If you're like me, and like almost every other investor in the world, you experience various emotions on a daily basis. For instance, it's hard to watch stocks rise and fall in value and not "feel" something. When those feelings get strong enough, you might decide to act on them, but that could lead to short-term decisions that end up being bad for your long-term financial health.

Here's the one big investment mistake driven by emotion that you should avoid as you watch the government shutdown drag on.

There's a "science" to emotions and investing

When you talk about investing, you can't ignore the emotional aspect of the activity. Fear and greed are powerful forces and can make people do things that are shocking at times. When it comes to investing, there's a substantial body of literature and research on the emotional aspect of the process, known as behavioral finance.

Image source: Getty Images.

There are a lot of good books on the subject. I personally reread The Little Book of Behavioral Investing: How Not to Be Your Own Worst Enemy by James Montier every year, which speaks to how important I believe understanding my emotions is. It's a short and simple read, and actually pretty funny at times, but the big benefit is that I remind myself of the mistakes I may make if I don't keep on top of my emotions. There's a very long list of pitfalls!

Right now, the one that I think is most important is the habit people have of extrapolating things too far into the future. You see this happen all the time. For example, during the coronavirus pandemic's height, Wall Street took the health scare and economic shutdown stories and ran with them.

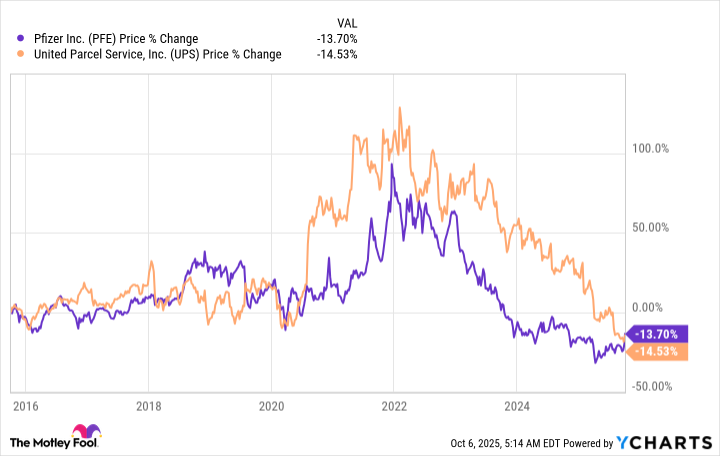

Data by YCharts.

On the healthcare side of things, companies that made vaccines, like pharmaceutical giant Pfizer (PFE 0.57%), saw their stocks rally strongly. It was as if investors believed that the world would need an ever-growing supply of COVID-19 drugs. That wasn't the case. More normal market dynamics soon reemerged, leading many of the once-hot drug stocks to tank, including Pfizer.

The same was true for online shopping, where increased shipping of packages led investors to bid up the price of delivery companies like United Parcel Service (UPS +0.18%). It seemed like investors believed that people would never shop in a physical retail store again. When the health scare passed and people started going back to stores, shipping volumes returned to more normal levels. Not surprisingly, UPS' stock fell, and business fundamentals again ruled the day.

This too shall pass, so don't treat it like it won't

Given the sometimes hyperbolic media attention being given to the government shutdown, be sure you step back and consider the facts. There have been multiple government shutdowns since 1974, when the Congressional Budget Act was passed. The longest shutdown lasted 35 days.

You probably shouldn't make long-term investment decisions based on something that's likely to be over in a month or so. In fact, if history is any guide, the impasse is likely to last much less than a month. The 35-day shutdown is just the longest a budget impasse has lasted. Even if this shutdown goes beyond 35 days, it's still unlikely to be a permanent thing. The two sides in Washington, D.C., will eventually come to terms, just like they have before.

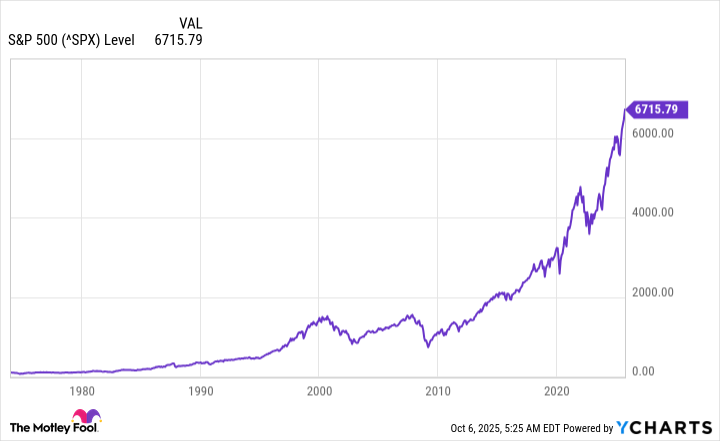

Data by YCharts.

The graph above of the S&P 500 (^GSPC 0.34%) starts in 1974, when the Congressional Budget Act was passed and shutdowns started to become a material government issue. Notice that the S&P 500 index hasn't turned into a huge money-losing machine since that point. It has risen steadily, just like it did before the act was passed.

Even if this particular shutdown leads to a bear market, those downturns end, too. Every bear market in Wall Street history has, eventually, been followed by a bull market (and vice versa). The worst thing you can do is take what is a short-term event and invest around it as if it is going to permanently change Wall Street. The shutdown is almost certainly going to be a short-term event.

Stick to your long-term plan

You should have a long-term investment plan. The plan is long-term precisely because it's meant to transcend short-term events, like a government shutdown. Don't upend your plan by letting your emotions get the better of you, or extrapolating the effect of short-term events too far into the future. It's likely to be one of the biggest behavioral investing risks you face right now.