When investors think about quantum computing stocks, IonQ is often one of the first names that comes to mind. The company's trapped ion technology and deep integrations with major cloud providers like Microsoft Azure, Amazon Web Services (AWS), and Alphabet's Google Cloud Platform (GCP) have earned IonQ a loyal following.

Over the past year, its stock price has soared an eye-popping 812% -- propelling its market capitalization to roughly $22 billion. While IonQ will likely continue to grab headlines, investors seeking the next breakthrough opportunity may want to look elsewhere.

That brings us to Quantinuum -- a rising star in the space that recently secured $600 million in funding from an impressive roster of backers including Honeywell (HON 0.53%), JPMorgan Chase, Amgen, Mitsui, and, most notably, Nvidia (NVDA 0.17%). Following its recent capital raise, Quantinuum is now valued at $10.6 billion.

Let's explore why Quantinuum could become the next monster company defining the quantum artificial intelligence (AI) market -- and how investors can gain exposure today.

NASDAQ: NVDA

Key Data Points

Quantum computing has trillion-dollar potential

Quantinuum's lineup of investors underscores the broad reach of quantum computing. Honeywell contributes industrial scale, JPMorgan represents financial services, Amgen highlights breakthroughs in pharmaceuticals, and Nvidia provides the bridge between accelerated computing and quantum AI. Together, these partners illustrate how quantum technology impacts nearly every major economic sector.

The potential applications are vast -- spanning fraud detection, risk modeling, logistics optimization, energy efficiency, drug discovery, molecular simulation, AI model training, and generative application design.

With such transformative use cases on the horizon, it's no surprise that McKinsey & Company projects quantum computing could generate trillions of dollars in economic value over the coming decades.

Image source: Getty Images.

How to invest in Quantinuum

Since Quantinuum remains a private company, investors cannot buy its stock directly. However, there is still a practical way to gain exposure: by investing in the publicly traded companies that already own equity stakes in Quantinuum.

This approach not only provides passive, insulated access to quantum computing's growth potential, but it also delivers diversified exposure through established blue chip stocks.

By owning shares of companies like Nvidia, Amgen, JPMorgan, and Honeywell, investors can participate in multiple industries that stand to benefit as quantum AI moves from research labs to tangible commercialization at scale. In other words, this strategy offers a balanced path to profit from the next computing evolution while staying anchored in some of the market's most durable, resilient, and profitable industry leaders.

Why quantum AI is such an important opportunity

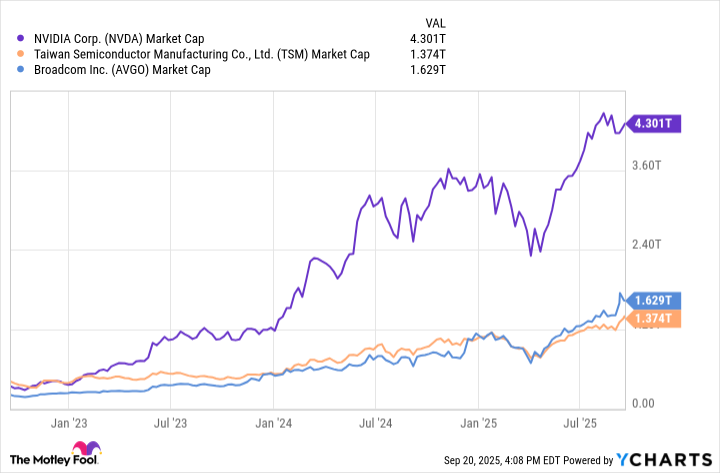

AI has already transformed global computing demand. In just a few years, companies like Nvidia, Broadcom, and Taiwan Semiconductor Manufacturing have ascended into the exclusive trillion-dollar market cap club. In fact, Nvidia's meteoric rise during the AI revolution has even made it the most valuable company in the world.

NVDA Market Cap data by YCharts

Now, quantum technology is positioned to extend this digital transformation by tackling problems that even today's most advanced supercomputers have trouble solving. When paired with AI, quantum computing has the potential to unlock unprecedented efficiencies and reshape industries that will define the next technological frontier.

Quantinuum's rise to a $10 billion valuation, backed by some of the biggest names across multiple industries, underscores that the shift to quantum applications is not merely hypothetical or experimental -- it is real and already under way.

For investors, the message is clear: You don't need to wait for Quantinuum's initial public offering (IPO) to participate in its upside. By building a basket of quantum-adjacent stocks -- established blue chips investing beyond their core platforms -- you can ride the near-term wave of AI upside while securing long-term tailwinds fueling the quantum era.