Nvidia (NASDAQ: NVDA) has turned out to be one of the hottest investments in the past three years, registering gains of 1,300% during this period on the back of remarkable demand for its data center chips.

If you'd invested $1,000 in Nvidia stock three years ago, before its artificial intelligence (AI)-fueled rally started, you'd be sitting on more than $14,300 right now. But not everyone could have predicted the gains Nvidia was likely to deliver from 2022 onward. Though Nvidia can still fly higher in the coming years thanks to the opportunity in the AI infrastructure market, its status as the world's largest company may keep it from replicating its eye-popping gains of the past three years.

That's why investors may be looking for an alternative that could replicate Nvidia's stock market trajectory. Advanced Micro Devices (AMD 0.80%) is one such semiconductor stock that could follow in Nvidia's footsteps. Let's look at the reasons why AMD is primed for a market-beating performance in 2026 and could eventually turn out to be a multibagger in the long run.

Image source: AMD.

AMD's data center business is set to take off next year

Though AMD stock has delivered respectable gains of 211% in the past three years, its performance has been nowhere close to that of Nvidia. Nvidia moved fast in the data center graphics processing unit (GPU) market, aggressively rolling out new products and attracting major cloud hyperscalers and AI companies with its powerful chip systems.

In fact, Nvidia was sitting on an estimated 92% of the data center GPU market at the end of last year while AMD's share stood at a minimal 4%. However, AMD's fortunes could change in 2026 thanks to its latest deal with OpenAI. The two companies have entered into an agreement to deploy 6 gigawatts (GW) of AI cloud infrastructure.

OpenAI will begin deploying AMD's MI450 AI GPUs in the second half of 2026. Importantly, according to AMD, OpenAI is going to "work with AMD as a core strategic compute partner to drive large-scale deployments of AMD technology starting with the AMD Instinct MI450 series and rack-scale AI solutions and extending to future generations."

Management believes that this partnership has the potential to "deliver tens of billions of dollars in revenue for AMD." That revenue could start flowing in from next year when the MI450 rollout begins. Additionally, AMD has been gradually building a solid customer base for its data center GPUs that could supercharge its growth in 2026.

The chip designer has been trying to challenge Nvidia in this market on the back of its product development moves, which include offering rack-scale solutions capable of handling large AI workloads. It is estimated that building a 1 GW data center could cost around $10 billion, with 60% of that investment going into chips and other hardware.

So the OpenAI partnership could open up a $36 billion multiyear revenue stream for AMD in the data center business. AMD has generated just under $7 billion in revenue from its data center segment in the first half of 2025, including the sales of its Ryzen processors. The company ended 2024 with more than $5 billion in data center GPU revenue. The OpenAI deal alone has the ability to supercharge AMD's data center growth in the long run.

Throw in the other customers that the company has been bringing on board, including Microsoft, xAI, and Meta Platforms, and there is a good chance that it will be able to corner a bigger share of the AI data center market next year.

Here's why the stock is set to soar next year

AMD may have underperformed Nvidia in the past three years, but its gains on the market so far this year are double those of its larger peer. The OpenAI partnership has sparked a massive rally in AMD stock, and analysts are scrambling to increase their growth expectations.

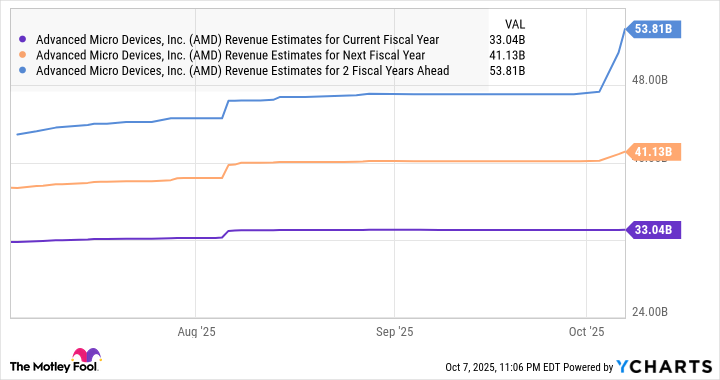

AMD Revenue Estimates for Current Fiscal Year data by YCharts

The chart above makes it clear that AMD's growth is expected to accelerate in a couple of years. Those estimates could head higher as the vote of confidence in AMD's data center GPUs could encourage more customers to buy them. AMD is currently trading at just 9.4 times sales -- a big discount to Nvidia's sales multiple of 28 -- making right now a very good time to buy shares.

The market could reward AMD with a premium valuation considering its improving growth prospects. Assuming the stock trades at 14 times sales after three years (which is half of Nvidia's multiple), its market cap could jump to $753 billion (based on the revenue it is expected to generate after a couple of years as seen in the chart).

That's more than double AMD's current market cap, so investors who missed out on Nvidia's red-hot rally should consider buying this AI stock before it flies higher.