The frenzy around artificial intelligence (AI) stocks continues unabated. A prime example is Nvidia. Its shares hit an all-time high on Oct. 9 after the U.S. government approved the sale of its AI semiconductor chips to the United Arab Emirates.

AI's popularity means many stocks in the sector are expensive. Finding a solid AI stock at a fair price can prove challenging. But there's one spectacular AI company with shares at a reasonable valuation that I'm watching.

That company is Micron Technology (MU +5.50%). Here are the factors that make this one of the best AI stocks to scoop up right now.

Image source: Micron Technology.

Why Micron Technology stock is a buy

Micron is a maker of computer memory and storage products. AI systems depend on these components to store and retrieve the data needed to execute tasks.

As a result, Micron's business is on fire. In its 2025 fiscal year, ended Aug. 28, revenue hit $37.4 billion, a significant jump from $25.1 billion in the prior year.

NASDAQ: MU

Key Data Points

Not only is revenue rising, Micron is also doing an excellent job managing its expenses. Consequently, its fiscal 2025 diluted earnings per share (EPS) saw a jaw-dropping increase to $7.59, compared to $0.70 last year.

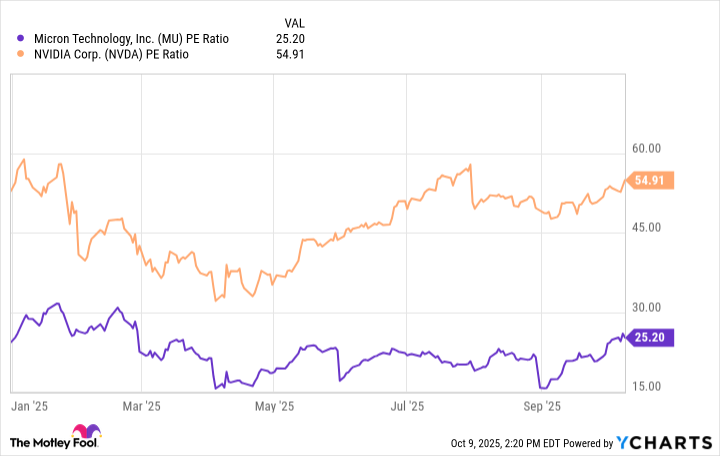

Micron's spectacular business performance led to a rise in its stock price. However, shares retain a reasonable valuation for an AI stock based on the price-to-earnings (P/E) ratio. Here's how Micron compares to Nvidia.

Data by YCharts.

The chart above shows Micron's P/E ratio is about half that of Nvidia's, indicating it's a better value. Also, while Micron's earnings multiple is rising, it's still below where it was at the start of the year.

Micron's strong business performance and appealing valuation make it a solid AI stock to buy.