The boom and bust cycle in electric vehicles (EVs) may be coming full circle. Stocks like Rivian Automotive (RIVN 1.52%) plummeted over the last few years as the bubble popped in the sector. Many companies have gone bankrupt, unable to make their business models viable.

Rivian remains unprofitable today, but it has large backers and a plan to greatly expand its manufacturing footprint through the rest of this decade. At around $15 a share today, Rivian stock has bounced back off its lows, but has traded in a similar range since the end of 2022.

With an inflection coming in its manufacturing plans, does that mean Rivian stock has finally bottomed and is set to make a comeback?

NASDAQ: RIVN

Key Data Points

Slowing deliveries, new factory plans

Rivian debuted its EV models in 2022, beginning deliveries for its first consumer models called the R1. This included a premium SUV and truck powered by electric batteries. It also sells commercial delivery vans to companies such as Amazon, which is a longtime investor in Rivian.

The R1 models are loved by customers, but they have failed to garner huge customer adoption due to their high price points of $75,000 or more. Rivian's quarterly deliveries actually peaked in 2023 and have slowly fallen ever since. With only just over 10,000 quarterly deliveries, Rivian is still a tiny player in the automotive space, which has kept it unprofitable.

To fix this issue, Rivian is expanding its factory in Illinois and just broke ground on a new factory coming to Georgia later this decade. These facilities will help Rivian build its upcoming R2 and R3 models, which will be cheaper than the R1 and hopefully more accessible to a wider customer base.

Automotive manufacturers need scale in order to generate a profit, with a competitor like Tesla not reaching the black until it started delivering close to 100,000 vehicles a quarter, if not more. Rivian will likely need the same to happen for it to start posting consistent profits for shareholders.

Image source: Getty Images.

Dissecting Rivian's valuation

With the stock price still well off its highs from the initial public offering (IPO), Rivian's market cap is $17.7 billion today. It is impossible to value this stock based on its trailing earnings or cash flow, since both are negative. However, we can try to forecast what Rivian's revenue and profits could be in the future if its new factories are successfully pumping out R2 and R3 vehicles.

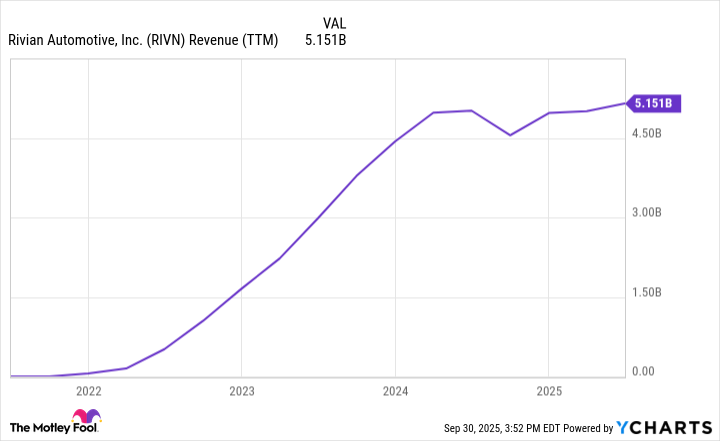

Today, Rivian's revenue is $5 billion. If the company scales up its R2 and R3 production, quarterly deliveries could grow from just over 10,000 last quarter to over 50,000. At a lower price point than the R1 vehicles, this could lead to around $20 billion in annual revenue for Rivian. An automaker will generally have a profit margin in between 0% and 10% given how hard the industry is to operate in (this is what Tesla's range has been in recent quarters). That would give Rivian $1 billion in net earnings by the end of this decade.

While this doesn't make the stock dirt cheap versus the current market cap, Rivian will be on much firmer financial footing if it can scale up production and reach positive earnings and cash flow.

RIVN Revenue (TTM) data by YCharts

Is Rivian stock set to make a comeback?

With Rivian at a small market cap compared to competitors like Tesla, investors are discounting whether it can successfully scale up its new production facilities. If $20 billion in annual revenue and $1 billion in earnings are achieved before 2030, I think it is possible that Rivian stock has finally bottomed and will start producing positive results for shareholders again.

This doesn't make the stock a buy. Rivian may double its share price by 2030 if the factory expansion is successful, but there is also the risk the company fails to achieve this scale. It has historically lost money, has thin gross margins, and has burned a ton of cash since its founding. This level of risk should keep any investor away from Rivian stock, even if the company has the potential to turn things around with these new models.

The juice isn't worth the squeeze with Rivian stock today.