Apparel is a fickle industry. Brands go through mini boom and bust cycles as consumer tastes evolve. If one season's new lineup fails to catch the attention of your core customers, it can rapidly hurt your business and lead to market share losses. That is what investors fear is happening at Lululemon (LULU +2.71%).

The premium athleisure brand has seen a major growth slowdown in the United States and Canada, and in response, the market has punished the stock, dragging it down by 66% from the all-time high it touched in early 2024. The trends are shifting toward baggier clothing, and Lululemon has been slow to adapt.

However, relative to its underlying business, Lululemon stock might be cheap at current levels. Is this stock finally a buy after its precipitous fall?

Image source: Getty Images.

Building back in North America

The majority of Lululemon's business is in North America, where it defined the premium athleisure market and popularized leggings for wear in everyday life. Last quarter, its net revenue in the Americas region grew by only 1% year over year. That slowdown greatly impacted the brand's consolidated growth, which fell to just 6% on a constant-dollar basis.

The growth slowdown was due in part to Lululemon bringing out an assortment of apparel that largely didn't line up with changing consumer tastes. Now, the company is working to refresh its inventory with the looser fitting styles that have become popular among younger shoppers. Given the brand's long dominance of the athleisure category, I am confident that Lululemon has the culture to adapt to these changing consumer trends.

NASDAQ: LULU

Key Data Points

Another area impacting Lululemon's business is the broad slowdown in consumer spending on apparel. Its revenue growth may have slowed, but it's in much better shape than some rivals. Competitors such as Nike and Athleta have seen declining revenues in recent quarters. As a result, Lululemon's management said the company has actually continued to gain market share in both men's and women's apparel.

Overall, investors are right to be nervous about Lululemon's slowing growth in North America, but in light of the macroeconomic headwinds and the company's ongoing efforts to adjust its product assortment, its stock price slump looks overdone.

Expanding internationally

Lululemon is still in the early innings of growing its international footprint. The company is gaining ground rapidly in China, where revenue was up 24% year over year last quarter. The Americas region still accounts for 70% of total net revenue, but that share is falling rapidly as consumers in other countries adopt more premium athleisure apparel.

Compared to other global apparel companies, Lululemon is way behind when it comes to international diversification. The company has plenty of room to grow in Asia (where brands like Adidas are highly popular), Australia, Latin America, Europe, and other areas. Expect it to engage in a steady expansion propelled by the openings of flagship stores in new areas. That should lead to consistently strong international revenue growth over the next 10 years.

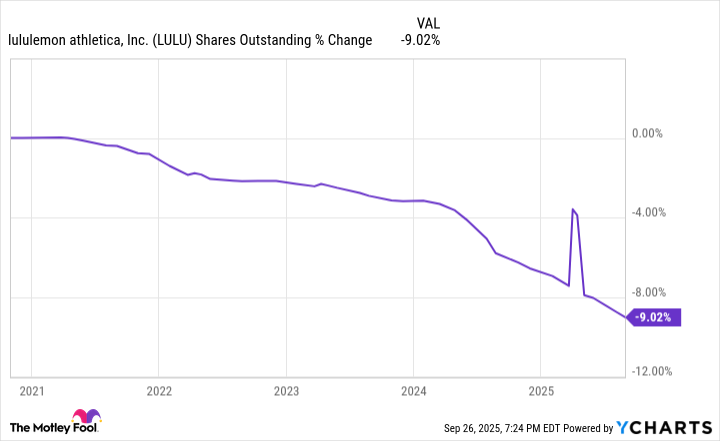

LULU Shares Outstanding data by YCharts.

Increasing capital returns to shareholders

Even if Lululemon's business is not firing on all cylinders today, it is still doing much better than investors are giving it credit. Over the longer term, observers may look back on 2025 as a minor speed bump in its growth story.

Today, Lululemon trades at a cheap price-to-earnings ratio (P/E) of 11.7. At the same time, the company is increasing the amount of money it's distributing via share buybacks. The number of shares outstanding has fallen at an accelerating rate in recent quarters and should continue to if the company keeps repurchasing stock at its depressed valuations. And when shares outstanding fall, that gives a mathematical boost to earnings per share (EPS) -- which are a key driver of stock price performance over the long term.

There's a lot of fear and uncertainty baked into Lululemon's stock price right now. However, I would suggest that investors should take the long view and remember that this is a beloved brand with years of innovation behind it. I think the future looks bright for Lululemon's business, making the stock a buy at its current level.