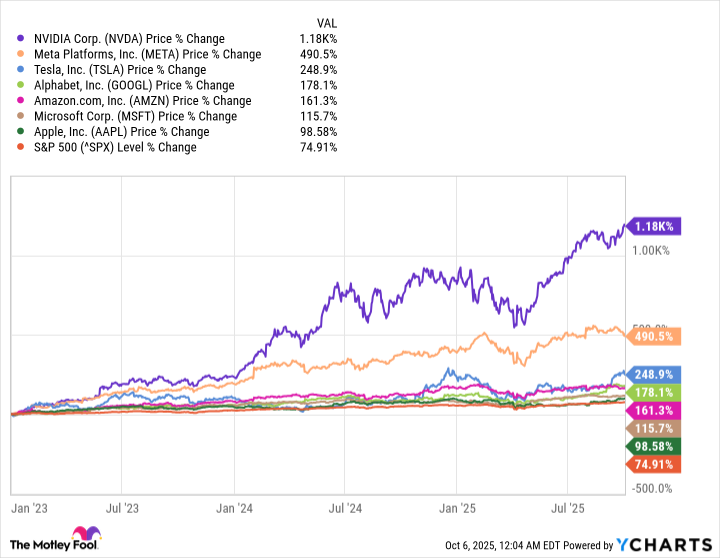

Wall Street adopted the "Magnificent Seven" moniker in 2023 to describe a group of seven technology companies that were consistently outperforming the rest of the market. They currently dominate different segments of the artificial intelligence (AI) industry, which has accelerated their returns.

In fact, since the AI boom started gathering momentum at the beginning of 2023, the Magnificent Seven stocks have delivered a median return of 178%. The benchmark S&P 500 index gained just 74% over the same period:

That means investors who don't own these powerhouse stocks have probably underperformed the broader market over the last few years, but I have some good news: There's a simple way to buy them all right now.

The Vanguard Mega Cap Growth ETF (MGK -0.17%) is an exchange-traded fund (ETF) that invests exclusively in America's largest companies, and a whopping 59.3% of the value of its entire portfolio is parked in the Magnificent Seven stocks alone.

Image source: Getty Images.

The Magnificent Seven, with a splash of diversification

The Vanguard Mega Cap Growth ETF tracks the CRSP U.S. Mega Cap Growth Index, which covers 70% of the market capitalization of the CRSP U.S. Total Market Index. That means if we ranked all 3,508 companies in the CRSP U.S. Total Market Index by size, from the largest to the smallest, the Mega Cap Growth Index would start at the top and work its way down the list until it captured 70% of its total value.

The Vanguard ETF holds just 69 stocks, which shows the U.S. corporate sector is extremely concentrated. To put it another way, just 69 companies represent 70% of the value of all 3,508 companies listed on American stock exchanges. That leaves the remaining 3,439 companies accounting for the other 30%.

Since the Magnificent Seven stocks have a combined value of $20.7 trillion, it's no surprise they collectively have such a dominant weighting in the Vanguard ETF.

|

Stock |

Vanguard ETF Portfolio Weighting |

|---|---|

|

Nvidia |

14.02% |

|

Microsoft |

13.10% |

|

Apple |

12.01% |

|

Amazon |

7.48% |

|

Alphabet |

5.02% |

|

Meta Platforms |

4.35% |

|

Tesla |

3.35% |

Data source: Vanguard. Portfolio weightings are accurate as of Aug. 31, 2025, and are subject to change.

Nvidia supplies the world's most powerful graphics processing units (GPUs) for data centers, which are the main chips used in AI development. Demand is outstripping supply for the company's latest Blackwell Ultra chips, which could fuel significant revenue growth from here.

Microsoft, Amazon, and Alphabet are three of Nvidia's biggest customers. They each develop AI models and software for their own purposes, but they also operate cloud platforms where they rent data center capacity to businesses that use it to deploy their own AI projects.

Social media giant Meta Platforms is another one of Nvidia's top customers. It integrated AI into its content recommendation engine to keep users on Facebook and Instagram for longer periods of time, but it also developed the world's most popular family of open-source large language models (LLMs) called Llama, which power new features like Meta AI.

Apple launched its Apple Intelligence software last year, introducing powerful new AI features for its iPhones, iPads, and Mac computers. With 2.35 billion active devices worldwide, this company could be one of the biggest distributors of AI software to consumers. Then there is Tesla, which is a leading developer of AI-powered autonomous driving and robotics technologies.

Despite its substantial exposure to the Magnificent Seven stocks, the Vanguard ETF does offer a splash of diversification. Non-technology megacap stocks like Eli Lilly, Visa, Costco Wholesale, and McDonald's are among its top 20 holdings.

The Vanguard ETF can help investors accelerate their returns

The Vanguard Mega Cap Growth ETF has delivered a compound annual return of 13.8% since its inception in 2007, and an accelerated annual return of 18.9% over the last 10 years, specifically. However, given its high degree of portfolio concentration, investors shouldn't put all of their eggs into this ETF alone.

Instead, the fund could be an ideal addition to any diversified portfolio that has little or no exposure to the Magnificent Seven already. Let's say, for instance, an investor parked $20,000 in the Vanguard Total Stock Market ETF 10 years ago, which is arguably the most diversified fund money can buy because it holds 3,500 stocks. That $20,000 would have grown to around $78,825 today.

However, had the investor split the $20,000 by placing $10,000 in the Vanguard Total Stock Market ETF and the other $10,000 in the Vanguard Mega Cap Growth ETF, they would be sitting on $95,882 today instead.

This approach aims to ensure that investors aren't overexposed to volatile trends like AI, helping to protect them against steep losses if the technology fails to live up to expectations in the long run.