Shares of Quantum Computing Inc. (QUBT +0.59%) are jumping on Monday, up 11% as of 2:23 p.m. ET. The spike comes as the S&P 500 (^GSPC +0.83%) and the Nasdaq Composite (^IXIC +1.38%) are both moving vastly higher.

The quantum computing stock is up on the news that JPMorgan Chase intends to invest $10 billion in a range of key industries and technologies important to U.S. security as part of its decade-long Security and Resiliency Initiative.

In the company's press release, CEO Jamie Dimon said that it "has become painfully clear that the United States has allowed itself to become too reliant on unreliable sources of critical minerals, products, and manufacturing," and that U.S. "security is predicated on the strength and resiliency of America's economy."

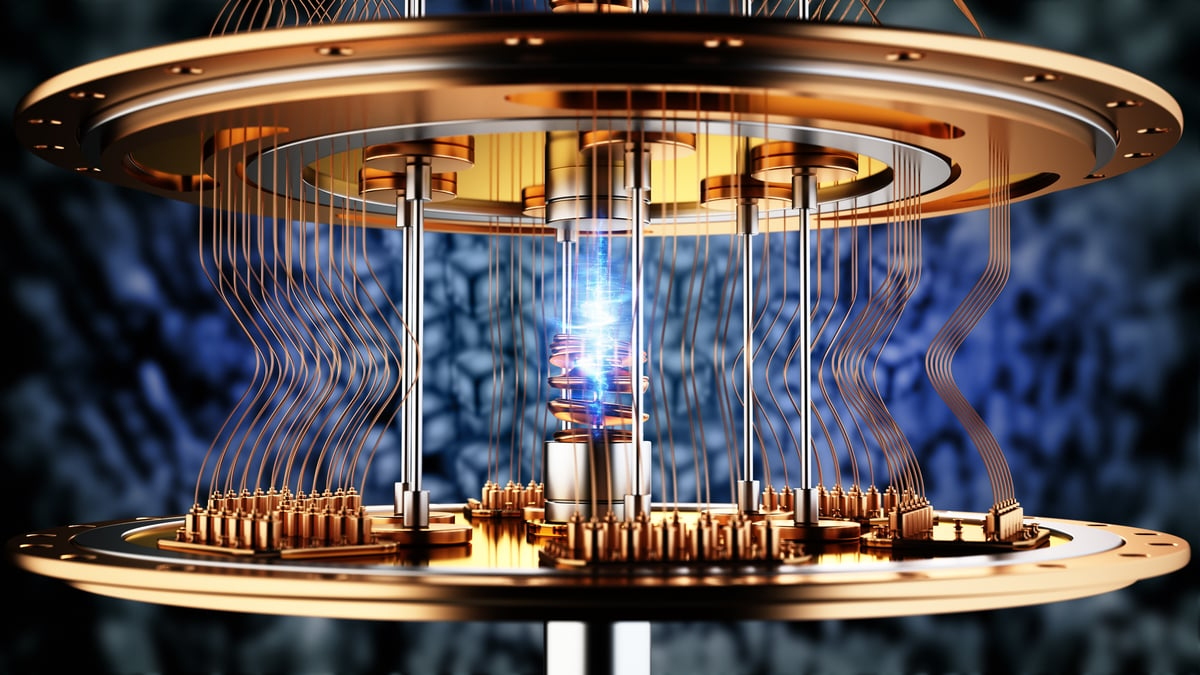

Image source: Getty Images.

Quantum Computing has a lot to prove

Pure-play quantum computing stock valuations are getting out of hand, in my view. That is true across the board, but Quantum Computing Inc.'s stock is particularly irrational. The company's trailing-12-month sales are less than $300,000, and it is operating deep in the red.

Despite this, its market cap is north of $4.5 billion. Investors should also know that the company relies heavily on stock sales that dilute shareholders. The valuation is built on hype, and I would not invest in it.