Wednesday's shutdown of the federal government didn't come as a surprise. Republicans and Democrats had their heels dug in, and investors had braced for several days that Congress and President Donald Trump would fail to reach a deal before the midnight deadline on Tuesday night.

The major indexes -- the S&P 500, the Dow Jones Industrial Average, and the Nasdaq Composite -- all opened Wednesday's trading day in the red before recovering. But there are some early trends. Investors are shifting some attention to gold futures, which were up today, and they are also putting more money into Bitcoin, which is up 3% on the day.

A financial shutdown can be perilous for financial stocks, as more people come under pressure to make their mortgage, automobile, and credit card payments. But there's one stock I like right now because of the shutdown, and that's Coinbase Global (COIN 2.36%).

NASDAQ: COIN

Key Data Points

About Coinbase Global stock

Coinbase Global is a leading cryptocurrency exchange and is a primary way for people around the world to trade Bitcoin, Ethereum, and other cryptocurrencies. Coinbase operates in more than 100 countries, making it a convenient way to trade assets overseas, and currently has $425 billion in assets on its platform. The company says it has a quarterly trading volume of a whopping $237 billion.

The company is continuing to grow, with net revenue of $1.42 billion in the second quarter, up from $1.38 billion a year ago. Income of $1.43 billion dwarfed the income of just $36 million a year ago.

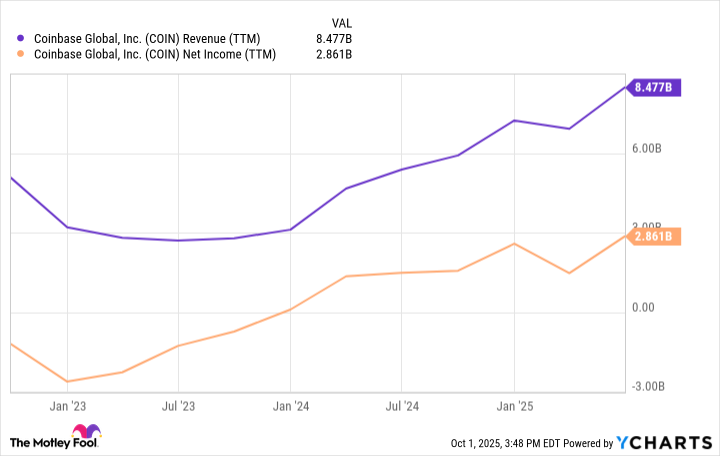

Coinbase is seeing massive revenue and income growth. Revenue is up nearly 3,000% in the past three years, and the company's net income is up 200% in that period.

COIN Revenue (TTM) data by YCharts. TTM = trailing 12 months.

There's also strong analyst sentiment with Coinbase stock. Of 34 analysts who cover Coinbase stock, half have a strong buy or buy rating, and 15 others have a hold rating, with a consensus price target of $371, indicating 7% short-term upside. The most bullish analyst, who has a $510 price target, suggests upside of 43%.

Image source: Getty Images.

The bottom line

Coinbase has an attractive business model. In the second quarter, a Coinbase One Basic subscription plan, which offers zero-fee trades, rewards, and benefits, costs $5 monthly. The membership plan is similar to what Robinhood Markets did with its Robinhood Gold premium subscription membership -- a feature that has helped Robinhood stock jump 271% so far this year.

I'm not suggesting that Coinbase will see those gains. But the membership fee and an increase in cryptocurrency trading during the government shutdown both bode well for Coinbase stock. It could be an ideal place to help protect your portfolio during the shutdown.