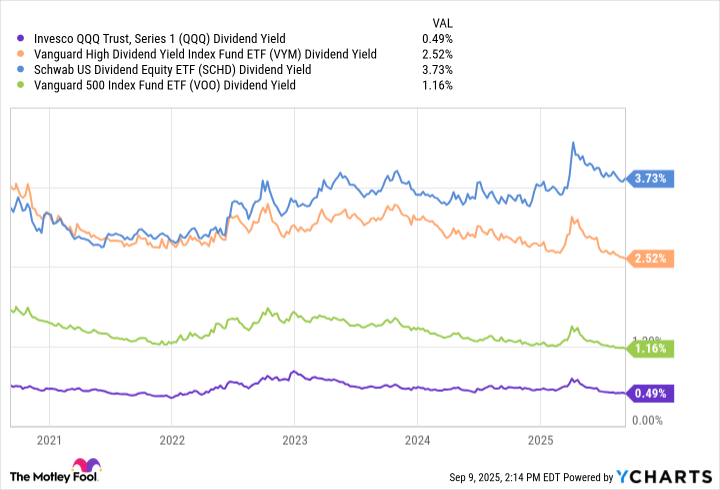

In addition, the QQQ ETF has the lowest dividend yield of the four stocks, with a payout ratio of only 0.49%. That's not a surprise, considering the heavy concentration of technology stocks in the ETF, but it's also likely a disappointment for those looking for steady income. The QQQ is all about growth, not income.

QQQ Dividend Yield data by YCharts

So is QQQ a buy?

There are a lot of good uses for the QQQ -- it's a fund that I would recommend for anyone who is looking to have a tech-heavy, diverse portfolio. Technology stocks are outperforming other sectors this year, so the QQQ has been a great pick. In fact, it's outperforming all three major indices so far this year.

But in a volatile market, the QQQ may not be the best pick for safety. A fund heavy on consumer staples, utilities, and healthcare would be a better choice -- unless you are convinced that tech stocks would be unaffected by a down market. But if your priority is stability and dividends, there are better ETFs than the QQQ.