Some of the largest index funds and exchange-traded funds (ETFs) in the world track the S&P 500. The Vanguard S&P 500 ETF (VOO +0.19%) has a staggering $1.37 trillion in net assets. Other popular ETFs, like the SPDR S&P 500 ETF and the iShares Core S&P 500 ETF, each have over $650 billion in net assets. The Invesco QQQ Trust, which mirrors the performance of the Nasdaq-100, has over $365 billion in net assets.

As large as these popular funds are, they are no match for the Vanguard Total Stock Market ETF (VTI +0.31%) -- which just surpassed $2 trillion in net assets. Here's what separates this ETF from S&P 500 index funds and why it's a top buy for long-term investors right now.

Image source: Getty Images.

Differences between the total stock market and the S&P 500

The most valuable U.S. companies have been leading the market to new heights. Nvidia, Microsoft, and Apple alone make up a combined 20% of the S&P 500 index. The "Ten Titans," which are Nvidia, Microsoft, Apple, and seven other mega-cap growth stocks, make up a combined 39% of the index.

The S&P 500 is massive, comprising 80% of the U.S. stock market. But what about the other 20%? That's where the Vanguard Total Stock Market ETF gains its edge.

NYSEMKT: VTI

Key Data Points

It has over 3,500 components compared to 504 for the Vanguard S&P 500 ETF. And best of all, both funds have the same expense ratio at just 0.03%, or just $0.30 for every $1,000 invested. This means there is no added cost to go with the Total Stock Market ETF over an S&P 500 index fund.

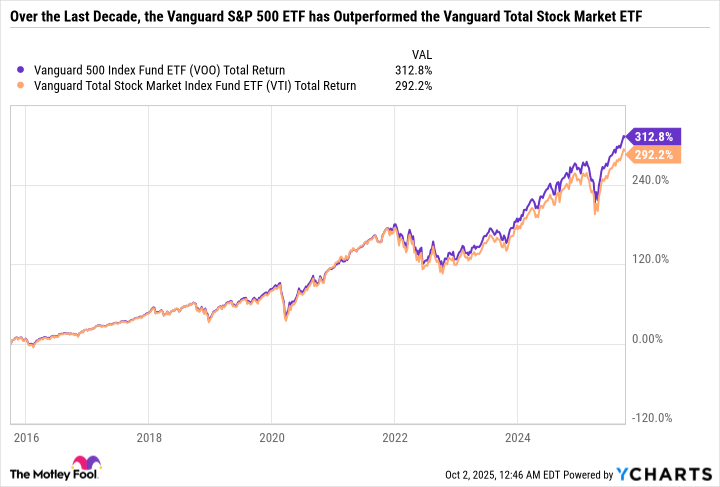

Granted, the Vanguard S&P 500 ETF has slightly outperformed the Total Stock Market ETF over the past decade, mainly because of mega-cap growth stocks. So even a little more exposure to Ten Titans stocks has been enough to move the needle.

VOO Total Return Level data by YCharts

Low-cost ETFs offer excellent ways for investors to create a diversified portfolio without needing a lot of capital. In addition to their low fees, the Vanguard Total Stock Market ETF and Vanguard S&P 500 ETF both have minimum investment amounts of just $1. These low requirements and fees would have been unimaginable just a couple of decades ago.

The Vanguard Total Stock Market ETF is an excellent choice for folks looking to buy the U.S. stock market and not just an index like the S&P 500 or Nasdaq-100. But since the S&P 500 is such a big part of the U.S. stock market, you can expect the Total Stock Market ETF to perform close to lockstep with the index.

Let ETFs work for you

Instead of getting bogged down by the differences between these funds, a better objective is to determine what you're trying to get out of ETFs.

ETFs can serve as role players in a portfolio. For example, if you want exposure to artificial intelligence (AI) stocks but don't know where to begin, you can invest in AI ETFs. Or if you're a growth stock investor looking to boost your passive income stream, then high-yield ETFs may be a good fit. These kinds of ETFs are especially useful for filling a need in your portfolio when you don't already have high-conviction ideas in a given theme.

Buying ETFs that are built around stocks you already own creates duplicate holdings and fails to achieve diversification. For example, if an investor's largest holdings are mega-cap tech stocks like Nvidia, Microsoft, and Apple, then buying an S&P 500 index fund in the hopes of gaining exposure to a basket of hundreds of stocks doesn't do much good, given the dominance of these companies.

Therefore, the Vanguard Total Stock Market ETF is best-suited for investors who aren't trying to fill a specific objective but rather, as a catch-all way to put capital in the market with slightly less exposure to the top names than the S&P 500.