Beth Kindig, CEO of the technology research firm I/O Fund, has built a reputation for bold calls in the tech sector. Much like Cathie Wood's long-standing conviction in Tesla, Kindig has consistently expressed unwavering enthusiasm for semiconductor giant Nvidia (NVDA -0.77%).

In a recent interview with Bloomberg, Kindig sparked debate after revealing her forecast that Nvidia could reach a $6 trillion market cap by the end of next calendar year -- implying roughly 43% upside from its current levels.

Image source: Getty Images.

Below, I'll outline the logic behind Kindig's projection and then examine the key drivers that, in my view, lend credibility to her thesis.

What would it take for Nvidia to reach a $6 trillion valuation?

The vast majority of Nvidia's revenue is driven by its data center segment. In the second fiscal quarter (ended July 27), Nvidia reported $41.1 billion in data center sales -- a 56% increase year over year. This translates to an annualized run rate of roughly $160 billion.

Kindig argues that the probability of Nvidia reaching $50 billion in quarterly data center revenue by year end -- or a $200 billion annual run rate -- is "very high," given the company is still in the early stages of scaling its next-generation Blackwell and Blackwell Ultra GPU architectures.

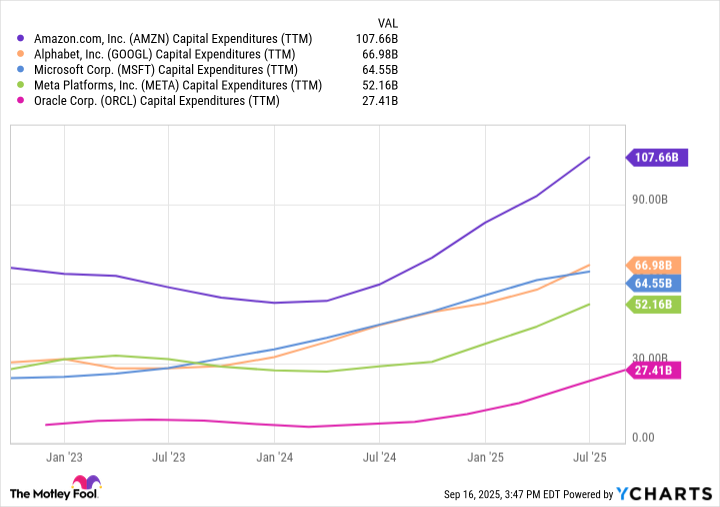

She further contends that Wall Street is underestimating capital expenditure (capex) trends across AI hyperscalers. In her estimation, analysts are not fully modeling the scale of demand for Nvidia's GPUs.

Kindig's math suggests that surging investment in infrastructure could push Nvidia's data center operation to $75 billion in quarterly sales ($300 billion annual run rate) by the end of next year -- implying 50% growth compared to her 2025 year-end figures.

Of course, understanding the arithmetic is just one piece of the story. The larger question is why I share Kindig's bullish stance -- and what's truly at stake for Nvidia as AI infrastructure spending accelerates.

What are the pillars supporting Nvidia's data center growth?

At the core of Kindig's thesis is hyperscaler capex spending. The world's largest cloud providers -- Amazon, Microsoft, and Alphabet -- are committing unprecedented sums to expand compute power, setting the stage for the next phase of the AI era.

AMZN Capital Expenditures (TTM) data by YCharts

The rationale is straightforward: As AI workloads grow and new applications emerge, both training and inference require increasingly sophisticated infrastructure. With hyperscalers doubling down on budgets, Nvidia is positioned to be the primary beneficiary as its GPUs remain the backbone of these AI services.

Consider robotics as an example. Companies like Amazon and Tesla are investing in systems that can navigate warehouse operations with human-grade precision. Training physical systems to interpret and engage with real-world environments is far more complex than the reactive large language models (LLMs) that power today's chatbots. Such advancements require massive GPU clusters -- precisely the systems Nvidia delivers.

Autonomous systems in transportation, manufacturing, and defense follow a similar trajectory. Moving from proof-of-concept to commercial deployment will drive an exponential increase in demand for compute. Nvidia's Blackwell architecture and its successors are designed for this leap -- combining efficiency with processing power that makes Nvidia an indispensable supplier for enterprises building mission-critical workflows.

At the same time, cloud infrastructure is undergoing its own major transformation. A new wave of GPU-as-a-service agreements is gaining momentum, with companies renting access to GPU capacity through providers such as Oracle, CoreWeave, and Nebius Group.

This model creates a multiplier effect for Nvidia whereby the company is not only supplying GPUs to the hyperscalers, but it's also partnering with specialized cloud operators that lease its hardware downstream. As businesses increasingly adopt multi-platform cloud strategies, they distribute workloads across several providers. In turn, this expands Nvidia's footprint in the swiftly evolving AI hardware ecosystem.

Is Nvidia stock a buy now?

Taken together, these catalysts create powerful secular tailwinds supporting Nvidia's long-term growth. The company's expanding data center business is not merely a byproduct of hyperscaler infrastructure investment; rather, it is the inevitable outcome of structural shifts driving the next generation of AI applications.

At a high level, the precise timing of a $6 trillion valuation is less important than the underlying trend: Nvidia is well-positioned to remain the dominant force in AI infrastructure. Against this backdrop, I think the stock offers meaningful alpha potential and makes for a compelling long-term position.