Shares of Ubiquiti (UI +2.34%), which makes wireless networking equipment and access points, jumped 25.1% in September, according to data from S&P Global Market Intelligence.

For context, last month, the S&P 500 index returned 3.7% and the tech-heavy Nasdaq Composite index returned 5.7%.

Image source: Ubiquiti.

Momentum continued into September from a phenomenal fiscal fourth-quarter report

Ubiquiti stock's strong performance in September can be summed up as follows: continued upward momentum from a phenomenal fiscal Q4 earnings report released in late August. In other words, the good news came in August and investors appeared to be continuing to buy shares in September.

On the note of buying shares, before we get into the company's trifecta of good news, investors should know that only a very small portion of its stock is available for purchase or sale. That's because Robert Pera, the company's founder, CEO, and Chairman, owns about 93% of Ubiquiti's total shares. So, the public stock float -- shares available to the public for buying and selling -- is only about 7% of total shares.

NYSE: UI

Key Data Points

On Aug. 22, Ubiquiti stock skyrocketed 30.6% after the company reported its results for its fourth quarter of fiscal 2025 (ended June 30). Not only did the quarter's revenue and earnings crush Wall Street's consensus estimates, but the company also significantly raised its quarterly cash dividend and initiated a stock buyback program.

In Q4, Ubiquiti's revenue surged 50% year over year to $759.2 million. Enterprise technology revenue increased 58% to $680.1 million, and service provider technology revenue rose 4% to $79 million. Earnings per share (EPS) based on generally accepted accounting principles (GAAP) jumped 56% year over year to $4.41, while adjusted EPS soared 103% to $3.54. Wall Street was expecting adjusted EPS of just $2.23, or 28% growth.

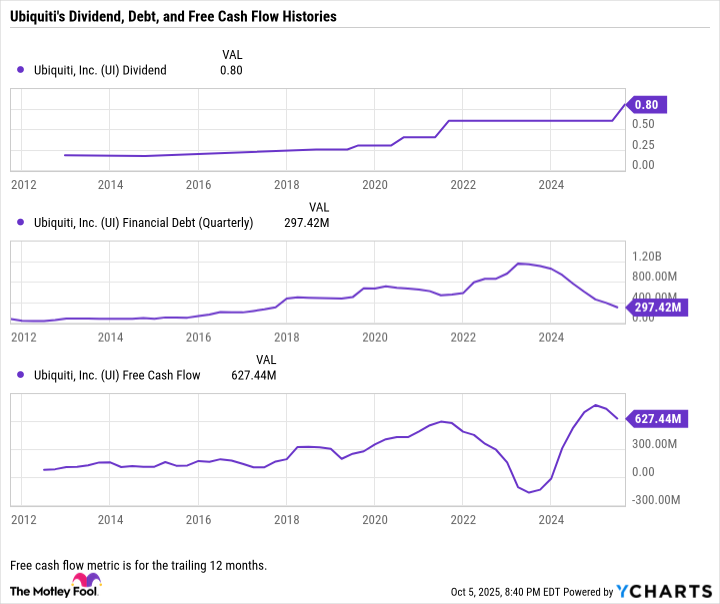

Ubiquiti raised its quarterly dividend by 33% to $0.80 per share, up from $0.60 per share. The higher dividend was payable on Sept. 8 to shareholders of record at the close of business on Sept. 2.

Data by YCharts.

This is the first time since 2021 the company has increased its dividend. The reason it didn't raise its dividend for a few years was to conserve cash in the aftermath of the start of the COVID-19 pandemic. Like other companies, Ubiquiti's supply chain was disrupted during the crisis, so it had trouble fulfilling all its orders. Moreover, it was paying extra for transportation to expedite customers' shipments. So, its financial results were hurt. Recently, the company has been paying off some debt that it incurred during this time.

The company's strengthened balance sheet and improved cash flow and business outlook has also given it the confidence to initiate a new stock repurchase program. The program authorizes it to repurchase up to $500 million of its common stock.

Limited information on growth prospects

Ubiquiti does not provide guidance nor does it hold earnings calls with Wall Street analysts. So, while the company's business is performing very well currently, investors have limited data in which to gauge its growth prospects over the short or long term.

Moreover, only a very limited number of Wall Street firms cover the stock and issue ratings on it.