Investors focused solely on the gigantic artificial intelligence (AI) beneficiaries need to expand their horizons. There are more stocks than Nvidia, Palantir, or Amazon that you can own in your investment portfolio, including ones that benefit from the AI revolution.

On such stock is Coupang (CPNG 0.56%). The technology company focused on e-commerce and emerging cloud computing provider keeps posting impressive growth and is investing heavily in AI. At a market cap well under $100 billion, does that make Coupang a better AI bet than its much larger American technology peers?

The answer is clear when you look at the numbers.

NYSE: CPNG

Key Data Points

World-class e-commerce in Korea, plus much more

Taking inspiration from the other e-commerce pioneers like Amazon, Coupang has built up a fortress business in South Korea defined by fast delivery, customer delight, and an ecosystem of retail offerings that trump all local competitors. Members of its online subscription service called Rocket Wow receive orders by 7 a.m. the next morning if ordered by midnight the night before, which is faster than most Amazon deliveries.

All of this is available for a small membership fee paid each month, which also provides discounts on food delivery through Coupang Eats, free delivery on grocery purchases, and a slew of other perks. It is no surprise, then, that Coupang has 23.9 million active customers in a country with a population of just 52 million. That is impressive penetration for a brand that is barely a decade old.

Now, Coupang is expanding even further as a technology and commerce provider. It acquired the distressed asset Farfetch to get a foothold in online fashion shopping, has expanded successfully into Taiwan, and recently revamped its cloud computing service focused on AI. Called the Coupang Intelligent Cloud, the company is aiming to take advantage of demand for AI workloads on data centers in Korea, especially as the government has proposed grants for homegrown data center builders.

Image source: Getty Images.

Better growth, cheaper valuation

Coupang's revenue grew 19% year over year on a foreign currency neutral basis last quarter to $8.5 billion, faster than Amazon's 10% growth for its retail operations. Other parts of Coupang's business are growing much faster, such as its expansion into Taiwan, with over 100% year-over-year revenue growth. With $32 billion in trailing revenue, Coupang is at a much earlier phase of its business life than Amazon, which should give it a longer runway to grow, especially if it expands into new geographies. Not to mention the optionality with the cloud computing business.

When looking at other AI technology stocks, Coupang's valuation is much more palatable. Nvidia has an unwieldy market cap of $4.4 trillion that will prevent the stock from being a monster winner over the long term, even though it has gone up by more than 10x for investors in the last few years. Palantir has a market cap of $424 billion and generates less than $3.44 billion in revenue.

Compare that to Coupang with a $59 billion market cap, $32 billion in revenue, and expanding profit margins that should help the company generate heaps of profits in the years to come. Coupang's investments in automation, AI, and robotics at its fulfillment centers should start to bear huge efficiency gains, which will further help the company expand its profit margins. Taken together, all these factors give Coupang stock a cheaper valuation than some of the hotter AI stocks popular with investors right now.

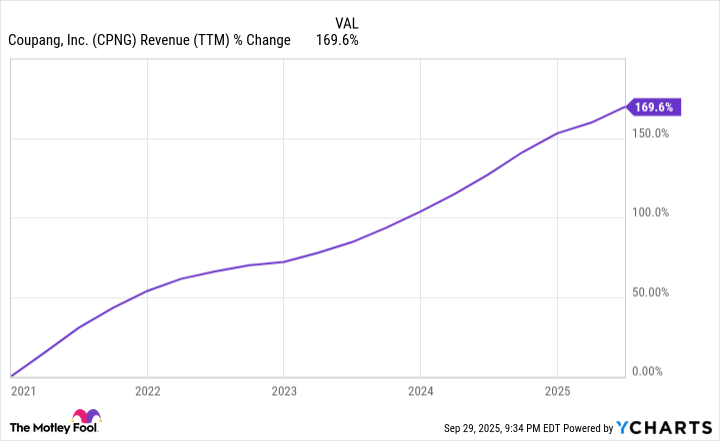

CPNG Revenue (TTM) data by YCharts

Is Coupang stock a better buy?

When looking at the combination of growth and size of the stock, Coupang looks like a better AI stock for investors hunting for big winners in their stock portfolio.

The company's revenue is up 170% since going public in 2021. Its market cap is just $59 billion vs. $32 billion in trailing revenue. It has plenty of irons in the fire to help revenue keep growing at a consistently strong pace over the next five years. Management is guiding for profit margins to expand to 10% or higher once the business matures.

Compare that to the huge market caps you have to buy with AI stocks like Palantir or Nvidia right now, and Coupang looks like a better buy for investors today.