Netflix (NFLX 1.70%) has been a fantastic growth stock over the years. In the past decade alone, it's up more than 1,100%, which would have turned a $10,000 investment into around $127,000 today.

While other companies still struggle to profit from streaming, Netflix has shown that it's possible, and that success has propelled it to a valuation of nearly $530 billion, as of Oct. 21.

But this growth stock isn't done by any stretch. The company continues to focus on new avenues to expand its operations as it looks to generate even greater returns for its shareholders. With so much still on the horizon, could this streaming stock potentially join the trillion-dollar club by 2030?

Image source: Getty Images.

Netflix's impressive growth can lead to a much higher valuation

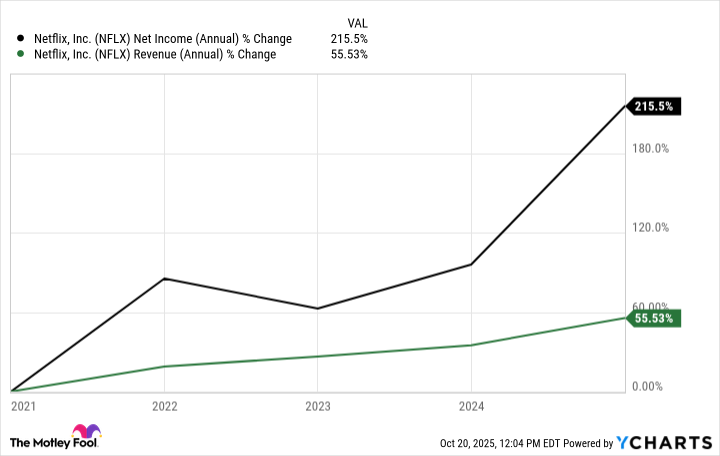

Netflix has already established a global service reaching more than 190 countries. Now, it is leveraging this massive reach to expand into sports content and advertising. These moves have helped it grow its top and bottom lines. Rising sales can be exciting and lure in many growth investors, but it's the earnings growth that can sustainably drive its share price up a whole lot higher.

Data by YCharts.

The stock might look expensive at a price-to-earnings multiple (P/E) of 53, but given the fast pace of its earnings growth and leading position within the streaming industry, a high multiple might be justifiable, particularly as Netflix enters new markets.

Is a $1 trillion valuation inevitable for Netflix?

For Netflix to get to a $1 trillion market cap, the stock would need to rise by more than 90% from where it trades today. Over a period of five years, that would translate into compound annual growth of about 13.8%.

Last year alone, net income rose 61% to $8.7 billion. The company's margins have steadily increased over the past decade, so it's not too difficult to envision a scenario where it reaches a $1 trillion valuation while bringing its P/E multiple down in the process.

NASDAQ: NFLX

Key Data Points

Why Netflix still looks like a no-brainer buy

Ultimately, this depends on how well the company executes on its strategy. Netflix's ability to produce compelling content while offering a range of subscription tiers puts it in a great position to continue growing for the foreseeable future. And management has previously set ambitious targets for the end of this decade: at least 400 million global subscribers, approximately $80 billion in annual revenue ($9 billion from advertising), and around $30 billion in operating income.

This remains a highly innovative business, which is why I think it's easy to justify buying the stock today and hanging on for the long haul. The $1 trillion target may be bullish, but it's very much achievable given the company's strong prospects.