The artificial intelligence (AI) boom exposed a critical bottleneck: The world is running short on both power and compute capacity needed to train the next generation of AI models.

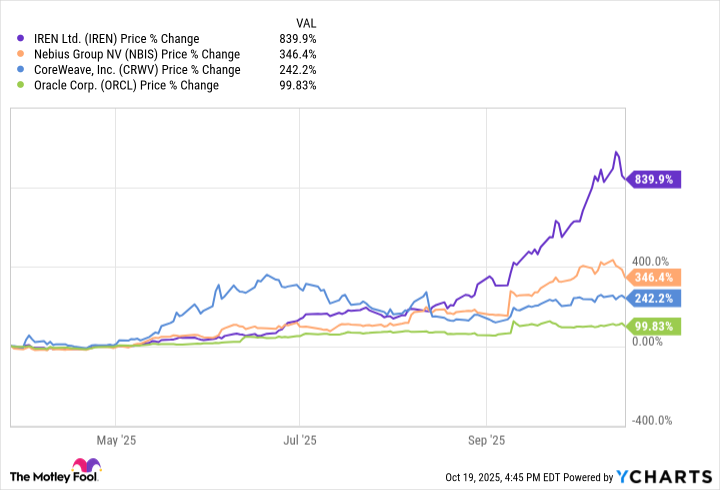

This constraint has given rise to a new class of infrastructure known as the neocloud -- independent, AI-focused providers capable of deploying graphics processing unit (GPU) clusters faster and more flexibly than traditional hyperscalers. So far, Nebius Group (NBIS 2.43%) and CoreWeave emerged as the early leaders.

But another contender, Iren (IREN +8.46%), is quietly building a network that could potentially elevate it into the same league.

NASDAQ: IREN

Key Data Points

What Iren is -- and why it matters

Iren is an infrastructure company developing data centers purpose-built for high-performance computing and AI workloads. Its business model is simple yet powerful: Secure renewable energy at scale, construct campuses optimized for GPUs, and rent that compute capacity to companies deploying AI models.

Unlike legacy cloud platforms that run on rigid, general-purpose architectures, Iren's facilities are engineered specifically for AI density. Each site integrates advanced liquid cooling systems, ultra-fast networking, and direct access to sustainable power -- the core ingredients needed to run energy-intensive AI workloads efficiently.

The company's ambition is clear: to become an alternative provider for organizations seeking private, secure, and high-performance compute clusters without relying on Amazon Web Services (AWS), Microsoft Azure, or Google Cloud Platform (GCP). Rather than competing with hyperscalers on software, Iren aims to outperform them on infrastructure speed, operational flexibility, and cost.

Image source: Getty Images.

Can Iren win enterprise-scale deals?

The neocloud market is already dominated by a few high-profile players.

Nebius recently signed a massive $17 billion contract with Microsoft, while CoreWeave has become deeply embedded with AI's flagship company, OpenAI. Even Oracle entered the race, securing a $300 billion deal with OpenAI for its cloud services.

These companies thrived by mastering a critical trifecta: reliable power, guaranteed GPU supply, and rapid hardware deployment. This intersection is precisely where Iren's potential advantage could emerge. If hyperscalers continue to face compute supply bottlenecks, Iren could position itself as an attractive alternative platform like its cohorts have done.

Still, there are limits. CoreWeave, for instance, built a full orchestration stack that spans both software and hardware. Iren, by contrast, remains focused primarily on the physical layer -- power, cooling, and rack space. That makes it more of a landlord than a turnkey cloud provider.

To win large-scale enterprise contracts, Iren will likely need to form strategic partnerships or allow broader software integrations that make its infrastructure easier to deploy and manage at scale.

Hidden gem, meme stock, or something in between?

Calling Iren the "next Nebius" would be premature -- but dismissing it as a speculative meme stock would be equally shortsighted.

The company occupies a unique middle ground between a pure-play AI infrastructure developer and an emerging cloud provider. It owns tangible assets -- land, power, and equipment -- in a market where physical capacity has suddenly become worth its weight in gold.

If Iren can execute on its expansion plans, secure a handful of long-term GPU hosting contracts, and demonstrate consistent performance for enterprise clients, its valuation could rerate meaningfully higher over the next few years. Investors have already shown a willingness to assign premium multiples to companies capable of supplying reliable compute at scale.

That said, execution risk remains real. Building and operating next-generation data centers is enormously capital-intensive, and any setbacks in hardware delivery or energy permitting could derail progress.

Against this backdrop, investors should view Iren not as a guaranteed "next Nebius," but as an early-stage infrastructure contender quietly assembling the right ingredients to become one. In a world where compute is the new oil, Iren's ability to scale power and GPU infrastructure could make it one of the quiet beneficiaries of the AI gold rush.