Ethereum (ETH 9.87%) is a platform for building decentralized digital applications, and Ether is the cryptocurrency that powers it. Whenever someone uses a decentralized application, triggers a smart contract, or transfers a crypto token built on Ethereum, they incur a fee that is payable in Ether.

This arrangement creates constant demand for Ether, which theoretically increases its value as long as the Ethereum network is continuously expanding. Decentralization continues to gain momentum in areas like finance and gaming, and Ethereum is the go-to platform for developers who want to bring their ideas to life, so it's no surprise some analysts see a major investment opportunity.

Tom Lee is the founder of Wall Street firm Fundstrat Global Advisors, and he's also the chairman of BitMine Immersion Technologies, which is the world's largest Ether treasury company. He thinks Ether could soar to $62,000 over the next 10 years, which implies a whopping 1,219% upside from where it trades today. But how realistic is his target?

Image source: Getty Images.

How Ethereum works

Decentralized applications use smart contracts, which are slivers of code that live on the Ethereum blockchain. Smart contracts are simply rules that govern how an application functions, and they typically can't be changed, which ensures no person, company, or government can manipulate the app's decentralized structure.

The Ethereum network itself is also fully decentralized because it's hosted on thousands of nodes (computers) around the world that maintain full copies of the Ethereum blockchain. This is more secure than using a single centralized data center.

Thousands of decentralized applications have been built on Ethereum. One example is Uniswap, which is an exchange that allows people to swap their cryptocurrencies for other cryptocurrencies. Smart contracts calculate the appropriate prices and even complete the requested trades, with no intermediary. Users can connect their crypto wallet to Uniswap directly without having to set up an account, so it's also extremely convenient.

Uniswap differs from centralized exchanges like Coinbase, which charge a fee to match buyers and sellers to execute trades. These exchanges are tightly regulated, so they have long signup processes and must verify the identity of every user.

Whenever a person uses Uniswap, they activate smart contracts, triggering a fee payable in Ether. Plus, Ether is often used as a bridge currency when users are converting crypto, which ensures sufficient liquidity is available and makes the process run more smoothly.

Tom Lee thinks Ether could soar 1,219%

Tom Lee is bullish on the price of Ether for a few reasons. From a fundamental perspective, he believes decentralized financial applications could replace the traditional financial system in the future, and the Ethereum network will be pivotal in that transition. There has been a lot of experimenting on that front already, with popular stablecoins like Tether using Ethereum.

Lee also points to technical factors that could drive upside from here. Ether has traded in a range over the last four years, which chartists might call a "base out," and this can sometimes precede a significant breakout (a sharp upside move). There is some precedent because Ether soared from around $130 to over $4,600 between 2020 and 2021 after trading in a sideways range in the two years prior.

Additionally, Lee cites the ratio of Ether's price relative to Bitcoin's (CRYPTO: BTC) price, which has averaged 0.0479 over the last eight years and peaked at 0.0807 in 2021. The current ratio is just 0.0384, suggesting Ether is underperforming its much larger crypto counterpart. If the ratio returned to 0.0807, that alone would see Ether more than double to over $10,000, based on Bitcoin's current price of $124,500.

However, when combining all of the above factors, Lee sees a pathway to $62,000 for Ether by the year 2035, implying a 1,219% gain over the next decade.

How realistic is Lee's target?

Tom Lee has made some very accurate stock market predictions over the years, but that doesn't mean he's right about Ether.

Based on Ether's current price of $4,700 and the circulating supply of 120.7 million coins, it has a market capitalization of around $567 billion. If Ether rose to $62,000 per coin, its market cap would soar to almost $7.5 trillion. That might be realistic if Ethereum leads a decentralized revolution that disrupts the existing financial system, but there is no real evidence that this will happen.

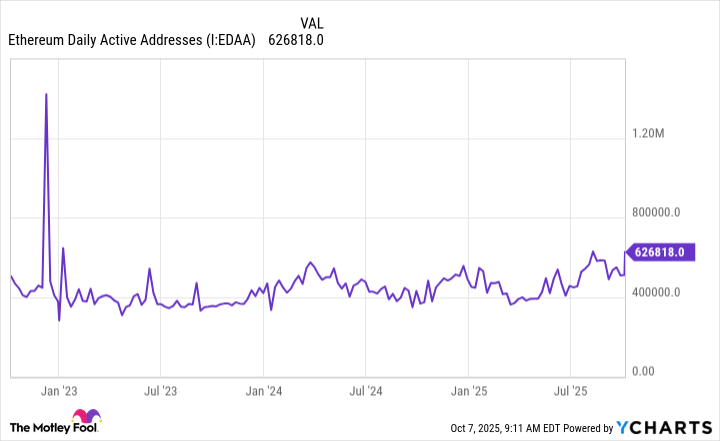

As I write this, just 626,000 unique Ethereum addresses are interacting with the network each day, which is a ballpark indication of how many people are actively participating in the ecosystem. That is a very small number, no matter which way you look at it, given there are more than 400 million active businesses around the world and around 8.2 billion people.

Plus, there hasn't been much growth in the number of daily active addresses over the last few years, which suggests widespread adoption of decentralized solutions is still a fantasy:

Ethereum Daily Active Addresses data by YCharts.

Finally, keep in mind that Lee is the chairman of BitMine, which owns a whopping 2.83 million Ether worth $13 billion, so he has a vested interest in making bullish forecasts. That doesn't mean we should dismiss his opinion, but his view is inherently biased, so I wouldn't bet the farm on his 2035 prediction playing out.