When it comes to investing in new power assets today, the big spending is likely to come in the solar and wind segments. That's great news for Constellation Energy (CEG 6.81%), which is the largest producer of competitive nuclear power in the United States. Here's the good news around this utility's business and why investors still need to think twice before buying the stock today.

Power is a necessity of modern life

Spend a single hour without electricity and you will immediately understand just how important power is to your modern life. Without electricity, you might as well be living in the Dark Ages, because it will most certainly feel like it. That's the core reason why the broader utility sector is so reliable. It has to be or the world comes to a screeching halt.

Image source: Getty Images.

There's a bit of a twist here, however, because renewable power is increasingly the focus when it comes to developing new generating capacity. Only solar and wind are intermittent power sources. They need to be paired with power that is always on, also known as baseload power, or the grid will go through brutal supply swings on a daily basis.

That's where a company like Constellation Energy comes in, because it is focused on providing baseload power thanks to its large fleet of nuclear power plants. Nuclear power is expensive to build, but once a reactor is operational it provides decades of reliable baseload power at a reasonable cost.

As more intermittent power gets attached to the grid, the need for the type of power that nuclear-focused Constellation provides will become more and more important. And at the same time, Constellation Energy is increasingly shifting to market-driven pricing for its power.

In other words, there's a strong opportunity for growth here. And Constellation is planning to augment this core strength with natural gas given its planned acquisition of Calpine. That will create a more diversified business that offers reliable nuclear and natural gas-fueled baseload power. Natural gas, for reference, is helping to bridge the gap between dirtier fuels like coal and renewables, since it is a cleaner-burning energy source.

NASDAQ: CEG

Key Data Points

The problem with Constellation Energy

From a business perspective there is a lot to like about Constellation Energy. But even a good business can be a bad investment if you pay too much for it, as famed value investor Benjamin Graham advised. And that's the problem today with Constellation Energy, since the stock looks like it is trading at a steep premium.

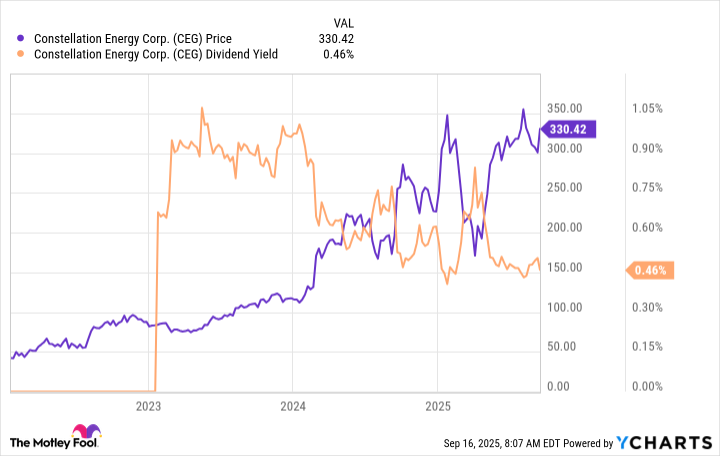

To start, Constellation's dividend yield is 0.5%. That's even lower than the 1.2% yield of the S&P 500 index and far below the 2.7% yield of the average utility. Constellation Energy's yield is also near the lowest levels in its history, but in fairness, the history here is pretty brief. Still, the relatively low yield is an indication that the stock is not cheap right now as the stock price sits near its all-time highs.

Then there are more traditional valuation metrics to consider, like price-to-earnings and price-to-book value. The company's history is too short to create a five-year average for either metric, but you can compare Constellation's P/E and P/B ratios to the industry averages. The results aren't compelling, with Constellation's P/E at around 34 compared to an industry average closer to 21. The price-to-book value ratio shows the same trend, with Constellation's P/B at nearly 7.7 compared to an industry average of 2.3.

The evidence is pretty clear. Constellation Energy is being afforded a very high price -- so high that even the slightest business shortfall could easily lead to a dramatic stock pullback. Which is important to keep in mind given the nature of nuclear power.

Although largely safe, high-profile nuclear disasters have occurred and shifted the mood dramatically in the negative direction around this power source. That's a worst-case scenario, of course, but given the current pricing of Constellation Energy, even a smaller hiccup, like a long-unplanned outage at a reactor, could lead investors to dump the shares.

Tread with caution with Constellation Energy

Constellation Energy is not a bad company, but it does appear to be an expensive one. Unless you have huge expectations for nuclear power more broadly and Constellation Energy in particular, you will probably be better off watching this high flyer from the sidelines right now.