We're now in the last quarter of 2025, a year that will be remembered for having a pleasantly resilient stock market despite some global tensions, trade wars, and a shaky economy. Tech stocks continue to lead the charge, up 18% on the year, while the benchmark S&P 500 is up only 11.6%.

Naysayers are warning of a tech bubble, particularly with artificial intelligence (AI) stocks, but those alarmist notions appear to be misguided. Grand View Research suggests that the global AI market will expand at a compound annual rate of 31.5% through 2033, growing from $279.2 billion in 2024 to nearly $3.5 trillion.

If you're looking to open new positions with AI stocks this October, two of the best you can choose are Nvidia (NVDA 0.60%) and Meta Platforms (META 0.10%). Both look primed to finish the year strong.

Nvidia

Chipmaker Nvidia is the big dog on Wall Street these days, being one of the biggest beneficiaries of the AI boom. Its market cap rose 1,380% in the last three years to top $4.4 trillion, and it seems well on its way to a $5 trillion valuation soon.

Nvidia makes graphics processing units (GPUs) that are essential for performing high-powered computing to run large language models, operate AI-powered programs, perform machine learning, and do other sophisticated tasks. The company is a revenue machine, bringing in $46.7 billion in the second quarter alone, up 56% from a year ago. Most of that revenue -- $41.1 billion -- comes from data center products, with the company's Blackwell GPUs being widely adapted now.

Even though Nvidia is shut out of the Chinese market, the company is trying to grow its revenue even more. It recently received an export license for the United Arab Emirates, which means it will be able to ship tens of billions of dollars in chips to the Middle East.

With its GPUs in wide use, Nvidia is aggressively working to add important partners to strengthen its competitive moat. Oracle announced on Oct. 14 that its OCI Zettascale 10 computing cluster for high-performance AI inference and training workloads will be powered by Nvidia GPUs. Nvidia also invested $5 billion into Intel, creating a partnership to develop generations of AI data center and PC chips.

It also introduced NVLink Fusion this year, which is compatible with equipment from outside companies, allowing third-party chips to be integrated into data centers that are powered by Nvidia GPUs.

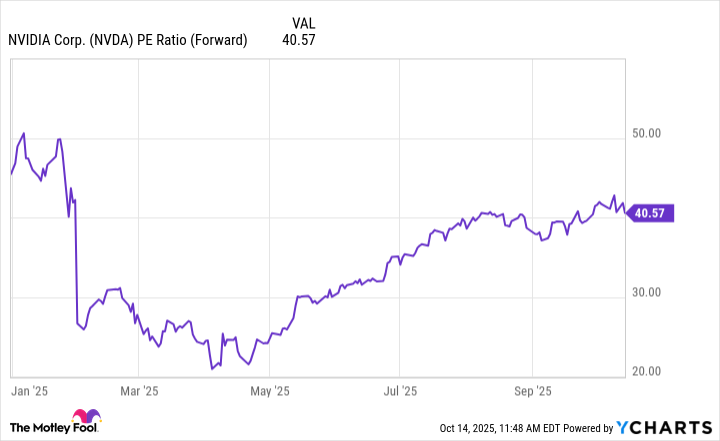

The company's forward price-to-earnings ratio of 40 is pricey, but not when you consider that it's roughly 20% lower than it was in the first quarter. Nvidia stock is a freight train that will continue to roll.

NVDA PE Ratio (Forward) data by YCharts.

Meta Platforms

While I suppose you could make the argument that Meta Platforms is a social media company, and not an AI stock, I beg to differ. Yes, nearly 3.5 billion people use Meta's family of platforms daily, including Facebook, Instagram, Messenger, Threads, and WhatsApp. But it's the company's embrace of AI, and the heavy investment that management is making in it, that make this a compelling AI stock.

Meta plans to spend $114 billion to $118 billion this year on AI infrastructure, and even more in 2026, to operate data centers that run the company's sophisticated AI programs. Meta's AI helps advertisers target their spending; curates feeds for users; and powers creative tools such as image generation, video, and large language models.

CEO Mark Zuckerberg says the company is working toward an era of what he calls "personal superintelligence" that uses AI.

"I am extremely optimistic that superintelligence will help humanity accelerate our pace of progress," he wrote in July. "But perhaps even more important is that superintelligence has the potential to begin a new era of personal empowerment where people will have greater agency to improve the world in the directions they choose."

Meta stock is up 20% this year. After declining 5% over the last month, this is an ideal AI stock to buy on the dip in October.