It's been a challenging year for restaurants, as consumers have tightened their spending on discretionary goods and services.

Dutch Bros (BROS 5.52%) has nose-dived over 27% in the last month. Year to date, Dutch Bros and Starbucks (SBUX 2.06%) are down 9% and 10.9%, respectively, while the S&P 500 index (^GSPC 0.43%) has gained 14.2%.

Here's why these two Fool.com contributors believe that the sell-off in these beverage stocks is a buying opportunity.

Dutch Bros is the growth story Starbucks used to be

Anders Bylund (Dutch Bros): I respect Starbucks to the ends of the Earth, and it's a tempting turnaround story right now. But once the attempted rebound plays out -- for better or worse -- I'm still looking at a mature global business with limited long-term growth prospects.

Dutch Bros is a different beast, at a very different stage of its growth story. It's also more than just a coffee chain.

Sure, the company has been around since 1992, but it shifted into a nationwide expansion mode as recently as 2021. With roughly 1,050 stores in operation so far, it's sort of like buying Starbucks stock in 1996. It's not an exact carbon copy, since Starbucks and others have been building a global coffee-shop market that didn't exist in the early 1990s. The similarity is still striking, though.

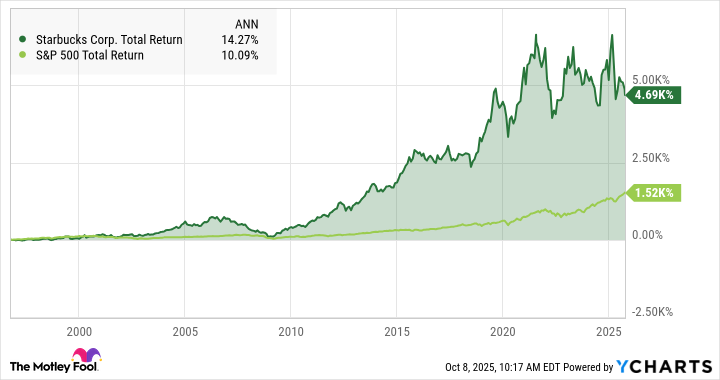

I don't have to remind you of the game-changing total returns Starbucks has delivered, right? Well, go ahead and twist my arm:

SBUX Total Return Level data by YCharts

That's an average annual return of 14.3% for nearly three full decades, including a couple of deep dives along the way. I obviously can't promise that Dutch Bros will copy this stellar growth story exactly, but I like the company's chances.

Dutch Bros brings more than just another brand name to the coffee-chain market:

-

Its "Broistas" are expected to serve drinks with a friendly attitude, almost always at the drive-through window.

-

The small coffee shops with minimal dine-in (or drink-in, I suppose) facilities facilitate faster store construction and lower costs of operation -- nobody's staying around after hours to clean the nonexistent sit-down area, for example.

-

Dutch Bros isn't afraid to expand its menu beyond coffee-based ideas; about 25% of its sales in 2024 came from the hand-mixed Rebel energy drinks, and that category is growing sales much faster than the hot coffee lineup.

So I can't promise a three-decade victory lap with fantastic investor returns. Even the most promising growth stories can stumble over the years. But I do like Dutch Bros' chances to become the next Starbucks, while the Seattle chain itself can only hope to regain and defend its established coffee king title. As a longtime Rule Breaker, I'd much rather invest in Dutch Bros' exciting growth story in 2025.

NYSE: BROS

Key Data Points

Starbucks has fallen far enough

Daniel Foelber: If you were to have closed your eyes six years ago and opened them up today, you'd find Starbucks down slightly while the S&P 500 has more than doubled with a 128.5% gain. The poor performance in Starbucks' stock price highlights the opportunity cost of investing in a company that fails to deliver on promises.

Starbucks' issues have evolved from a few bullet points to a comprehensive list. The company has failed to significantly expand its international business, particularly in China. For years, it has heavily relied on price increases to drive growth, which has run its course. And now, Starbucks is struggling to grow sales volumes as customers resist price increases.

The Starbucks Rewards program, paired with mobile order and pay, used to be a differentiating factor. But the competition has caught up. And Starbucks' somewhat sterile stores have made the customer experience more transactional, which doesn't bode well when customers are already spread thin with cost-of-living inflation.

As a result, Starbucks' margins are under pressure, growth is stagnating, and the company is resorting to big ideas to turn the business around.

One of those big ideas was to hire the former CEO of Chipotle Mexican Grill, Brian Niccol, a little over a year ago. Niccol had a lot of success at Yum! Brands through Pizza Hut and Taco Bell before moving to Chipotle.

But the deal came at a high cost, as Niccol is one of the highest-paid CEOs among S&P 500 companies. In July, Fortune ran a piece stating that Niccol is earning 6,666 times more than the median employee at Starbucks. That's not exactly a good look in any context, but especially when the stock is performing poorly.

On Sept. 25, Niccol published a letter discussing key updates in his Back to Starbucks plan. Starbucks now expects to end fiscal 2025 with a 1% decline in North American stores, with renovations at 1,000 existing stores over the next 12 months, and the elimination of 900 nonretail partner roles, as well as closing open positions.

The move is a clear signal that Starbucks is no longer in growth mode. It is trying to find its footing and improve the experience by focusing on boosting the quality of its stores rather than increasing their quantity.

I think the move is exactly what Starbucks needs right now. But the negative reaction in Starbucks' stock price is no surprise. Investors are tired of the company being in turnaround mode. It's understandable that some long-term investors are even reconsidering Starbucks' role in their portfolios.

Despite all the challenges, Starbucks is a buy for investors who believe its turnaround will eventually pay off. The brand remains strong, and it would be a mistake to underestimate the value of Starbucks' global recognition. In the meantime, the company just raised its dividend for the 15th consecutive year -- boosting the yield to 3.1%.

Overall, I view Starbucks as a good buy because the company is openly saying its existing strategy needs a tune-up. Even if improvements take time, holding the stock will likely generate a substantial amount of passive income.