Dividends are one of the most effective ways to make money in the stock market. They're consistent, reliable (in most cases), and they're not affected by a stock's price movements. Worst case, having automatic dividends can help pad losses when a stock is falling. In the best case, it can compound your gains when a stock is rising.

Dividend stocks may not receive the same attention as high-flying growth stocks, but the combination of income and stability can be just as valuable in the long term. If you're looking for two good dividend stocks to add to your portfolio, the following options are worth considering.

Image source: Getty Images.

The king of beverages

Beverage giant Coca-Cola (KO +1.41%) needs no introduction. It's one of the most well-known companies and brands in the world and has been around since 1892. Because of its maturity, Coca-Cola's stock isn't one I'd expect to produce double-digit percentage growth year after year, but its dividend is as reliable as it comes.

NYSE: KO

Key Data Points

Coca-Cola is a Dividend King (a company with at least 50 consecutive years of dividend increases), with 63 consecutive years of dividend increases under its belt. Only eight companies on the market have a longer streak than that. Its world-class business and reliable dividend make Coca-Cola one of the best dividend stocks in the market.

Coca-Cola's products are sold virtually everywhere in the world. It has achieved distribution that most companies can only dream of, partly because of the business model it has adopted and perfected. Instead of selling finished products, Coca-Cola sells syrups and concentrates, which are then distributed by its bottling partners worldwide.

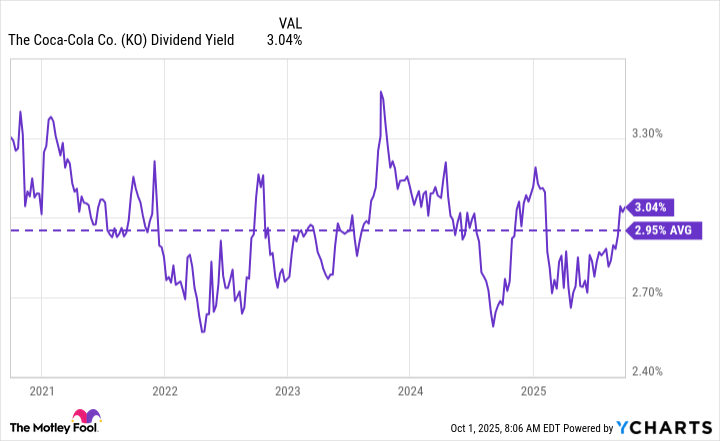

This asset-light business model allows Coca-Cola to operate with impressive margins and ensure it can maintain its dividend while also making the necessary investments to keep its business competitive. Coca-Cola's quarterly dividend is $0.51, with a yield of around 3% at the time of this writing (close to its average for the past five years).

KO Dividend Yield data by YCharts

At 3%, a $1,000 investment could pay out $30 annually. It doesn't sound like much, but with dividend stocks, it's about playing the long game. Ideally, you would reinvest these dividends to acquire more shares, and then begin receiving the payouts in cash when they can provide more meaningful cash flow.

The king of tobacco

Altria (MO +1.44%) is a tobacco giant that has many recognizable brands under its umbrella, like Marlboro, Black & Mild, Copenhagen, Skoal, and a handful of others. It's also part of the Dividend Kings club, with 56 consecutive years of dividend increases and 60 total increases in that time. In the past decade, its dividend has increased by more than 87%.

NYSE: MO

Key Data Points

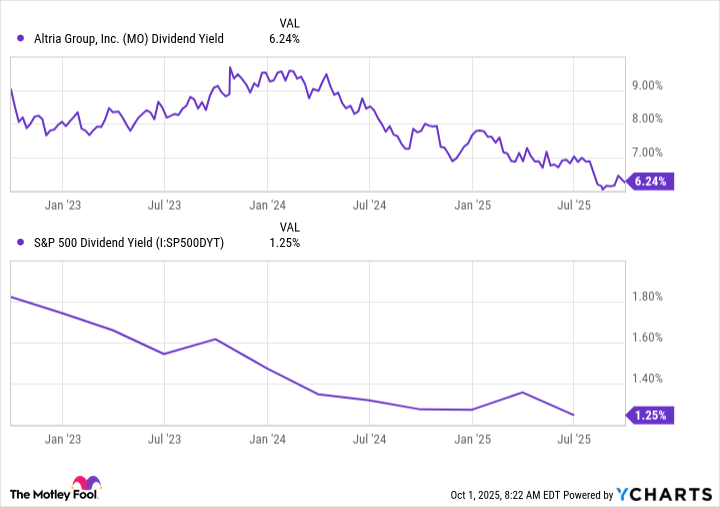

Altria is known for consistently offering one of the highest dividends among S&P 500 companies. Its current yield (as of Oct. 1) is around 6.2%, which is close to five times higher than the S&P 500 average. At that yield, a $1,000 investment would pay around $62 annually.

MO Dividend Yield data by YCharts

One problem that Altria's business faces is the declining smoking rate of adults in America. This has had a direct impact on Altria's volume, but the company has been able to offset this using its pricing power. For better or worse, tobacco is a product that most users buy regardless of prices or economic conditions. This has worked in Altria's favor, though it's not the best long-term solution.

That said, Altria has been making intentional efforts to find alternative smokeless options that can help diversify its business beyond traditional cigarettes and cigars. In the second quarter, its On! nicotine pouches showed the highest growth, increasing volume by 26.5% year over year.

Altria's business is built to last, which is what you want from any stock, but especially a dividend stock where the most value is received by holding onto it for years.