Wall Street is gearing up for a fresh earnings season for the quarter ended Sept. 30. Companies will provide updates on their operating performance and offer forecasts for the remainder of the year, which can influence the value of their shares.

Streaming giant Netflix (NFLX 0.04%) is scheduled to report its third-quarter results on Oct. 21, so it's one of the first tech giants investors will hear from. The company is already having a great year, but it could get even better if management's guidance is anything to go by. Should investors buy Netflix stock ahead of the release?

Image source: Netflix.

Look for accelerating revenue growth

Netflix operates the world's largest streaming platform for movies and television shows. The company no longer reports its subscriber numbers, but with over 300 million members at the end of 2024, it was towering over competitors like Amazon Prime and Disney's Disney+.

Netflix's advertising tier is one of its biggest growth drivers right now. It regularly accounts for around half of all signups in countries where it's available, mainly because of its low price of just $7.99 per month. It's far cheaper than the ad-free Standard ($17.99 per month) and Premium ($24.99 per month) tiers, but that doesn't mean it's less valuable for Netflix.

As the ad-tier subscriber base grows larger, Netflix can charge businesses a higher price per advertising slot, which means each member actually becomes more valuable over time. The company's advertising revenue doubled in 2024, and a similar result is expected in 2025. Investors should look for an updated forecast on Oct. 21.

Netflix generated a record $11.1 billion in total revenue during the second quarter of 2025 (ended June 30). It represented a 15.9% increase from the year-ago period, which was an acceleration from the 12.5% growth the company delivered in the first quarter three months earlier. The advertising business undoubtedly contributed to that momentum.

Based on management's guidance for the third quarter, Netflix's revenue likely climbed at an even faster pace of 17.3%, to $11.5 billion. If the official number comes in even higher, that would be very bullish for its stock.

NASDAQ: NFLX

Key Data Points

Netflix could spend a record amount on content this year

Netflix is extremely profitable, which sets it apart from most of its competitors. In the 12 months ended June 30, the company generated $10.2 billion in net income, which translated to earnings of $23.47 per share. This allows the streaming giant to out-spend its peers, so it always has a packed slate of fresh content.

According to management's guidance, Netflix will spend a record $18 billion on creating and licensing content this year alone. A growing portion of that spending is going toward live programming, which is a major drawcard for new members and a powerful tool for keeping existing members engaged.

Last year, Netflix exclusively showed both NFL games on Christmas Day. They attracted around 30 million viewers each, making them the most-streamed matches in the sport's history. The average subscriber spends around two hours watching Netflix each day, but the average NFL game runs for over three hours, so live sports can certainly boost engagement. This is valuable for Netflix's advertising business -- the longer each member spends on the platform, the more ads they see, and the more money the streaming giant makes.

Unsurprisingly, Netflix plans to exclusively show both Christmas Day NFL games again this year. The company is also leaning into other live sports like boxing; in September, it streamed the Canelo Alvarez vs. Terrence Crawford bout, which drew over 41 million viewers.

Is Netflix stock a buy ahead of Oct. 21?

Netflix's business has significant momentum right now, and one single quarter probably won't change that. Therefore, whether or not investors should buy its stock ahead of the upcoming Oct. 21 earnings release might depend on their time horizon.

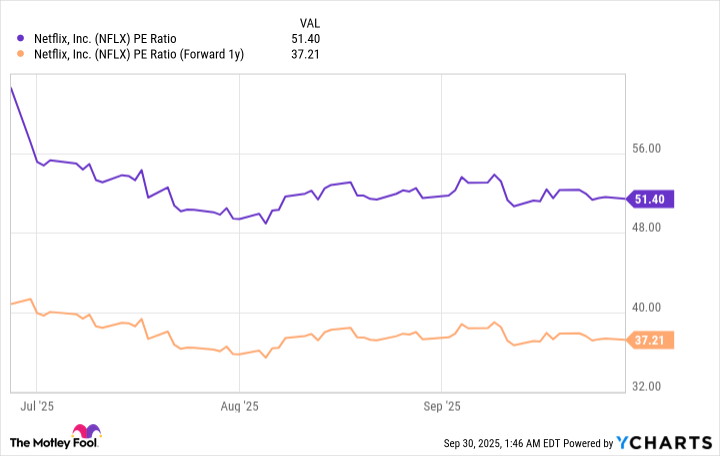

The stock is trading at a price-to-earnings (P/E) ratio of 51.4 as I write this, so it's expensive compared to the Nasdaq-100 technology index which trades at a P/E ratio of 32.6. As a result, short-term investors who are looking for gains in the next few months might be left disappointed.

However, if we value Netflix based on its future potential earnings, its stock looks far more attractive. For example, Wall Street analysts think the company's earnings will grow to $32.39 per share in 2026 (according to Yahoo! Finance), placing its stock at a forward P/E ratio of 37.2. In other words, the stock would have to rise 38% by the end of next year just to maintain its current P/E ratio, which is certainly possible given the company's momentum.

NFLX PE Ratio data by YCharts

Therefore, as long as investors plan to hold Netflix stock for at least a couple of years, buying it ahead of Oct. 21 isn't a bad idea.