Tesla (TSLA +0.00%) had a rough start to 2025. In the first half of the year, its electric vehicle (EV) sales shrank at an even faster pace than they did in 2024 as competition from low-cost manufacturers continued to chip away at its market share in key regions around the world.

Fortunately, Tesla's EV sales returned to growth in the recent third quarter (ended Sept. 30). The company will release its full operating results for the quarter on Wednesday, Oct. 22, which will give investors an update not only on its EV business, but also on future product platforms like the Cybercab autonomous robotaxi and the Optimus humanoid robot.

Is Tesla stock a buy ahead of the upcoming report? Read on.

Image source: Tesla.

Tesla's quarterly EV deliveries just returned to growth, but there's a catch

Tesla delivered 1.79 million EVs during 2024, which was a 1% decrease from the previous year. The decline picked up steam in the first half of 2025, with deliveries shrinking by 13% to 720,803.

Increasing competition fueled the weakness. For example, Tesla experienced a drop in deliveries in China during the first half of 2025, despite EV sales surging by 43% overall across the country. As a result, its market share dipped by 4.2 percentage points to 7.5%, while more affordable domestic brands like BYD (BYDDY 1.90%) continued to charge ahead. There was a similar trend in other key markets like Europe.

But as I touched on earlier, Tesla's sales rebounded in the third quarter. The company delivered 497,099 EVs worldwide, which was up 7% year over year. Tesla hasn't provided a geographic breakdown of those sales, but the growth was likely driven by the U.S., where many consumers rushed to buy EVs before the $7,500 government tax credit expired on Sept. 30.

Tesla has a dominant market share of 43.1% in the U.S., far ahead of second-placed General Motors at 13.8%, mainly because trade barriers make it impossible for low-cost Chinese brands like BYD to compete. Therefore, the company likely experienced a massive one-off tailwind from the expiry of the EV tax credit.

Unfortunately, that means some of those third-quarter sales were probably pulled forward from the fourth quarter, which could lead to a weaker-than-expected result in the final three months of this year.

NASDAQ: TSLA

Key Data Points

The Cybercab and Optimus take center stage

Since Tesla has already released its third-quarter EV delivery numbers, Oct. 22 will be all about CEO Elon Musk's conference call with investors, where he typically offers updates on upcoming products like the Cybercab robotaxi and Optimus humanoid robot.

The Cybercab will be of particular interest to Wall Street analysts because it's scheduled to enter mass production in 2026. Musk wants to build a ride-hailing network in which the robotaxi can autonomously haul passengers around the clock, creating a new revenue stream for Tesla with potentially high profit margins.

However, Tesla's full self-driving (FSD) software is still awaiting regulatory approval for unsupervised use in the U.S., and without it, the Cybercab can't officially hit the road. Musk is hopeful FSD will get the green light in some states before the end of 2025, so investors should listen for an update during his conference call on Oct. 22.

Optimus is much further away from commercialization. Tesla isn't expecting to hit its production target of 1 million units annually for around five years, so it could be a while before the robot makes a meaningful contribution to the company's financial results.

However, Musk believes humanoid robots could outnumber actual humans by 2040, because of their versatile use-cases in households and businesses alike. As a result, he predicts Optimus will generate a staggering $10 trillion in revenue over the long term.

Should you buy Tesla stock before Oct. 22?

As you can tell, the Tesla story has a lot of moving parts. Despite its shrinking EV sales, its stock has soared by 90% over the past year as investors place early bets on the future success of Optimus and the Cybercab. Unfortunately, it now trades at a sky-high valuation, which opens the door to a potentially sharp correction.

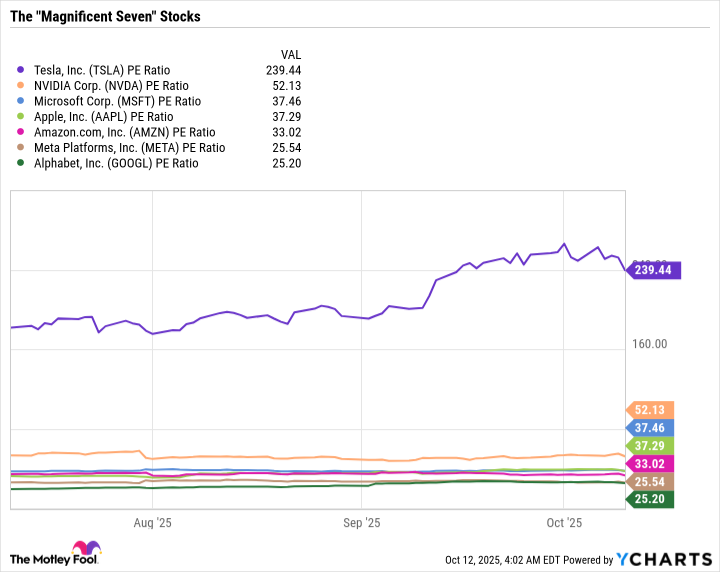

Tesla's price-to-earnings (P/E) ratio is an eye-popping 239 as I write this, making it seven times more expensive than the Nasdaq-100, which trades at a P/E ratio of just 33.5. It's also the most expensive stock in the "Magnificent Seven" by several orders of magnitude -- in fact, its P/E ratio is almost five times higher than Nvidia's:

Data by YCharts.

There isn't much Elon Musk can say on Oct. 22 that will make Tesla stock look attractive at this level. Of course, if products like the Cybercab and Optimus are commercial successes over the long term, then Tesla stock might actually be cheap at the current level. But there are simply too many unknowns, and there is evidence that the company is already lagging behind the competition in the autonomous robotaxi business.

As a result, investors might want to avoid Tesla stock ahead of Oct. 22. It might be a good idea to remain on the sidelines until it aligns more closely with its peers in the Magnificent Seven from a valuation perspective.