When it comes to cryptocurrency, most investors gravitate toward mainstream staples like Bitcoin and Ethereum. These are the digital equivalents of blue chip stocks -- offering scale, liquidity, and broad market recognition.

But just as in the stock market, not every investor is satisfied with the stability that comes with household names. Some deliberately seek out higher-risk opportunities in more speculative corners of the market.

In the cryptocurrency arena, one of the most prominent -- and controversial -- of these speculative players is Dogecoin (DOGE 2.58%). With its price hovering around $0.28, the key question is whether it now presents a compelling entry point for investors willing to take on an elevated risk profile.

Image source: Getty Images.

What determines Dogecoin's price?

Just like with any asset, specific dynamics influence how price are value are determined. For Bitcoin, its fixed supply of 21 million coins creates a scarcity mindset -- leading many to view it as a form of digital gold. Ethereum, on the other hand, benefits from a robust ecosystem that underpins much of the decentralized finance (DeFi) movement -- making it a platform with tangible utility.

Dogecoin stands in stark contrast to the cryptos above. Originally launched as a meme coin, its very foundation lies more in internet culture than building practical applications. As a result, Dogecoin's price action is less tied to business fundamentals or technical indicators and more dependent on social dynamics.

The virality of online chatter or celebrity endorsements often act as the catalysts for tokens like Dogecoin. In this sense, Dogecoin operates well outside the traditional frameworks of valuation as its movements are largely (if not entirely) unpredictable -- driven by hype cycles that are nearly impossible to forecast with consistency.

Looking at Dogecoin's historical price action

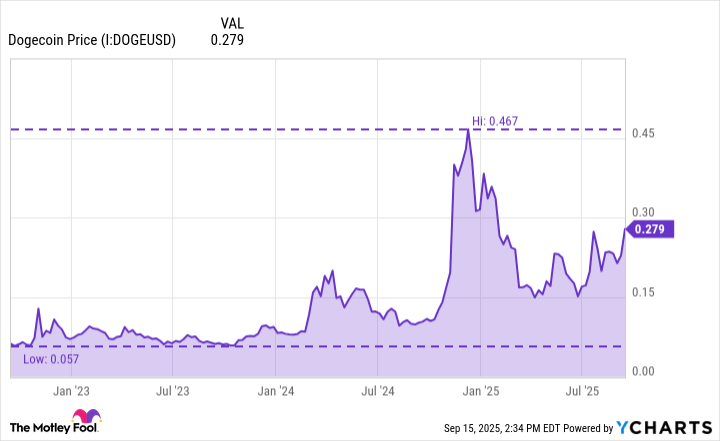

As the chart below illustrates, Dogecoin has endured its trademark volatility over the last few years. For much of 2023 and 2024, the token traded within a relatively narrow range -- exhibiting only modest spikes and corrections. This prolonged stretch of sideways action signaled a cooling of speculative fervor compared to prior narrative-driven rallies.

Dogecoin Price data by YCharts

This all changed in late 2024. The catalyst behind Dogecoin's dramatic rally was the announcement of the Department of Government Efficiency (D.O.G.E.) by then-President-elect Donald Trump and one of his most visible campaign surrogates, Tesla CEO Elon Musk -- a tongue-in-cheek supporter of Dogecoin.

The symbolic "coincidence" of the initiative's acronym with Dogecoin's ticker symbol ignited speculation that the cryptocurrency might somehow be tied to official government actions. Of course, this narrative had little basis in reality.

Unsurprisingly, no substantive adoption materialized and the Dogecoin frenzy began to fade. In many ways, this episode epitomizes Dogecoin's reliance on internet culture over sound fundamentals. The token is repeatedly subject to rapid -- and often fleeting -- surges hallmarked by narrative-driven enthusiasm, which are swiftly followed by inevitable sharp reversals.

Where could Dogecoin be headed next?

At its current price of roughly $0.28, Dogecoin is sitting in a middle ground: Comfortably above prior lows, yet still well-below its highs from just a year ago.

If momentum returns to the broader cryptocurrency market, Dogecoin's trading history suggests that it could push higher into the $0.30 to $0.35 range. Conversely, in a crypto winter environment, it wouldn't be surprising to see the token retest bottoms closer to the $0.15 level.

That said, these technical considerations only tell part of the story. Unlike businesses with measurable key performance indicators or clear utility, Dogecoin's trajectory is driven almost entirely by its community as opposed to macro dynamics. This makes Dogecoin an inherently precarious investment choice.

The price chart above underscores a sobering reality: Dogecoin functions less as a store of value and more like a speculative instrument. Investing in Dogecoin is akin to buying a lottery ticket -- where outcomes depend on timing and luck rather than strategy.

While it likely will continue to generate short bursts of excitement and intrigue, history makes it clear that Dogecoin tends to give back its gains after a hype narrative becomes stale. Given its unreliability, I would exercise caution when it comes to assessing Dogecoin for your portfolio. More established cryptocurrencies are the better option for long-term investors looking to generate durable wealth.