Apparel retailing is a challenging business. There are low barriers to entry, it's highly competitive, and fashion tastes tend to be fickle. What was a hot brand one year can be ice cold just a few years later, and poor inventory management can lead to widespread markdowns, crushing margins.

Just look at Nike or Lululemon. Both of those stocks are among the biggest winners in the history of the apparel sector, but have fallen on tough times lately for a range of reasons, including style misses and new competition, leading to declining sales for both companies in the U.S.

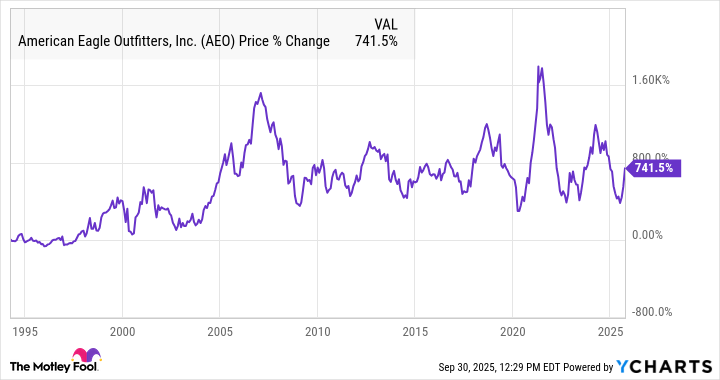

Teen apparel retailer American Eagle Outfitters (AEO 0.04%) has had a volatile history, swinging back and forth between peaks and valleys over the last 20 years, as the chart below shows.

As you can see, American Eagle also appears to be in the middle of an upswing following better-than-expected second-quarter results and a hike in its guidance. Two new celebrity partnerships seem to be driving a recovery.

Image source: Getty Images.

American Eagle's splashy moves

American Eagle launched a controversial ad campaign with the actress Sydney Sweeney in July. The campaign, with the tagline "Sydney Sweeney Has Great Jeans," featured video and photos of her in American Eagle jeans with a voice-over describing genetics.

The ad generated a lot of buzz, not all of it positive, but it did provide a measurable lift to the company's sales and even got a comment from President Donald Trump. Sweeney-branded items like a denim jacket and a wide-leg pair of jeans sold out quickly. According to The Wall Street Journal, the campaign helped bring in 1 million new customers between July and September.

The company plans to continue running those ads at least through the end of the year, and Sweeney has signed on as the brand's ambassador for the rest of the year as well, with her top-selling items set to be restocked ahead of the holiday season.

NYSE: AEO

Key Data Points

American Eagle is also collaborating with one of the country's most influential athletes, Kansas City Chiefs tight end Travis Kelce, who is now engaged to Taylor Swift. The retailer launched a tie-in with Kelce's Tru Kolors clothing brand the day after he and Swift announced their engagement.

According to early press coverage, the collaboration is doing well, leading men's web traffic. And a second collection is set to be released soon, with the campaign including a one-day pop-up store in Kansas City, Missouri. American Eagle also made Kelce creative director of the partnership.

The impact of that launch, which came at the end of August and after the second quarter ended, is likely to show up in American Eagle's third-quarter results.

Is American Eagle a buy?

It's been a challenging time for the apparel retail sector as consumer discretionary spending has been down in the U.S. due to the weakening job market and fears about tariffs and rising prices.

In American Eagle's second quarter, which mostly took place before the new campaigns, overall comparable-store sales (comps) were down 1%, though earnings per share rose 15%, due almost entirely to share buybacks. The company reduced shares outstanding by 13.2% over the last year, showing its commitment to returning capital to shareholders and taking advantage of its low stock price.

American Eagle's guidance is also looking up as the company called for comps to be up by the low single digits in the third and fourth quarters, its seasonally strongest times of year. Although the company does see margins falling, which factors in pressure from tariffs, leading to a decline in operating income.

Still, that guidance may be underestimating the impact of its campaigns with Sweeney and Kelce, and those moves also show why American Eagle has had staying power in an industry that is no stranger to bankruptcies, such as Aéropostale's.

If the momentum continues, the stock could have a pleasant surprise for investors in the second half of the year. At a price-to-earnings ratio of 17, there's certainly room for the stock to go higher if the results warrant.