There hardly ever seems to be a shortage of up-and-coming stocks offering blistering sales growth rates. However, the list of these growth stocks with positive cash generation and minimal shareholder dilution is much, much shorter.

One promising young company that offers investors this blend of high growth and cash creation is handcrafted beverages chain Dutch Bros (BROS +0.73%). With its stock down 30% in just the last month, here's why now is the perfect time to consider buying Dutch Bros shares.

NYSE: BROS

Key Data Points

Dutch Bros' growth potential in one chart

Dutch Bros primarily sells iced and blended drinks, whether they're coffee and energy drinks or smoothies and shakes. Its drive-thru focus with escape lanes offers customers a differentiated, to-go option.

The company has quickly built a cult-like following among its loyal members and has doubled its store count to over 1,000 locations between 2021 and today. However, Dutch Bros' shares outstanding have nearly tripled over this same time, as management leaned on new share offerings to raise money for new store growth.

Image source: Dutch Bros.

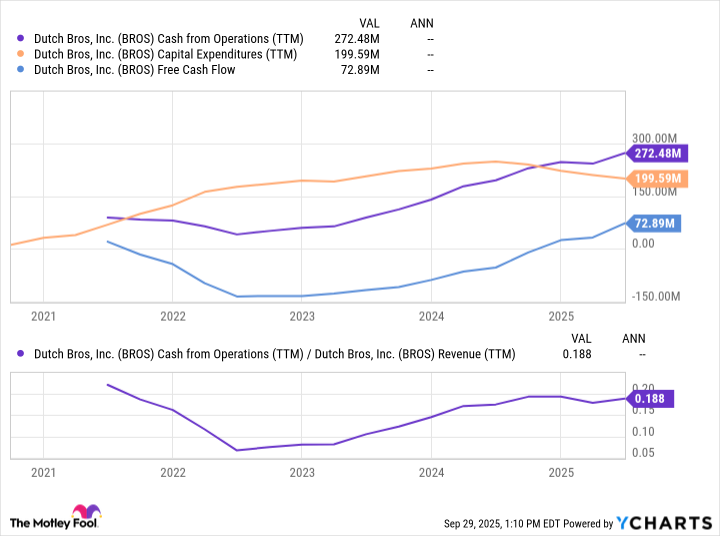

This ballooning share count diluted shareholders' value heavily and made the company nearly uninvestable in my eyes at the time. Dutch Bros changed my opinion on this matter late in 2024 when it reached a massive tipping point: earning more in cash from operations (CFO) than it spent on capital expenditures for new stores.

Data by YCharts

The inflection point in the top chart is critical because the company is now funding its store count expansion ambitions in-house, rather than relying upon new share offerings.

Despite spending $200 million on capex to open 131 new stores over the last year, Dutch Bros generated $272 million in cash from operations, netting $73 million in free cash flow after these two are combined.

Planning to double its store count to 2,029 locations by 2029, with a total addressable market of 7,000-plus stores nationwide over the long haul, Dutch Bros offers immense potential at just 35 times CFO.