If you haven't owned Nvidia (NVDA +2.06%) stock over the past few years, you've missed out on a ton of returns. However, even after an incredible run, you would have made a ton of money even if you invested in Nvidia slightly late. For example, Nvidia's stock was up over 800% from the start of 2023 through 2024. Most people threw in the towel at the start of this year and said that they missed the move and ignored the stock. However, Nvidia has had another strong year and is up another 33% so far.

I think there's still plenty of room for Nvidia's stock to run over the next five years, and just because you missed the initial big movement doesn't mean you have to miss out on the next leg up. Nvidia's stock price could hit jaw-dropping levels by 2030, and projections from Nvidia's management back it up.

Image source: Getty Images.

Nvidia expects increased AI spending over the next few years

Nvidia has been the king of the artificial intelligence investment trend because of its graphics processing units (GPUs). The computing devices are the muscle behind practically every generative AI model. GPUs have a unique ability to process multiple calculations in parallel. This effect is amplified when thousands of GPUs are connected in clusters.

Nvidia's GPUs aren't cheap, either. When you hear about a data center being outfitted with hundreds of thousands of GPUs, Nvidia is getting a massive chunk of the total cost. Management estimates that for a gigawatt AI factory, it captures around 50% of that spend. That likely doesn't include other costs like land and building infrastructure, but it's still an impressive revenue share.

NASDAQ: NVDA

Key Data Points

Many of the AI hyperscalers already informed investors of their 2026 capital expenditure plans, and most forecast that they will spend a record-breaking amount on AI data centers after spending a record-breaking amount in 2025. Nvidia expects this trend to continue, as it believes that global data center capital expenditures will reach $3 trillion to $4 trillion by 2030. With the AI hyperscalers spending an estimated $600 billion this year, this bodes well for Nvidia's stock.

But what kind of returns can investors expect?

Nvidia's stock has plenty of room to run if management is correct

If AI hyperscalers are spending $600 billion this year and Wall Street analysts expect Nvidia to generate around $206 billion in revenue, Nvidia gets around a third of all data center capital expenditures. However, with rising competition from companies like Broadcom that are partnering directly with AI hyperscalers to create a custom AI accelerator chip, some of Nvidia's market share may fall. Additionally, a large part of the $3 trillion to $4 trillion market opportunity is in China, where Nvidia's chips cannot be sold currently because its export license hasn't been granted. Even if it does get approval, there's no guarantee that China will be buying them at the same level they previously did.

As a result, I think it's better to model Nvidia getting 20% of total capital expenditures. If I'm wrong, it will likely be to the upside, which will result in even greater gains. If Nvidia can capture 20% of $3 trillion in spending by 2030, that would indicate $600 billion in revenue. If we assume Nvidia can maintain its 50% profit margin and achieve a price-to-earnings valuation of 30 times earnings, that would price the stock at a market cap of $9 trillion.

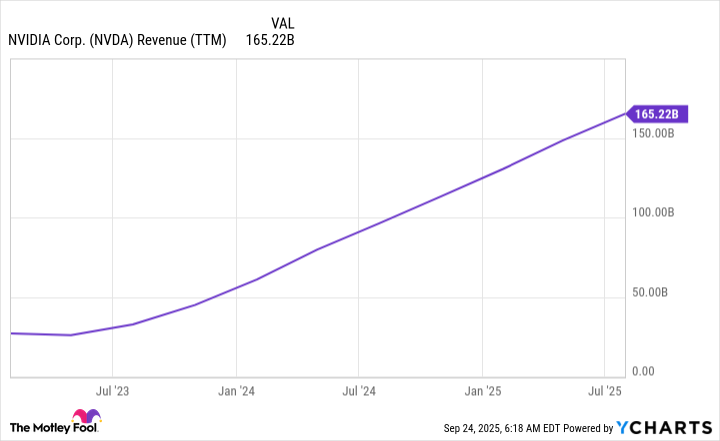

NVDA Revenue (TTM) data by YCharts

With Nvidia's stock price sitting at $178 at a $4.3 trillion valuation, that would indicate Nvidia's stock price will reach $370 by 2030 -- an upside of over 100%. Considering that the market typically doubles once every seven years, this would be a market-beating growth rate.

Furthermore, this is a very conservative estimate if Nvidia's management's market projection turns out to be correct. As a result, I think Nvidia is a top stock to buy now, as the AI computing power buildout cycle is far from over.