NuScale Power (SMR +8.37%) sells exactly what artificial intelligence (AI) needs: reliable 24/7 power generation from small modular reactors (SMRs). These SMRs can be built near data centers, producing electricity in places where the grid doesn't reach.

The matchup seems like it was destined in the stars. But that's not the only reason I've got my eyes on NuScale in 2025.

Image source: Getty Images.

What I'm watching

NuScale has design approval from the U.S. Nuclear Regulatory Commission (NRC), something no other microreactor developer can claim. In May 2025, NuScale's 77-megawatt electric reactor design became its second design approved by the NRC (the first came in 2023). This gives it first-mover advantage in an industry that's growing crowded with would-be contenders, though it hasn't put any into operation yet.

Other advanced nuclear companies, like Oklo (OKLO +5.73%), are likely still a few years from getting their first NRC design approval. If you're betting on which SMR company will actually put steel in the ground first, NuScale's regulatory head start is pretty hard to ignore.

NYSE: SMR

Key Data Points

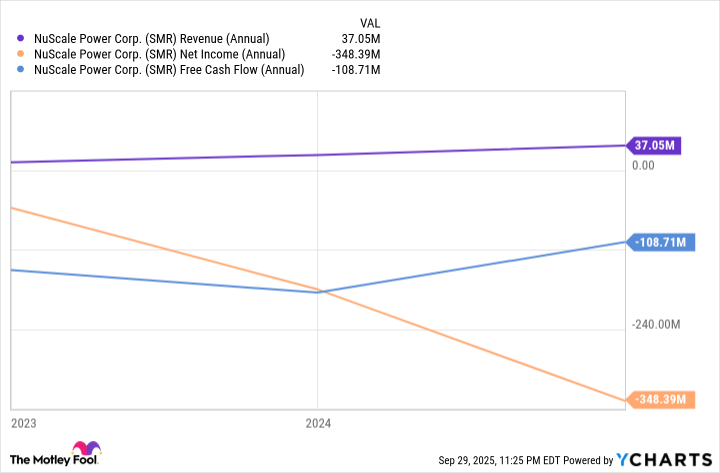

Here's something else that's hard to ignore: NuScale's balance sheet. Right now, the company isn't generating meaningful revenue (about $8 million in the second quarter). And while it had about $490 million in cash at the end of June, it's also burned about $55 million in cash so far this year.

SMR Revenue (Annual) data by YCharts

This cash burn is more acutely felt because NuScale hasn't built an SMR for commercial operation, nor does it have a customer lined up to enter a definitive agreement to buy one.

However, it does have RoPower, a Romanian energy company, that wants to deploy a power plant using energy from six of NuScale's SMRs. Likewise, it could have something going with ENTRA1 Energy, which wants to use NuScale's SMRs to provide power across the Tennessee Valley Authority.

Both are potential partnerships, though neither has become a solid deal -- yet.

NuScale is a high-risk/high-reward stock -- a speculative play on the future of energy, and it's one I'm watching in 2025.