The quantum computing space has been getting more and more attention from investors. Case in point, IonQ (IONQ 6.53%) is up 50% over the last month (as of Oct. 10). This quantum computing company uses trapped ion technology for superior accuracy and quantum systems that can operate at room temperature.

IonQ's recent jump in price may make you hesitant to invest. But if you want to add shares to your portfolio, there's still time.

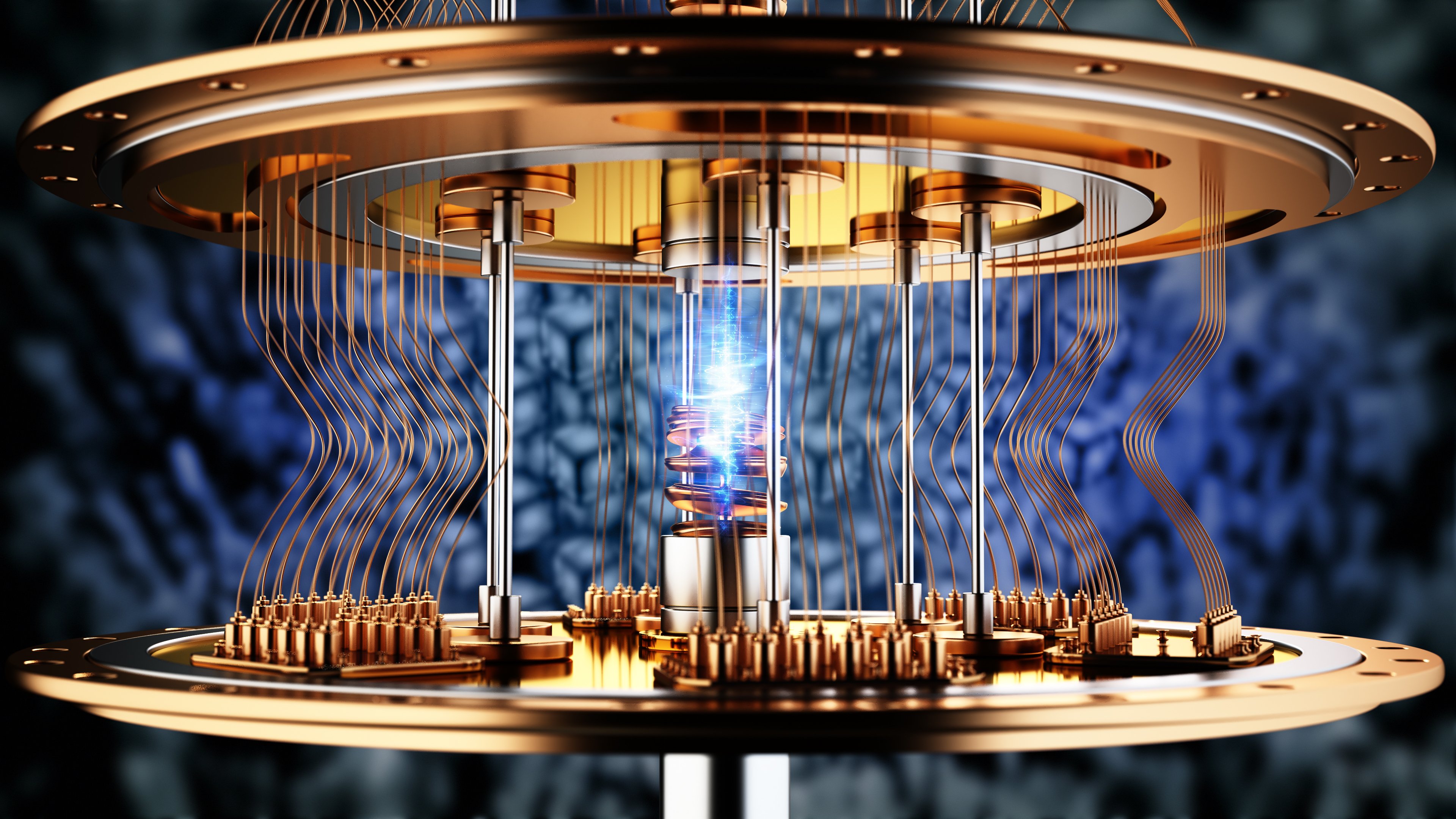

Image source: Getty Images.

The quantum computing industry has massive growth potential

Even though several top quantum computing stocks have done well recently, this is a young industry. Pure-play quantum computing companies, IonQ included, have yet to reach profitability. Early investors are banking on the potential this technology has and not the current financial results.

IonQ has reported $52 million in revenue over the trailing 12 months (TTM) -- not much, but still more than its three main competitors (D-Wave Quantum, Rigetti Computing, and Quantum Computing) combined. However, McKinsey estimates that quantum computing revenue will jump from $4 billion in 2024 to as high as $72 billion by 2035. If that happens, IonQ could see its revenue soar over the next five to 10 years.

NYSE: IONQ

Key Data Points

Peter Chapman, chairman and CEO of IonQ, says that he expects it to be profitable and approach $1 billion in sales by 2030. Since IonQ is the most successful pure-play company in this space by revenue and market cap, I like its chances of doing well as the industry grows. It's a volatile and high-risk company, but if it can hit its targets, the recent increase in share price will be just the beginning.