Docusign (DOCU 8.69%) stock went public in 2018 at $29, and by September 2021, it had soared more than tenfold to a record high of $310. The COVID-19 pandemic fueled incredible demand for the company's digital agreement tools, because they allowed businesses to continue making deals despite lockdowns and social restrictions.

However, that demand hit a wall when social conditions returned to normal in 2022, making it difficult for Docusign to maintain its pandemic-era revenue growth. Its stock has since plunged by 78% from its record high, and trades at just $67.

However, Docusign introduced a new platform last year called Intelligent Agreement Management (IAM), and it's designed to make agreement management processes even simpler through a suite of features powered by artificial intelligence (AI). The platform is helping the company recapture some of its lost momentum, so here's why investors might want to own Docusign stock heading into the new year.

Image source: Getty Images.

IAM helps solve a $2 trillion problem

According to global consulting firm Deloitte, the business community loses a staggering $2 trillion in economic value every single year due to inefficient agreement management processes. It calls this the "agreement trap," and IAM is helping enterprises recapture some of that value by using AI to streamline contract drafting, negotiating, closing, and everything in between.

At the heart of IAM is a feature called Navigator. It's a digital repository where businesses can store all of their digital documents, and using AI, it extracts valuable information from each of them and makes it discoverable through a search function. This saves employees untold amounts of time, because they no longer have to sift through piles of agreements manually to find what they are looking for.

Businesses are processing tens of millions of contracts through Navigator every single month. In fact, during the fiscal 2026 second quarter (ended July 31), Docusign CEO Allan Thygesen said the number of documents ingested by Navigator had soared by a whopping 150% compared to just six months earlier.

But Navigator is one of many IAM features. AI-Assisted Review, for example, analyzes every contract and identifies potential risks and opportunities, based on the organization's preset standards. Then there is Maestro, which allows businesses to create agreement workflows without writing any programming code. This is useful for rapidly adding web forms or identification requirements into a contract.

NASDAQ: DOCU

Key Data Points

Docusign's revenue growth recently picked up steam

Docusign's revenue more than doubled in the two years between fiscal 2020 and 2022, when demand was at its peak. But it's now growing far more modestly; the company generated $800.6 million in revenue during the fiscal 2026 second quarter, which was up just 9% from the year-ago period. However, that was actually an acceleration from the 8% growth it delivered in the first quarter three months earlier.

In fact, the strong result prompted management to increase its full-year revenue guidance for fiscal 2026 for the second time. The company is now expected to bring in $3.201 billion at the top end of the forecast range.

Docusign was investing heavily in growth-oriented operating costs like marketing and research and development at the height of the pandemic, which is a key reason why its revenue was soaring. However, it resulted in unsustainable losses at the bottom line.

The company is now spending more cautiously, with its total operating costs increasing by just 5% year over year during the first half of fiscal 2026. Although this shift is producing slower revenue growth, it's driving significant profits. The company generated $135.1 million in net income on a generally accepted accounting principles (GAAP) basis in the first half of the year, and $385.9 million on a non-GAAP (adjusted) basis.

By generating steady profits, Docusign has the flexibility to start reinvesting in growth-focused costs like marketing once again, which could drive a further acceleration in revenue growth from here.

Docusign stock looks like a bargain right now

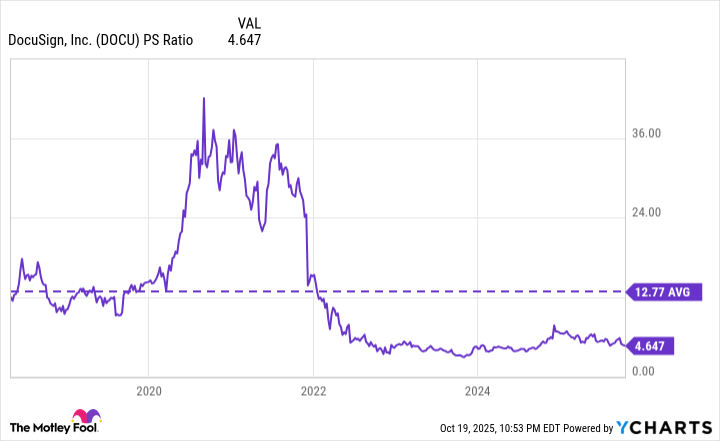

Docusign stock is trading at a price-to-sales (P/S) ratio of 4.6, which is a 63% discount to its average of 12.7 dating back to its initial public offering in 2018. It's an even steeper discount to its peak P/S ratio of around 40 from 2021.

DOCU PS Ratio data by YCharts

Based on Docusign's recent operating results and the clear momentum in its new AI-powered products like Navigator, its stock could be a great buy at the current price for investors who are looking for an under-the-radar growth story to take into 2026.