If you're focused on rare earth metals like lithium or cobalt, it might be time to look at uranium. Cameco (CCJ +2.53%) is one of the world's premier uranium suppliers, and it just delivered a blowout earnings beat. And with uranium demand expected to surge in the coming decade, Cameco might have more upside ahead.

NYSE: CCJ

Key Data Points

Nov. 5 could be another breakout moment for Cameco

To understand the big moment Cameco is having, we need to step back and understand what Cameco does. It mines and processes uranium. The majority of its revenue comes from long-term contracts supplying "yellowcake" (uranium concentrate) to utilities worldwide. As such, when demand for uranium goes up, Cameco's top-line growth typically follows.

Yellowcake packaged in a steel drum at Cameco's Rabbit Lake facility. Image source: Cameco.

And, from the looks of it, the uranium market is booming. Demand for uranium is expected to surge about 28% by 2030 and 100% by 2040, according to the World Nuclear Association. Most of this is driven by a concomitant surge in electricity needs. From electric vehicles to artificial intelligence (AI), the world is demanding more energy. And not just any old energy product, but clean energy.

Nuclear power is a clean energy source that can provide reliable 24/7 power, which makes it seem like the best solution to the gargantuan needs of AI data centers.

That puts Cameco, as one of the world's premier suppliers of uranium, in an enviable position. It owns high-quality assets like the McArthur River and Cigar Lake mines in Saskatchewan, which are some of the lowest-cost uranium producers worldwide. As the last decade of stagnant uranium prices showed, this structural cost advantage can help Cameco maintain profitability even when uranium prices swing unfavorably against it.

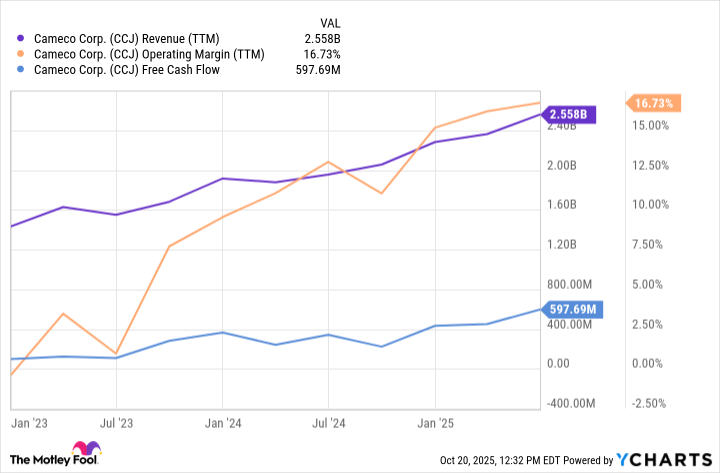

Data by YCharts.

A surge in uranium demand, coupled with this structural advantage, gives Cameco a leg up in a mining industry that's as costly as it is unpredictable.

For aggressive investors betting that nuclear power will play a key role in the future, Cameco could be worth a closer look before its next earnings date.