Editor's note: This article was written when the stock was below $12 per share. Monday's stock price jump has pushed the stock to $13.35 as of 1:55 p.m. ET.

Archer Aviation's (ACHR +0.00%) proposed air taxi recently set some new flight records in testing -- and its stock has been climbing ever since.

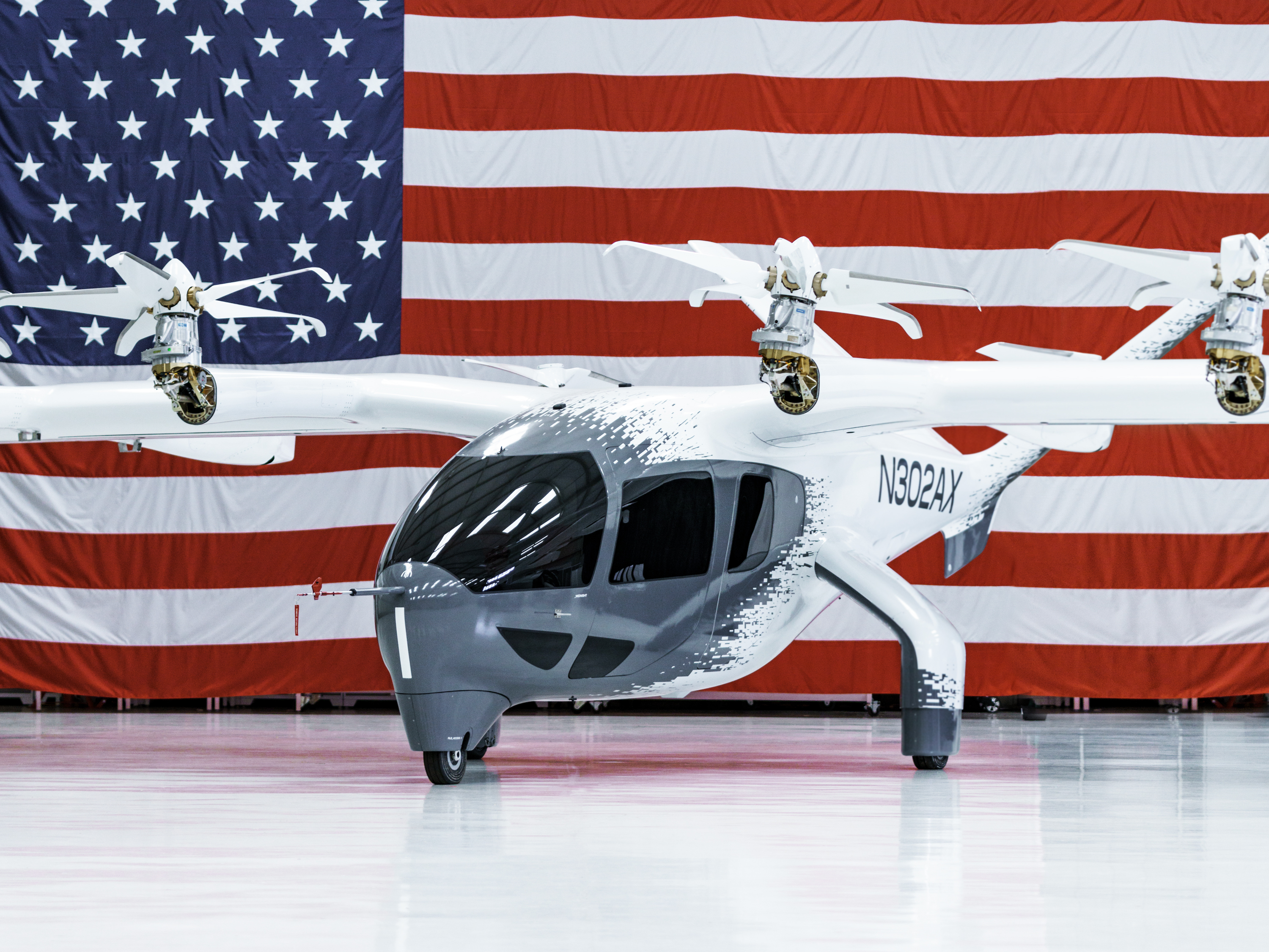

At the end of September, the company caught the public's eye again when its Midnight aircraft reached altitudes of 7,000 feet and 10,000 feet during test flights, its highest altitudes to date. Shortly before that, a pilot took one on its longest flight so far: about 55 miles in 31 minutes.

Both records add to the growing body of evidence that Archer has what it takes to turn its vision of flying taxis into a reality -- and relatively soon.

With Archer getting close to commercialization and its shares still trading for under $12, is now the time to buy this transportation stock?

