The artificial intelligence (AI) boom is carrying significant momentum right now, and it's showing no signs of slowing down. A few months ago, Nvidia CEO Jensen Huang said he expects data center operators to spend as much as $4 trillion to upgrade their infrastructure to meet demand from AI developers over the next five years alone.

If that weren't enough, Nvidia announced plans last week to invest a whopping $100 billion in ChatGPT creator OpenAI, so Huang and his team clearly expect substantial growth on the software side, too.

Investors who haven't owned AI stocks like Nvidia over the last few years have almost certainly underperformed the benchmark S&P 500 index. But it isn't too late, and buying an exchange-traded fund (ETF) could be a great way to gain exposure to a cross-section of the industry without having to pick winners and losers.

A single share of the iShares Future AI and Tech ETF (ARTY +0.02%) trades for under $50. Here's why it might be a great option for investors of all experience levels.

Image source: Getty Images.

A diverse portfolio of AI semiconductor, infrastructure, and software stocks

The iShares ETF invests in global companies up and down the AI value chain, including those developing software, services, chips, and infrastructure. It only holds 48 stocks, so it's highly concentrated, meaning investors should aim to buy it as part of a diversified portfolio of other ETFs and individual stocks to keep their risk in check.

That said, the ETF includes almost every AI stock investors could want, and its top 10 holdings are some of the most dominant players in the game:

|

Stock |

iShares ETF Portfolio Weighting |

|---|---|

|

1. Vertiv Holdings |

5.00% |

|

2. Super Micro Computer |

4.85% |

|

3. Arista Networks |

4.55% |

|

4. Nvidia |

4.46% |

|

5. Advanced Micro Devices |

4.42% |

|

6. Broadcom |

4.25% |

|

7. Advantest Corp |

3.53% |

|

8. Palantir Technologies |

3.28% |

|

9. Marvell Technology |

3.15% |

|

10. Constellation Energy |

3.11% |

Data source: iShares. Portfolio weightings are accurate as of Sept. 19, and are subject to change.

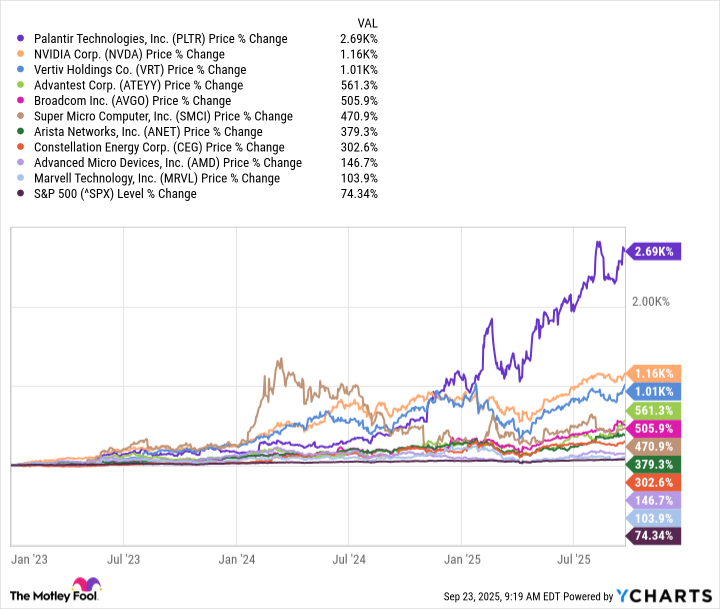

Those 10 stocks have delivered an eye-popping median return of 488% since the start of 2023, which is when the AI boom really started gathering momentum. Moreover, every single one of them has outperformed the S&P 500 over that period:

Data by YCharts.

Vertiv produces many of the components required to build data centers, including power supplies, power distribution systems, and server racks. It also offers a suite of planning and maintenance services to help customers optimize their infrastructure. Super Micro Computer and Arista Networks, on the other hand, supply components like servers and networking equipment, which are critical to achieving the rapid processing speeds required for AI workloads.

Nvidia and AMD design some of the world's best graphics processing units (GPUs), which are the primary chips used in AI development. Nvidia still has the edge from a technological standpoint with its Blackwell Ultra GPUs, but AMD could close the gap when it launches its MI400 series next year.

Outside its top 10 positions, investors will find many other AI powerhouses in the iShares ETF, including Microsoft, Snowflake, Amazon, Meta Platforms, Oracle, and more.

The iShares ETF is crushing the market right now

The iShares Future AI and Tech ETF was originally established in 2018 with a focus on AI and robotics, but it was completely restructured in August last year to invest more narrowly in AI alone. As a result, it doesn't have much of a track record for investors to analyze.

That said, the ETF has delivered a return of around 46% since the restructure, crushing the S&P 500, which is up by 25% over the same period.

NYSEMKT: ARTY

Key Data Points

The strong performance does come at a cost because the ETF has an expense ratio of 0.47%, meaning an investment of $10,000 will incur an annual fee of $47. That doesn't sound like much, but some index funds, such as those issued by Vanguard, offer expense ratios as low as 0.03%. The iShares ETF is actively managed, so a team of experts will regularly buy and sell stocks to deliver the best potential returns for investors, and that comes with higher costs.

If the iShares ETF continues to outperform the broader market by such a wide margin, its higher expense ratio will pay for itself in the long run. There is a good chance its momentum continues into 2026 and beyond, considering the trillions of dollars in AI infrastructure spending in the pipeline.

But as I mentioned, this ETF is highly geared toward the success of AI, so it could suffer significant downside if the boom loses steam. Therefore, it's important to own it as part of a diversified portfolio.