In September 2020, handcrafted marketplace Etsy (ETSY 1.74%) was included in the S&P 500 -- surprisingly before Tesla. While inclusion in the popular index didn't do anything for Etsy's business, many investors saw it as a moment of validation. It seemed that the e-commerce business had arrived.

Unfortunately for investors, Etsy's tenure in the S&P 500 didn't last long. Four years after it was included included, Etsy stock was removed from the index due to the company no longer being representative of large U.S. companies. Rather, it was more representative of a small-cap stock.

The stock peaked in late 2021 and had dropped roughly 80% by the time it was removed from the S&P 500. It's still down by 76% from its all-time high as of this writing. And that does make things interesting for investors today.

Image source: Getty Images.

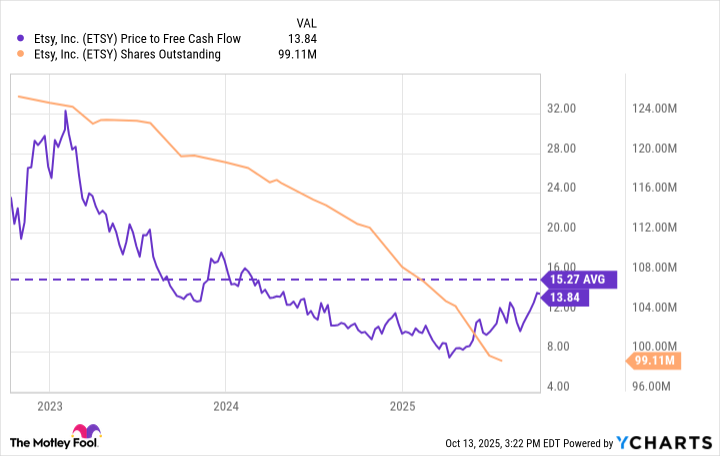

Even though the stock was plunging, Etsy's business remained resilient, and it continued to generate substantial free cash flow. And as of this writing, shares trade at a price-to-free-cash-flow valuation of less than 14. That's considered cheap, and it's one of the lowest for the company since it went public a decade ago.

Etsy has been trading at a cheap valuation for the last three years. During this time, management has opportunistically bought back stock, and these buybacks have been substantial. In just three years, it has reduced the amount of shares outstanding by 21%.

ETSY Price to Free Cash Flow data by YCharts.

However, there are two reasons the stock may finally be about to break out from its disappointing performance over the last few years.

Why history says to pay attention here

Rob Arnott of Research Affiliates has found an interesting pattern. According to a report he co-authored with Forrest Henslee in 2024, stocks that are removed from the S&P 500 initially underperform the stock market average for several months. But extending the time horizon to five years, they outperform the market average by a few percentage points annually.

Considering that the Motley Fool investment philosophy says to hold stocks for at least five years, the five-year outperformance observed in Arnott's report is noteworthy.

The reason for the outperformance is simple: Stocks that are removed from the S&P 500 usually wind up falling by a great amount, due to disappointment from retail investors and lack of support from institutional investors who focus on larger-cap companies. In short, shares get too cheap, providing good returns from that lower starting point. And Etsy's low valuation suggests that it may have already hit rock bottom.

NYSE: ETSY

Key Data Points

Arnott's research is one reason to believe that the stock is worth paying attention to here at a once-in-a-decade valuation. But there's another reason as well: It could surprise investors with growth.

The company's primary problem at the moment is that adoption for its platform has flattened. I'd argue that the trend for active buyers is the most important. In the second quarter of 2025, active buyers on Etsy's platform dropped by nearly 5% to 87 million. For perspective, it ended 2021 with 96 million.

In short, the company has boosted revenue in some ways and cash flow has been strong. But without increasing adoption with new buyers, it's hard to grow enough to move the stock.

However, adoption trends might soon change. Etsy just got a surprising boost from ChatGPT, which will integrate with Etsy's platform so that users can theoretically find and buy what they're looking for without leaving ChatGPT. It's worth noting that Etsy is the first platform to integrate with ChatGPT. And if this represents a new way of shopping on the internet, it could give Etsy's business just enough of a boost.

I believe that a good example here is eBay. Like Etsy, it also has struggled with growth. But resilience with the business and strong cash flow allowed management to reduce its outstanding shares by 33% over the last five years.

Over the last three years, eBay has averaged a paltry 2.5% revenue growth. But its stock is up 141% over these three years.

EBAY data by YCharts; YoY = year over year.

In summary, eBay was discarded because of weak growth. But as it reduced its share count, it was eventually able to outperform the market from its cheaper starting point. And it's worth noting that much of its recent outperformance was driven by reporting its best growth in about two years.

If ChatGPT can help Etsy achieve a better growth rate to close out 2025, then this former S&P 500 stock may join the ranks of past outcasts that went on to beat the market.