Adding growth stocks to your investment portfolio is one way to tap into the potential of tomorrow's winners. These companies are innovators in industries poised for disruption and grow rapidly as they capture market share from legacy operators. The challenge lies in striking a balance between growth and profitability.

Two companies looking to upend a legacy industry are Lemonade Inc. (LMND 0.86%) and Root Inc. (ROOT 1.82%). These two insurers are growing rapidly and are refining their risk models to improve their bottom lines, and their impressive growth has captured the attention of investors. But which is a better buy today?

Image source: Getty Images.

Root and Lemonade share these traits

Root Insurance and Lemonade were both founded in 2015 with a mission to disrupt the insurance industry through technology.

Both companies utilize mobile apps, automation, and data science to streamline underwriting, minimize friction, and cater to consumers. Along the way, both have struggled with profitability, facing high loss ratios as they grow.

Here's where the two fintechs differ

Root's business focuses on underwriting auto insurance using telematics to assess driving behavior and dynamically price risk. Its app tracks acceleration, braking, and turning to personalize premiums, making Root's underwriting deeply behavior-based.

NASDAQ: ROOT

Key Data Points

The company believes that car insurance rates should be based solely on driving habits, rather than demographics and other traditional factors used by insurers. It utilizes its extensive data, combined with machine learning and artificial intelligence (AI), to more accurately price insurance and respond to shifts in economic trends.

It uses about two to four weeks of test drive data from users' smartphones. From there, it takes thousands of variables, including distracted driving, to identify and avoid the riskiest drivers on the road. According to the company, these drivers are estimated to be twice as likely to be involved in an accident compared to its targeted customers.

NYSE: LMND

Key Data Points

In contrast, Lemonade focuses on a broader range of insurance coverage, including renters, homeowners, pet, life, and auto insurance. The company was an early adopter of AI chatbots to handle everything from buying policies to processing claims, delivering a smooth experience for customers.

Lemonade Car has been a key growth driver for the company, surpassing $150 million in in-force premiums in the second quarter of this year. This auto insurance product is available in 10 states, covering roughly 50% of the U.S. car insurance market; the company plans to launch in additional states by the end of 2026.

Which stock is a better buy?

Lemonade generates more buzz among investors and is perhaps a more recognizable name. Its use of AI has made it a popular stock in the fintech sector, and it is making real progress.

Root, however, is further along in terms of profitability. The company achieved a full-year positive income last year under generally accepted accounting principles (GAAP), with earnings per share (EPS) of $1.54. Lemonade, in comparison, had a loss per share of $3.07.

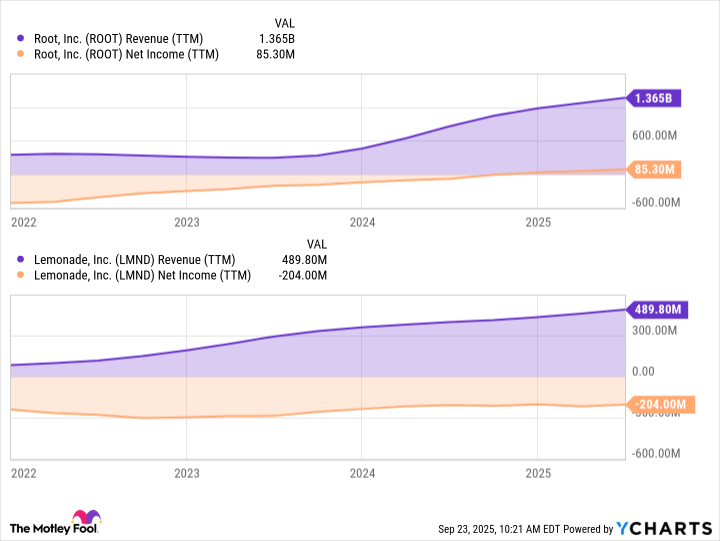

ROOT Revenue (TTM) data by YCharts

Analysts expect Root to report EPS of $1.49 this year and $2.55 next year. Meanwhile, Lemonade is projected to incur a loss per share of $2.69 this year, which is expected to narrow to $1.63 in 2026. On a valuation basis, Root trades at 1.3 times trailing-12-month sales, while Lemonade is priced at 6.9 times sales.

While Lemonade is making solid progress on its underwriting profitability, the company still has a ways to go before reaching profitability. Root, on the other hand, is turning a profit already and is priced at a more affordable valuation. For these reasons, I think Root is a better buy at the moment.