My favorite way to invest in the stock market is through exchange-traded funds (ETFs) because of how simple they make it. Instead of spending lots of time researching many individual companies, I can put money into a few ETFs that check off many of the boxes I look for in my investments.

Some ETFs also can provide instant diversification -- and that's a good thing. When a fund has dozens, hundreds, or even thousands of companies contributing to its performance, the damage that any individual company's potentially poor performance can do to your returns is reduced.

Financial giant Vanguard is known for offering a bunch of high-quality ETFs. If you have $1,000 available to invest now, consider the following two options. Each serves a different purpose, but they can complement each other well in a portfolio.

Image source: Getty Images.

1. Vanguard S&P 500 ETF

The Vanguard S&P 500 ETF (VOO +0.04%) is the largest holding in my portfolio, mainly because of how closely it's tied to the U.S. economy. The S&P 500 index is composed of 500 of the largest public U.S. companies, so it tends to grow as the country's economy grows.

When you invest in the Vanguard S&P 500 ETF, you know you're getting exposure to some of the top companies not just in America, but globally. It's full of blue chip stocks that I trust to lead the way long term.

NYSEMKT: VOO

Key Data Points

Because some tech companies have seen their market caps rise to remarkable levels due to the AI boom, the value of this ETF has gotten much more concentrated in its largest positions than it used to be. However, it still contains leading companies from every major sector. There's JPMorgan Chase and Visa in the financial sector; ExxonMobil and Chevron in the energy sector; Eli Lilly and Johnson & Johnson in the healthcare sector; Amazon and Tesla in the consumer discretionary sector; Walmart and Coca-Cola in the consumer staples sector; and plenty of others.

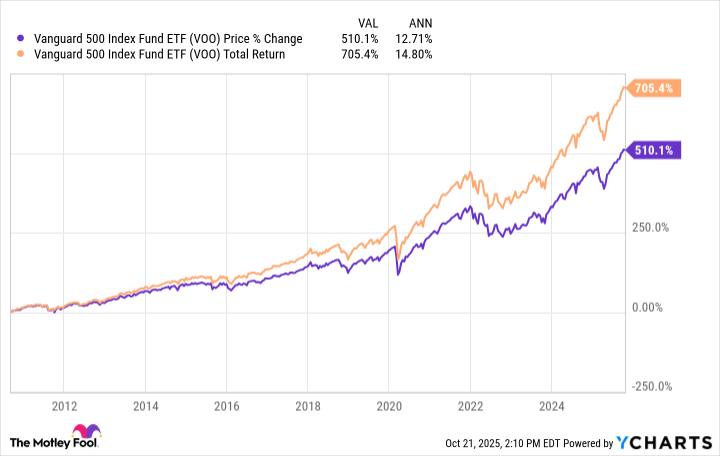

The Vanguard S&P 500 ETF will inevitably experience volatility (like any other stock or ETF), but it has been a great long-term investment, averaging annualized returns of more than 12.7% since it hit the market in September 2010.

With its minuscule 0.03% expense ratio, you're only paying $0.30 a year for every $1,000 you have invested in the ETF. That's about as cheap a price as you'll find to get broad exposure to the companies driving the U.S. economy.

2. Vanguard High Dividend Yield ETF

The Vanguard High Dividend Yield ETF (VYM 0.51%) is a great option for anyone looking for their investments to provide them with consistent income. As the name suggests, it focuses on dividend-paying companies, particularly those that have track records of reliable payouts and financial stability.

NYSEMKT: VYM

Key Data Points

Since its portfolio is dividend focused, it's not as concentrated in tech stocks as the S&P 500 or some other ETFs that are weighted by market caps. As of the end of the third quarter, financial sector companies made up 21.6% of the ETF's weight, followed by tech (13%), industrials (13%), healthcare (12.4%), and consumer discretionary (10.1%).

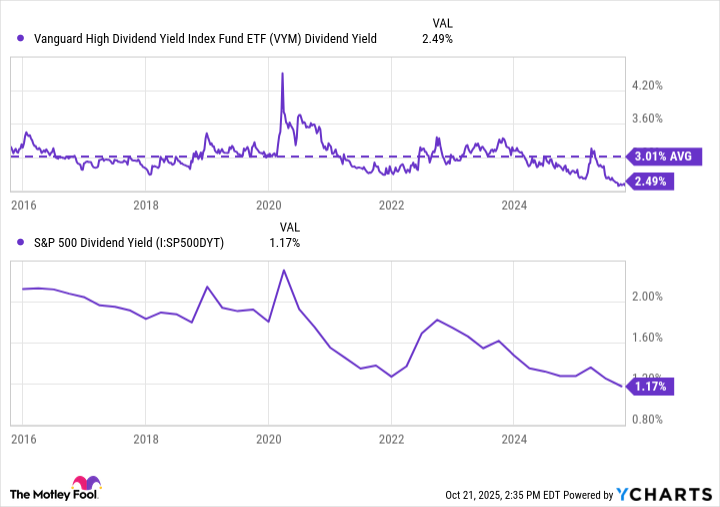

Its dividend yield as of Oct. 21 was around 2.5%, which is slightly below its 3% average over the past decade, but still more than double the S&P 500's current yield.

VYM Dividend Yield data by YCharts.

Having a dividend ETF in your portfolio can be a great way to generate income, which can be a cushion for your returns when the market experiences high volatility. Over the past decade, the ETF's price is up 112%, but on a total return basis (which assumes that dividends are reinvested), it has returned around 190%.

It's not just about the ETF's current dividend yield and payout, either. Those payouts fluctuate because all of its component companies make their distributions at different times, and make individual decisions about whether to raise them, cut them, or hold them steady. However, when you zoom out, you'll see that the Vanguard High Dividend Yield ETF has slowly but surely increased its payouts over time.