NYSE: ACHR

Key Data Points

How Archer could revolutionize urban transportation

Archer is engineering small electric vertical takeoff and landing (eVTOL) craft intended for short-hop flights. Its flagship craft, Midnight, is designed to carry four passengers plus a pilot, shuttling them on point-to-point trips of about 15 miles to 20 miles.

Although the market for eVTOLs doesn't exist yet, demand for them could spread rapidly once they become available. That's because they can help address one of urban life's thorniest problems: traffic.

Image source: Getty Images.

Taxis, ride-hailing platforms, and urban transit have all alleviated gridlock to some degree. Even so, congested city streets at rush hour can still turn short-distance drives into grueling hour-long trips.

Traffic is even more frustrating when you're trying to get to places like airports or hospitals, where time is of the essence. Indeed, it's no wonder that Archer has a partnership with United Airlines. Short-hop trips to airports could become a major growth vector for the company in the future.

Flying toward key regulatory milestones

The next event that could send Archer stock soaring would be the Midnight receiving its type certification from the Federal Aviation Administration (FAA), which would allow it to fly paying passengers commercially.

The company's making progress in pursuit of that goal. It has Part 141 for pilot training and Part 135 to begin commercial operations. And it's now actively pursuing type certification.

Meanwhile, the White House has been promoting eVTOL development. In the wake of a flurry of executive orders issued by President Donald Trump, Archer is taking part in an eVTOL pilot program that could see trial operations of Midnight craft in the U.S. in 2026.

Around the same time, Archer was named the official air taxi provider of the 2028 Los Angeles Olympics. That sprawling city experiences some of the worst traffic congestion in the U.S., and assuming that Archer is able to meet its goals, the Olympics would offer it a prime-time opportunity to showcase the potential of its eVTOLs to the world.

The dark side of the dream

Archer's vision is a moonshot, an ambitious attempt to begin disrupting a transportation industry that hasn't experienced a massive shift in quite a while. And, like the moon itself, this vision has a dark side -- at least while it remains just a vision.

That dark side is the staggering amount of work that still needs to be done to make eVTOLs an everyday presence. It's one thing for the company to get regulatory approval to fly its air taxis. It's quite another to put the infrastructure in place to fully support those craft, and then develop a system that allows them to fly and turn a profit.

Archer will need to build a lot of aircraft, which isn't going to be cheap. It will also need to build or lease numerous vertiports for landings and takeoffs. It'll also need batteries, charging stations, and pilots. As you can probably guess, in the best case, its capital expenditures in the near term will be large.

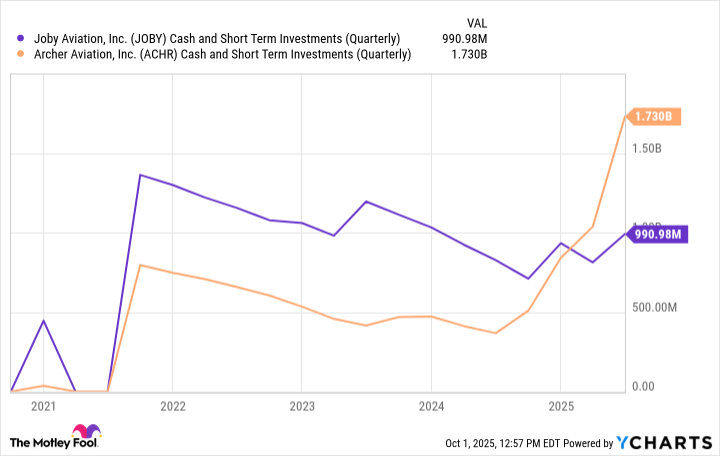

At the same time, Archer claims to have a $6 billion order book, which is almost as much as its present market valuation of about $7.2 billion. It also had a hefty cash position of about $1.7 billion as of the end of June -- over $700 million more than its chief rival, Joby Aviation.

JOBY Cash and Short Term Investments (Quarterly) data by YCharts.

Should you buy Archer now?

If Archer executes on its vision and gets regulatory approval for its Midnight craft, today's share price could seem like peanuts in retrospect.

At the same time, it isn't appropriate for every portfolio. Conservative investors, for instance, will likely want to stay away. Archer is pre-revenue, it has not yet developed the infrastructure that it will require to roll out its eVTOLs widely as air taxis, and it will incur significant losses in the process of building out its future. Any setbacks, delays, or negative news could send the stock reeling.

As such, I would view this stock as a potential speculative play, but I wouldn't make it a core holding.

For growth investors who know what they're buying, adding a slice of Archer could expose you to an eVTOL market that Morgan Stanley forecasts could be worth about $9 trillion 25 years from now. Those who have a low risk tolerance, however, might want to wait for Archer to hit another key milestone -- like FAA approval -- before considering the stock.