There's a memorable scene in the film The Big Short where Ryan Gosling's character smirks and says most people are intimidated by finance because they don't understand the language. He's right. Wall Street has a talent for making simple ideas sound overly complex -- turning investing into something that feels out of reach for everyday people.

But the truth is, successful investing doesn't require fancy terms or insider access. Terms like "EBITDA" or "basis points" or "alpha" might sound intimidating, but they describe concepts that anyone can grasp with a little patience.

When I worked as an investment banking analyst specializing in mergers and acquisitions, I lived and breathed this jargon. We tossed around phrases like "pro forma financials" and "synergy projections" daily. It was part of the job -- but it also created the illusion that investing was reserved for experts.

But you don't need to understand every spreadsheet or acronym to succeed as an investor. What matters most is consistency, discipline, and a clear plan for your money.

If you've ever searched for how to start investing and felt overwhelmed, you're not alone. The good news is that building wealth doesn't have to be complicated. Follow this simple three-step plan, and you can set yourself up for a lifetime of financial growth -- no Wall Street dictionary required.

1. Build a strong savings foundation

Before you start investing, you need one essential thing: a solid savings cushion. Think of it as your financial foundation -- the base that keeps you secure when unexpected expenses arise. Start by setting aside a fixed portion of your paycheck each month, ideally 10% to 20%, and automate the transfers, so the money moves directly into your savings account before you have a chance to spend it.

Creating a detailed monthly budget can help, too. Track every expense for 30 days to see where your money actually goes. Many people are surprised to find how much they spend on dining out, unused subscriptions, or impulse purchases. Redirecting even a portion of that cash toward savings can make a real difference over time.

Your first milestone should be an emergency fund worth from three to six months of living expenses. Keep it safe but accessible -- ideally in a high-yield savings account. These accounts typically pay far more interest than traditional ones, allowing your cash to grow passively while you prepare to invest.

Image source: Getty Images.

2. Open a brokerage account and start investing

Once your savings foundation is in place, it's time to make your money work for you. The next step is to open a brokerage account with a reputable provider such as Vanguard, Charles Schwab, Fidelity, or Robinhood Markets.

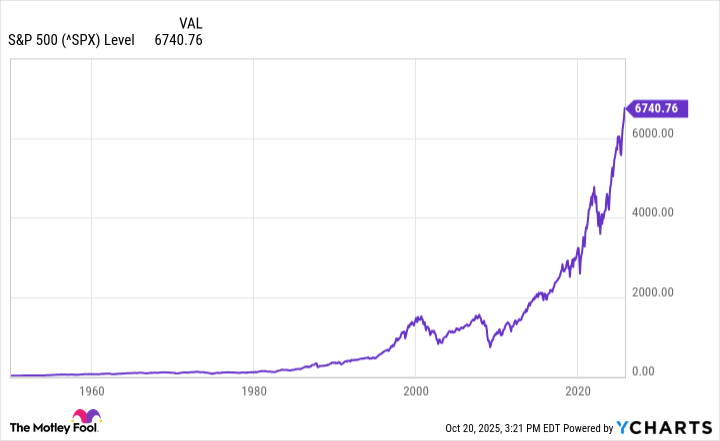

Within your brokerage, start with low-cost index funds or exchange-traded funds (ETFs). For example, an S&P 500 (^GSPC 0.13%) ETF gives you instant exposure to America's top companies -- essentially letting you own a slice of the entire stock market. Over time, this has proven to be one of the most reliable ways to build wealth.

As you gain confidence, consider diversifying with a few specialized ETFs. A technology ETF such as Invesco QQQ Trust (QQQ 0.60%) can help capture innovation, a dividend ETF can generate passive income, and a bond ETF can add stability. For those comfortable with higher risk, allocating a small portion to cryptocurrency can provide exposure to emerging digital assets.

The goal isn't to chase fads -- it's to build a well-balanced, diversified portfolio that compounds steadily over decades.

3. Invest consistently, and think long-term

Markets move in cycles, and even the strongest portfolios will experience ups and downs. What separates successful investors from everyone else is consistency. Invest regularly, no matter what the headlines say. Automation helps -- set up recurring deposits into your brokerage account so you're always buying, whether prices are high or low.

SNPINDEX: ^GSPC

Key Data Points

When markets dip, view it as an opportunity to buy stocks at a discount -- not a reason to panic. Over time, the power of compounding can turn steady contributions into significant wealth. By staying disciplined -- doubling down on your winners and trimming underperformers -- you'll naturally position your portfolio toward long-term strength.

Ultimately, building wealth isn't about timing the market -- it's about time in the market. The longer your money stays invested and compounds, the larger your financial snowball becomes.